- Osiris News

- Posts

- 🏛️📉 Treasury Mandate Crushes Stablecoins, SOL Bleeds

🏛️📉 Treasury Mandate Crushes Stablecoins, SOL Bleeds

Treasury regulations disrupt stablecoin markets, triggering crypto market turbulence and revealing the fragile intersection of regulatory pressure and digital financial innovation.

🏛️📉 Treasury Mandate Crushes Stablecoins, SOL Bleeds

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. The air is thick with a strange kind of whiplash. It feels like trying to read a building’s blueprints during an earthquake. In one corner, men in sharp suits are methodically rewriting the rules of construction. In the other, the ground itself is shaking, cracking support beams and swallowing whole floors into the digital ether. The screens show a sea of red, but the numbers are not the story.

The story is the tension between the grinding force of regulation and the brutal reality of fragile code.The market is attempting to process two failures at once: the failure of old systems to adapt and the failure of new systems to survive. The result is a quiet, grinding dread, punctuated by moments of sheer panic.

🔍 Quick Overview

Stablecoin Shake-Up: The US Treasury wants stablecoins backed strictly by T-Bills, telling DeFi’s wilder experiments to swap magic beans for government paper.

Solana's Stress Test: One oversized liquidation triggered a $350M cascade, showing even Solana’s speed can’t outrun a badly placed whale.

The $350 Million Bridge Toll: A major cross-chain bridge exploit cost $350M, proof that some crypto “infrastructure” still behaves like a rope bridge in a hurricane.

Science Gets Tokenized: VCs just dropped $150M into DeSci, betting blockchains can fix research funding faster than peer review can say “rejected.”

Bitcoin's New Friends: Fifteen days of nonstop ETF inflows have Bitcoin moving in sync with the S&P 500, looking less like digital gold and more like a high-beta tech stock with FOMO.

A strong rebound swept through the market. Solana surged nearly 3%, Ethereum and BNB posted solid 2% gains, and Bitcoin and XRP followed with lighter climbs. After days of pressure, buyers finally showed up with some conviction.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

Bitcoin fell below $89,000, marking a greater than 5% loss for 2025, after Federal Reserve minutes revealed deep division and uncertainty regarding the December interest rate decision. This macro uncertainty is pressuring crypto markets, with analysts warning that intensified selling could retest the $74,500 support level.

India, in partnership with Polygon and Anq, plans to launch the rupee-pegged Asset Reserve Certificate (ARC) stablecoin in Q1 2026 to combat capital flight caused by dollar-backed alternatives. This move establishes a two-tiered digital currency system, allowing private innovation above the foundational RBI CBDC.

Zero-knowledge proofs (ZKPs) are proposed as the solution to the digital identity crisis, allowing users to prove compliance or age without revealing sensitive underlying data.ZKPs could establish on-chain trust histories for AI agents and satisfy KYC/AML needs without creating centralized data honeypots for hackers.

BlackRock registered the name "iShares Staked Ethereum Trust ETF" in Delaware, signaling an imminent formal application for a new crypto product that incorporates staking rewards.This follows Grayscale’s recent approval to add staking to its ETHE product, suggesting the SEC is becoming more receptive to yield-bearing crypto ETFs.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

Beyond the Noise

The suits arrived from the Treasury Department today, bringing a new set of rules for stablecoins. This is the heavy hitter, the story that will echo for years. The proposed framework is simple and direct: for any non-bank stablecoin issuer in the United States, reserves must be 100% backed by short-term U.S. Treasury bills. No commercial paper, no mysterious asset baskets, just the plain, boring debt of the U.S. government. Treasury Secretary Yellen spoke of the need for “immediate, verifiable liquidity,” a phrase that sounds dull but lands like a cannonball. As one analyst put it, “This is the regulatory clarity we needed, but the reserve mandate is a sledgehammer, not a scalpel.”

The market reaction was instant. Capital fled to perceived safety, pushing USDC, which is largely compliant already, to trade at a 1.2% premium. This is the market pricing in regulatory risk in real-time. For decentralized and algorithmic stablecoins, however, this is an existential threat. Their business models, built on complex collateralization, cannot easily pivot to holding a mountain of low-yield T-Bills. Their trading volumes dropped 18% hours after the draft release. The framework offers a 90-day grace period, but it is less a window of opportunity than a countdown timer. As one protocol founder noted, the cost of compliance will “push smaller issuers out, consolidating power among the giants.”

