Welcome to today's edition of Osiris News. Bitcoin is trading like a tech stock with a hangover, while gold is doing exactly what crypto was supposed to do. The price action is ugly, pinned below $89,000 by a billion-dollar liquidity drain in the spot ETFs. Yet, if you look away from the charts and into the boardrooms, the industry is maturing at breakneck speed. Tether is effectively becoming a gold central bank, and Hyperliquid is capturing the commodities trade on-chain. The divergence between public market fear and private market execution has rarely been starker. While traders hyperventilate over a potential government shutdown, the smart money is quietly buying the plumbing.

🔍 Quick Overview

Market Correlation: Bitcoin ETFs bleed $1.3B as gold rallies; the "digital gold" narrative is on hold.

Tether: Launching a regulated US stablecoin while hoarding $24B in physical gold.

Hyperliquid: On-chain silver perps hit $1.4B volume, proving DeFi can compete on product.

Stablecoin Regulation: The crypto bill is dead, so Fidelity is launching its own stablecoin anyway.

Security Theater: US-linked wallets drained of $40M after a contractor shared a private key.

Bitcoin is firmly holding the $90,000 level after a 3.1% move, though leadership for the session is narrowly claimed by Ethereum, which is tracking slightly higher. This strong performance at the top is confirmed by robust market breadth, as the rest of the majors, including BNB, XRP, and Solana, are tightly clustered with solid gains around the 2.1% to 2.2% range.

Trending News

A winter storm in D.C. delayed the Senate Agriculture Committee's hearing on the "Clarity Act," stalling momentum for permanent crypto rules. Prediction market odds for the bill's passage dropped from 80% to 50% as industry leaders warn of a shift to a difficult "show me" market phase.

The stablecoin issuer now holds approximately $24 billion in gold reserves stored in the Swiss Alps, aiming to position itself as a "gold central bank." Tether is actively trading the metal and launching a new US-domiciled stablecoin, USAT, to compete with traditional banks.

The HYPE token rallied to $33 as traders flocked to the decentralized exchange to trade volatile silver and gold perpetuals. The platform processed over $1 billion in 24-hour volume for silver alone, utilizing a deflationary buyback mechanism to burn tokens with fee revenue.

The combined value of USDT and USDC dropped to $257.9 billion, signaling a genuine exit of capital rather than sideline positioning. USDC led the decline with a $4 billion contraction in ten days, suggesting U.S. institutional investors are retreating amid regulatory stalls.

New From Us

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

The signal this week isn’t the red candle; it’s the structural break in asset correlation. Public markets are suffering from a severe case of liquidity indigestion. Investors yanked over $1.3 billion from spot Bitcoin ETFs last week, spooked by tariff headlines and the allure of risk-free yields. With order book depth reportedly thinner than last year, these redemptions are inflicting outsized damage on price. While gold rips to new highs above $5,300 as a geopolitical hedge, Bitcoin is being treated as a risk-on asset that gets sold first when the macro picture blurs. The correlation break is real; capital is rotating into safety, and right now, that means metal, not digital code.

While the public market dumps spot, the largest operator in the space is pivoting its entire strategy to capture this exact rotation. Tether is aggressively diversifying its backing, reportedly holding 140 tons of gold in a Swiss bunker, a hoard worth roughly $24 billion. They aren't just sitting on it; they are hiring traders from HSBC to actively arbitrage the metal. Simultaneously, they launched USAT, a regulated, onshore stablecoin issued via Anchorage Digital Bank. This is a direct attack on Circle’s USDC monopoly. By creating a "good twin" to USDT under the OCC's purview, Tether is attempting to capture US institutional liquidity that is legally barred from touching their offshore product. They are effectively moving their empire inside the regulatory fence, utilizing Cantor Fitzgerald as the custodian to buy legitimacy.

The beneficiaries of this commodity boom are not the traditional exchanges, but the decentralized infrastructure rails. Hyperliquid has surged in activity following its HIP-3 upgrade, which allowed for the permissionless listing of non-crypto assets. The platform’s Silver perpetual market hit over $1.4 billion in 24-hour volume, rivaling major centralized venues. Traders are using crypto rails to long traditional commodities because the user experience is superior and the market never closes. The native token, HYPE, rallied over 40% on the week as fee burns accelerated. This validates the thesis that decentralized exchanges can compete on product offering, not just on being non-custodial.

In Washington, the legislative sausage-making has hit a critical snag. The Clarity Act, intended to be the landmark market structure bill, is effectively dead. The banking lobby killed it. The sticking point is stablecoin yield. Banks view third-party exchanges passing yield to users as a direct threat to their low-interest deposit monopoly. Consequently, traditional finance giants are taking matters into their own hands. Fidelity announced the launch of its own stablecoin, the Fidelity Digital Dollar (FIDD), on Ethereum. By utilizing a national trust bank charter, they are bypassing the legislative gridlock to issue a compliant token. The message is clear: TradFi wants the stablecoin market, but they want it on their terms, without the DeFi yield pass-throughs.

