Welcome to today's edition of Osiris News. Bitcoin finally cleared the $96,000 hurdle, fueled by the largest single-day ETF inflow in three months. The price action triggered a mechanical short squeeze that liquidated nearly $800 million in bearish bets, forcing the market to reprice higher. While the charts signal a breakout, the political machinery in Washington just ground to a halt. Coinbase publicly withdrew support for the Senate's market structure bill, causing the Banking Committee to cancel today's scheduled markup. The industry is effectively trading on Wall Street's liquidity while rejecting Washington's attempt to regulate the yield curve. It is a messy decoupling of price discovery from legislative progress.

🔍 Quick Overview

Bitcoin Breakout: ETF inflows triggered an $800M short squeeze, pushing the market past $96k.

Washington Gridlock: Coinbase kills the Senate bill over stablecoin yield, halting regulatory progress.

ETF Demand Shock: Spot ETFs are now absorbing Bitcoin faster than miners can produce it.

Polygon's Pivot: Spends $250M on acquisitions, shifting from scaling to a payments provider.

Privacy's Win: The SEC closed its Zcash probe with no action, de-risking privacy protocols.

Bitcoin is holding the line with a manageable 1.3% dip, but the tape clearly shows risk-off behavior dominating the 24-hour window. The rest of the board exhibits poor breadth, as Ethereum and Solana are lagging BTC's performance, while XRP is absorbing the heaviest selling pressure, down 3.6% on the day.

Trending News

Spot Bitcoin ETFs recorded $753.8M in daily inflows, driving price past $96,000. This buy-side pressure triggered a short squeeze that liquidated roughly $600M in bearish bets, confirming a breakout from recent ranges.

The exchange withdrew backing for the Senate's market structure bill over provisions banning stablecoin yield and restricting DeFi. This opposition effectively stalled the committee vote, forcing lawmakers to rework the draft legislation.

The regulator closed its investigation into the Zcash Foundation without levying fines or enforcement actions. This move suggests a potential softening in the SEC's stance toward privacy-preserving protocols under new leadership.

The Chicago Mercantile Exchange is launching futures contracts for Cardano, Chainlink, and Stellar on February 9. This expansion signals growing institutional demand for regulated hedging tools beyond just Bitcoin and Ethereum.