While this slow-motion regulatory crisis unfolded, a faster one tore through the Solana ecosystem. A liquidation cascade is a horrible, beautiful thing to watch from a distance. It is a chain reaction of forced selling: falling prices trigger automated liquidations, which push prices down further to trigger more selling. It is the financial equivalent of a collapsing building. It began when a single whale was forced to exit a massive leveraged position. The price of SOL dropped 14.5% in four hours, wiping out $350 million in total value locked. “The speed of the cascade was unprecedented,” a trader said on a podcast, “we saw $80 million vanish in under 15 minutes.”

The problem was exacerbated by slow oracle price feeds, which meant the system liquidated collateral at the wrong prices, like a butcher using a broken scale. The network itself did not halt, a small victory for the engineers, but the economic damage was severe. Governance forums are now ablaze with debate on whether to use protocol treasuries to cover the bad debt. The moral lens is quieter: for every whale liquidation, thousands of smaller users see their funds trapped in lending pools, trust eroding with every tick down.

As if that were not enough, the day opened with structural failure. A major cross-chain bridge connecting Ethereum and a Cosmos-based chain was exploited for approximately $350 million. This was not a simple mistake; it was a sophisticated attack on core logic, a zero-day vulnerability in signature verification. Simply put, attackers found a flaw that let them forge the keys to the vault, minting unauthorized tokens to drain funds. The bridge’s native token, BRIDGE, collapsed by 38%. Security firms are scrambling, warning that other bridges using similar code may be vulnerable. It is a stark reminder that the highways connecting these digital economies are often little more than rickety rope bridges swaying over a canyon.

Amid the wreckage, however, fresh foundations are being poured. The Decentralized Science (DeSci) movement saw a massive influx of capital, with two platforms raising over $150 million in venture funding. The goal is to use blockchain to fix broken scientific research. Through IP tokenization, patents or data become tradable tokens, enabling fractional ownership and funding for high-risk projects. The top DeSci tokens jumped 45% in a week. It is a narrative of hope, a signal that even as old parts of crypto burn, new ones sprout. The dissonance is striking: one sector loses millions to old code, while another raises millions to fund the future of medicine.

Long-term building continues on Ethereum as well. Chatter around the upcoming Pectra upgrade centers on Verkle Trees. It is a deeply technical topic, but the upshot is simple. Verkle Trees are a new data structure that drastically shrinks the data required to verify the chain. This unlocks “stateless clients,” allowing full Ethereum nodes to run on devices with minimal storage, a massive step for decentralization. It is the slow, unglamorous work of upgrading core infrastructure, like replacing a city's pipes so it can grow for another fifty years. It doesn't make headlines, but it ensures survival.

This Caught My Eye:

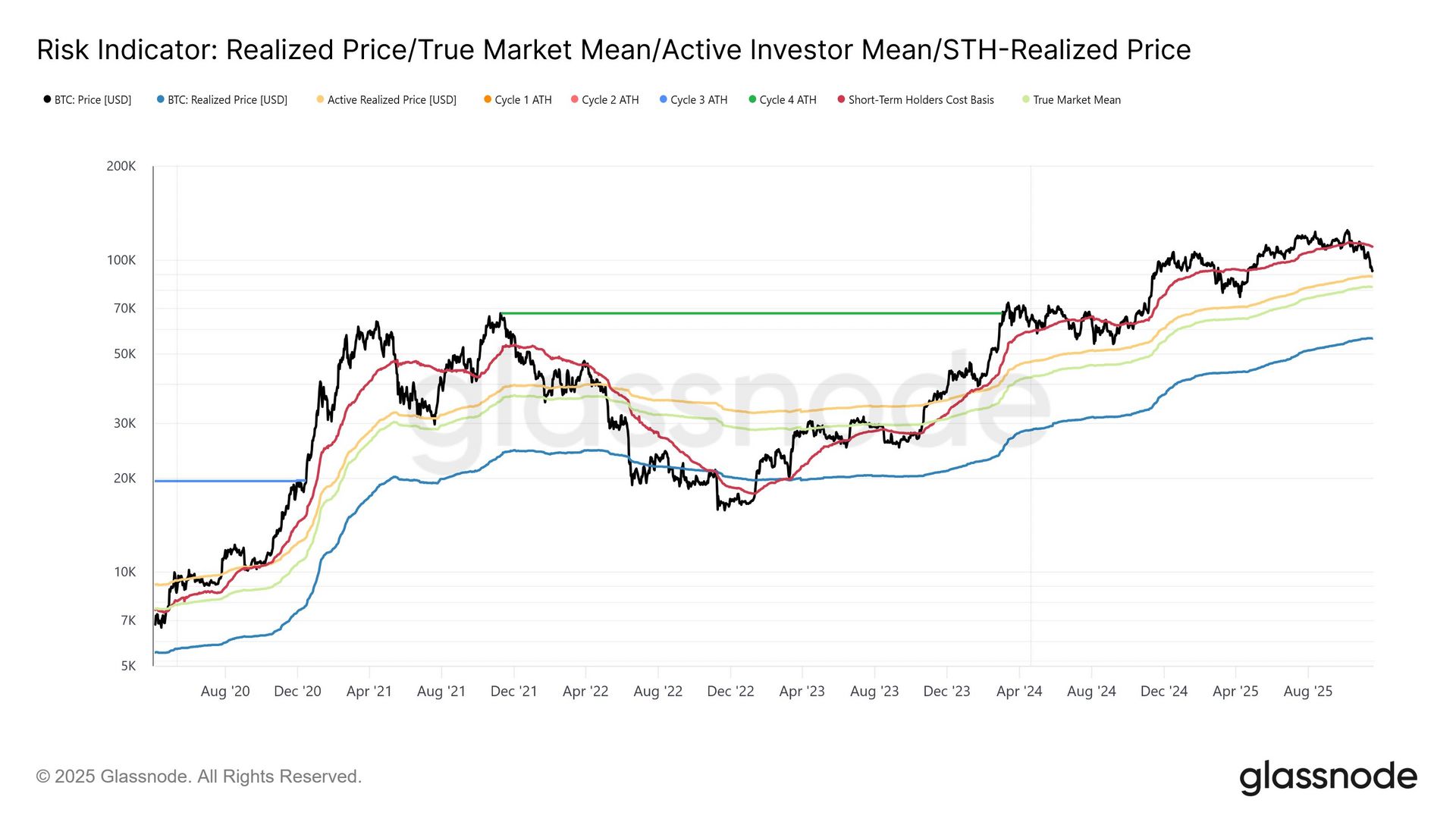

Source : glassnode

Here’s a breakdown of the chart:

Bitcoin is sitting right on top of the Active Investors Mean, a key bull-market support line. Losing it, then losing the True Market Mean, would be the strongest bear-trend confirmation since 2022.

The stack of on-chain cost bases is tightening. If price falls below both $88.6K and $82K, it signals that the majority of active and long-term holders have flipped from profit to stress, opening room for deeper downside.

Looking Ahead

The market is caught in a powerful crosscurrent. On one side, institutionalization and regulation pull toward order, represented by the Treasury’s mandate. This force wants to tame the wildness of crypto, placing it in a well-lit, well-audited box. The sustained inflows into Bitcoin ETFs, which now correlate tightly with the S&P 500, are a testament to this pull. Bitcoin is becoming a macro asset, subject to the same rules and whims as everything else.

On the other side lies the raw, chaotic energy of decentralized innovation, producing both miracles and disasters. The Solana cascade and the bridge exploit are brutal reminders that this technology remains experimental and incredibly fragile. The risk is not just financial; it is systemic. The promise of DeSci and Verkle Trees shows the creative power of this space, but that power demands responsibility. The question for tomorrow is whether these two forces can coexist. Can the industry build secure bridges and resilient protocols before regulators decide the construction site is too dangerous and fence it off for good? The ground is still shaking, and the inspectors are taking notes.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!