Beneath the heavy price action, the analyst pulse reveals a distinct divergence. While sentiment for BTC remains stuck in neutral territory due to the ETF bleed, ETH is showing bullish signals (NFA). This split suggests that despite the price stagnation, the market is pricing Ethereum's utility in the tokenization stack, backed by BlackRock and Circle, differently than Bitcoin's current role as a high-beta risk asset. The market is absorbing the tariff news without a complete collapse in confidence for the smart contract layer, even as the store-of-value narrative takes a short-term hit from gold's performance.

The competence crisis in Washington adds another layer of irony to the regulatory conversation. A $40 million theft from US government-linked wallets was exposed after a contractor allegedly bragged about it on Telegram. The funds, which included seized assets, were drained because a private key was reportedly compromised during a screen share. This amateur security lapse undermines the credibility of any proposed Strategic Bitcoin Reserve. It is difficult to take the government's custody ambitions seriously when their contractors are losing keys like loose change. Meanwhile, BitGo’s successful IPO filing at a $2 billion valuation shows that the market is willing to pay a premium for competent, regulated custody.

This Caught My Eye:

Here’s a breakdown:

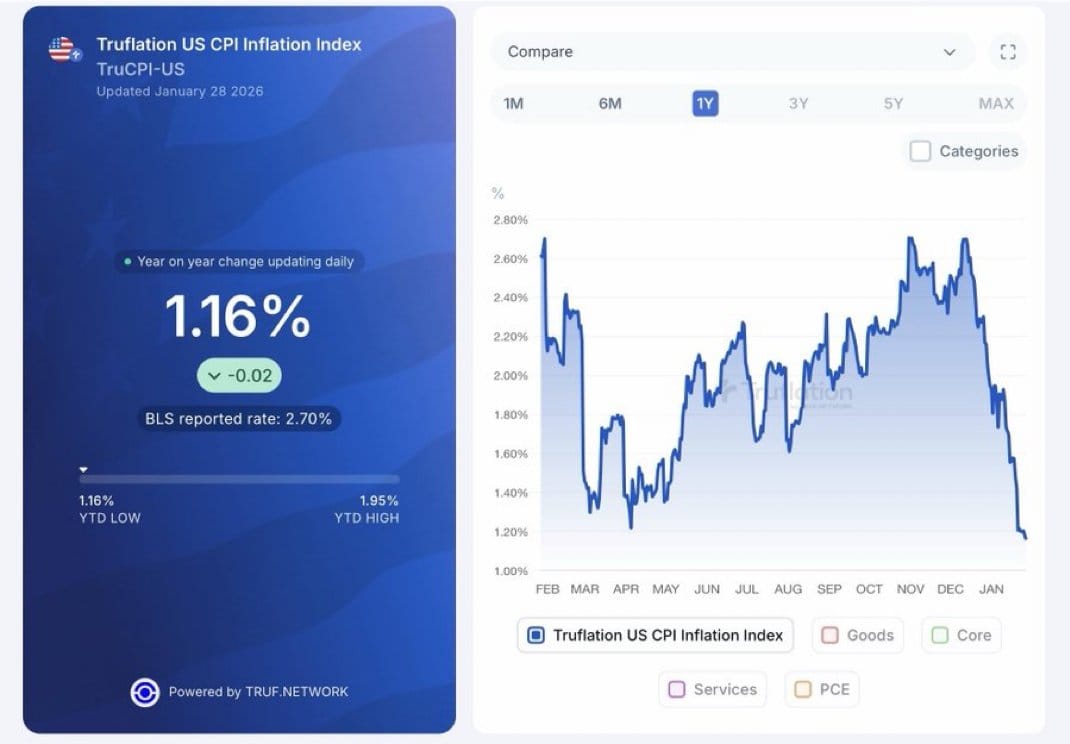

The Truflation US CPI Inflation Index is at 1.16% year over year (down 0.02), marking the year to date low versus a 1.95% high.

This reading sits far below the BLS reported CPI rate of 2.70%, highlighting a wide gap between a daily inflation estimate and the official print that can influence how markets price macro conditions.

Looking Ahead

The immediate focus shifts to the Federal Reserve’s interest rate decision tomorrow and the looming government shutdown deadline on Friday. With the market already jittery, any hawkish surprise from the Fed or a failure to pass a spending bill could exacerbate the liquidity drain seen in the ETFs. Watch the spot flows closely over the next 48 hours; if the outflows persist despite price stabilizing, it indicates a deeper risk-off shift among institutional allocators. Conversely, if the macro data comes in soft, the underlying bid from accumulators could stabilize the floor. The macro environment is noisy, but the infrastructure build-out ignores the ticker.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!