- Osiris News

- Posts

- 🩹📉 Under $100K: Bitcoin’s Hangover Day

🩹📉 Under $100K: Bitcoin’s Hangover Day

Bitcoin's market trembles after hot inflation data, revealing a quiet economic hangover where market narratives collide with unexpected CPI revelations and strategic financial shifts.

🩹📉 Under $100K: Bitcoin’s Hangover Day

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. There is the feeling of a morning after. The air is thin and the light is a little too bright. The charts are bleeding red, not in a panic, but with the slow, steady drip of a painful realization. It is the quiet hangover that follows a week of loud promises, a reminder that gravity always wins.

The cause of the headache arrived yesterday afternoon, wrapped in the dry language of an economic report. The Consumer Price Index, the government’s main inflation gauge, came in hot. Hotter than expected. Hotter than hoped. For weeks, the market had been telling itself a story about cooling prices and a friendly Federal Reserve ready to open the liquidity taps. Yesterday’s data did not just change a number on a spreadsheet; it changed the story. And in this market, the story is everything.

🔍 Quick Overview

ETF Indecision: The SEC punted on the Ethereum ETF decision again, kicking the can down the road so often it’s practically a professional sport.

Wall Street's Warming Up: Morgan Stanley is reportedly eyeing spot Bitcoin ETFs, another sign the old guard is finally learning to love the new money.

Inflation's Ghost: Hot inflation numbers gave the market a brief scare, a firm reminder that macroeconomics is still the ghost in crypto’s machine.

Layer 2 Lockup: A massive token unlock has traders on edge, proving that even in the digital world, there’s no such thing as a free lunch.

The Real World Arrives: Real World Asset tokens are the new talk of the town, as projects race to put everything from real estate to fine wine on the blockchain.

Markets are bleeding deeper today. Bitcoin has slipped below $97K, Ethereum is hovering just above $3.2K, and Solana continues to lead the downside with nearly a 5% drop. XRP and BNB are also firmly in the red. The selloff feels like exhaustion rather than panic, volumes are thinner, and buyers are mostly waiting it out. It’s a risk-off close to the week, with traders stepping back rather than fighting the momentum.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

Polymarket partnered with UFC and TKO Group Holdings to integrate prediction markets into live fight broadcasts.The deal signals prediction markets' growing integration with mainstream entertainment and Polymarket's ambition to reach a $15 B valuation.

The Czech National Bank (CNB) established a $1 million "test portfolio" including Bitcoin, a USD stablecoin, and a tokenized deposit. This direct Bitcoin acquisition by a central bank is a significant development being closely watched by other institutions.

JPMorgan upgraded Circle from "underweight" to "overweight," setting a $100 stock price target by December 2026, citing strong Q3 results. The upgrade suggests growing confidence in USDC's role in traditional finance following the GENIUS Act.

Uniswap launched Continuous Clearing Auctions (CCA) on Uniswap v4 for customizable token auctions. The new system could improve DeFi stability and sustainability by providing immediate liquidity for secondary trading.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Is your social strategy ready for what's next in 2025?

HubSpot Media's latest Social Playbook reveals what's actually working for over 1,000 global marketing leaders across TikTok, Instagram, LinkedIn, Pinterest, Facebook, and YouTube.

Inside this comprehensive report, you’ll discover:

Which platforms are delivering the highest ROI in 2025

Content formats driving the most engagement across industries

How AI is transforming social content creation and analytics

Tactical recommendations you can implement immediately

Unlock the playbook—free when you subscribe to the Masters in Marketing newsletter.

Get cutting-edge insights, twice a week, from the marketing leaders shaping the future.

Beyond the Noise

The market took the punch square on the jaw. Core inflation ticked up when it was supposed to tick down, a small deviation with enormous consequences. (Source: U.S. Bureau of Labor Statistics). Risk assets sagged across the board. Bitcoin, which had been fighting hard to build a home above $100,000, stumbled back to the mid-$90s. Somewhere in the background, I can almost hear “Ein verletzter. Alarm! Alarm!” from Commandos on loop. It is a clean, brutal reaction. Higher-for-longer rates make safe, boring bonds look better and speculative assets look worse. The wave of new institutional money that had roared into the market is facing its first real test of conviction.