New From Us

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

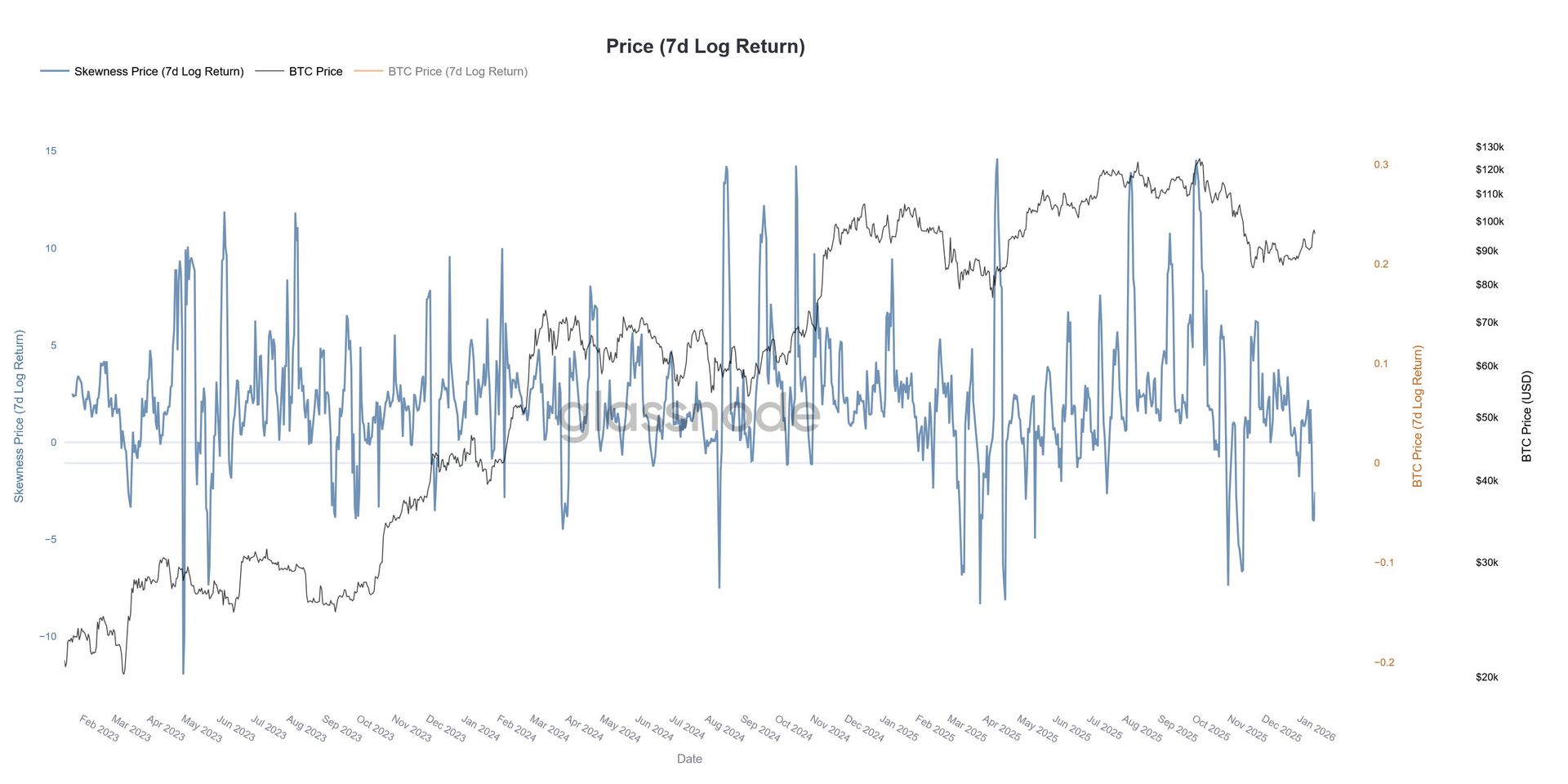

The $753 million inflow into spot Bitcoin ETFs acted as a demand shock against thin order books. Fidelity and Bitwise led the charge, absorbing coins faster than miners can produce them. This demand forced a gamma squeeze, punishing traders who positioned for a "sell the news" inflation print. The market absorbed the liquidity without a significant pullback, indicating that the supply side remains exhausted at these levels.

The legislative pause is the result of a specific conflict over net interest margin. The draft "CLARITY Act" included provisions favored by the banking lobby to ban "passive interest" on stablecoins. Traditional banks view yield-bearing stablecoins as a direct threat to their deposit models. Coinbase refused to endorse a bill that would outlaw their ability to pass yield to users, effectively killing the bill in committee. The standoff confirms that incumbents are willing to tolerate crypto rails only if they retain the monopoly on the underlying spread.

Despite the political gridlock, the analyst pulse reflects steady optimism across the board. Sentiment remains consistently positive for both market leaders with no divergence, suggesting a unified market outlook rather than a capital rotation trade. The broader market consensus is holding steady in positive territory without signs of overheating. This alignment typically supports trend continuation, as capital isn't fleeing one asset to chase the other.

Infrastructure capital is moving to solve the settlement problem regardless of the Senate's timeline. Polygon Labs deployed $250 million to acquire Coinme and Sequence, pivoting from a scaling solution to a full-stack payments provider. They are verticalizing the stack to offer compliant fiat on-ramps and wallet infrastructure, betting that future value capture lies in payment settlement rather than just block space execution. This move positions them to service the regulated stablecoin market that the banks are currently fighting to control.

In a quiet but significant win for privacy, the SEC closed its investigation into the Zcash Foundation without enforcement action. This signals a shift in the regulatory posture toward privacy-preserving protocols, which had previously been targets for money laundering probes. It suggests that the new leadership at the Commission is prioritizing market structure over prosecuting code, removing a long-standing overhang for assets utilizing zero-knowledge proofs.

This Caught My Eye:

Here’s a breakdown:

ETH/BTC is pressing right into an 8-year downtrend line that has rejected every major rally since 2017, making this a potential inflection point for ETH and the broader altcoin market.

A clean breakout and hold above this trend would signal a regime shift away from BTC dominance, while another rejection would simply extend the long-running underperformance into 2026.

Looking Ahead

The cancellation of the Senate Banking Committee markup leaves the legislative calendar in limbo. Traders should watch for the release of the Senate Agriculture Committee’s draft text later this month, which may offer a more favorable framework for digital commodities under the CFTC. Volatility will likely persist as the market digests the supply shock from the ETF inflows against the regulatory uncertainty. If the spot buying pressure continues at this volume, the short-term price floor has likely moved higher regardless of the legislative stall. Sentiment remains consistently positive for both market leaders with no divergence.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!