This macro chill blew straight through the narratives that were blooming just days ago. The talk of an explosive rally in “AI Coins,” a story built on the assumption of fresh central bank money flooding the system, suddenly sounds like it belongs to another season. When the cost of capital goes up, the appetite for high-concept, far-future bets goes down. The speculative froth that lifts the most exotic boats is the first thing to evaporate when the tide of liquidity recedes. Promises whispered on Tuesday felt a lot further away by Friday morning.

The pressure changes the physics of the space. It forces a flight to quality, or at least to perceived quality. Look at the schism between Ethereum and Solana. Earlier this week, we saw the contrast: Ethereum’s methodical, unglamorous work on the Dencun upgrade, promising to make its Layer 2 networks 10x cheaper with “blobs,” versus Solana’s struggle with a network failing 70% of the time under heavy load. In a bull market, investors might forgive Solana’s growing pains in exchange for raw speed. In a nervous, risk-off market, stability starts to look very appealing. A network that works slowly is better than one that does not work at all.

This shift in mood makes the regulatory headwinds feel stronger too. The SEC’s ongoing campaign against centralized staking services is a perfect example. Chairman Gensler’s argument, that these services are unregistered securities, has forced exchanges to delist or alter staking for U.S. customers. In a roaring market, this is an annoyance. In a down market, it is a real problem. It removes one of the simplest, most accessible sources of yield for regular investors at the exact moment their portfolios are taking a hit. The quiet moral lens: the regulator’s hammer, meant to protect investors, often lands hardest on the smallest ones by removing their safest options first.

So where does the institutional money go? The $524 million that surged into Bitcoin ETFs on Tuesday now looks like a high-water mark before the storm. The question is whether those buyers have the stomach for this. Is this a dip they will buy, or a warning that makes them pause? We are seeing a great sorting. The capital that arrived looking for a quick, inflation-proof trade is being shaken out. The capital that arrived with a ten-year thesis, that this technology is a fundamental upgrade to the world’s financial plumbing, is what remains. This is the moment we find out how much of that long-term capital is really here.

Even in a sea of red, some currents deepen rather than fade. The conversation around tokenized Real-World Assets (RWAs) is getting more interesting, not less. As speculative DeFi yields and staking rewards come under pressure, the idea of earning a steady return from a tokenized portfolio of real estate or private credit starts to look attractive. This is the institutional-grade work being done by firms like BlackRock and JPMorgan. It is a narrative that does not depend on a Fed pivot or a meme. It depends on legal frameworks and balance sheets. In a market suddenly obsessed with reality, it might be the most powerful story of all.

What to watch this weekend: Friday’s final ETF flow numbers will show whether institutions used this dip to accumulate or headed for the exits.

This Caught My Eye:

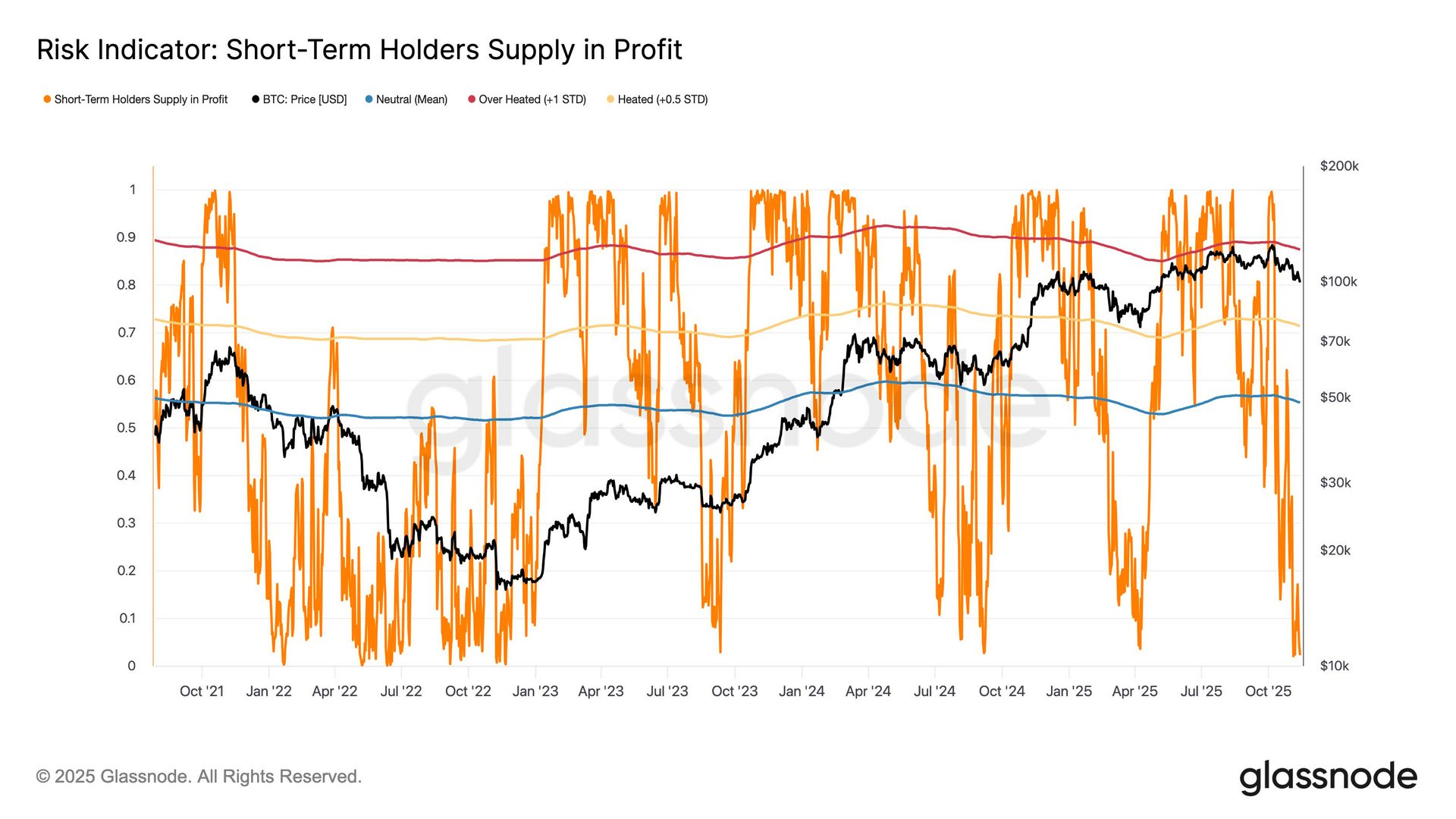

Source : glassnode

Here’s a breakdown of the chart:

Short-term Bitcoin holders are deep in the red, with roughly 99% of coins acquired within the past five months now below cost basis, a capitulation-level signal historically tied to market bottoms.

This reset mirrors prior mid-cycle corrections, where structural holders absorbed weak hands before momentum shifted back toward long-term accumulation.

Looking Ahead

We are left with a market that has been humbled. It has been reminded, rather forcefully, that it is not an island. The grand internal narratives about technological revolutions are powerful, but they are still subject to the brute force of the global economy. For all the talk of being an inflation hedge, Bitcoin still behaves like a risk asset when the people who control the world’s reserve currency get nervous about inflation.

The path forward is now less clear. The coiled spring we saw mid-week has been rattled. The tension is no longer between competing crypto stories, but between the entire crypto ecosystem and the macro backdrop. The question that will define the coming weeks is one of resilience. Can the foundation of institutional adoption and real-world utility being built withstand these tremors, or was the run to $100,000 just a brief moment of optimism in a world about to get colder? The market is watching the old gods again, and waiting for the next sign.

Until Monday,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!