- Osiris News

- Posts

- ⚖️⏩ SEC's ETF Express Lane: Altcoins Next?

⚖️⏩ SEC's ETF Express Lane: Altcoins Next?

SEC's ETF breakthrough signals potential altcoin revolution, revealing a transformative regulatory landscape that could reshape cryptocurrency market dynamics and institutional investment strategies.

⚖️⏩ SEC's ETF Express Lane: Altcoins Next?

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News, if you are looking at the charts and feeling the ghost of September, you are not alone. The month closed with a sharp, clean drop that washed the leverage from the system and left the air feeling thin. Bitcoin slipped to $108.5K, Ethereum dipped below $4,000, and the Fear & Greed Index sagged to a brittle 28, a number that smells like anxiety. It was a classic September swoon, the kind of downturn that makes you question your convictions.

But today’s story is not about the fear. It is about a quiet, bureaucratic shift in Washington D.C. that feels like a key turning in a very large, very heavy lock. While traders were nursing their wounds from over $1.1 billion in liquidations, a government agency released a new set of rules that fundamentally changes the game for every asset that is not Bitcoin or Ethereum. The theme today is the collision of cyclical fear and structural change. The market got a dose of its seasonal medicine just as the biggest catalyst for the next wave of adoption was being written into the federal register.

🔍 Quick Overview

Altcoin ETFs Unlocked: The SEC just fast-tracked altcoin ETF approvals, cutting red tape like a seasoned chef, setting the stage for institutional money to flow in.

Plasma's Stable Debut: A new Layer 1, Plasma, launched its mainnet, purpose-built for stablecoins, already boasting billions in TVL and backed by Tether, think of it as a dedicated highway for digital dollars.

Regulatory Net Tightens: Regulators are tightening the screws, fining exchanges and probing insider trading, while Circle's "reversible" USDC idea challenges crypto's immutable core like trying to un-ring a bell.

DEX Perps Soar: Decentralized perpetual trading volumes hit a record $70 billion, with Aster leading the charge, a bustling market where volumes soar, but smart contract exploits still lurk like a rogue wave.

September's End, Uptober's Hope: The market dipped through September, painting the Fear & Greed Index red, but "Uptober" historically brings strong rebounds, like a reliable market-wide spring after a long winter.

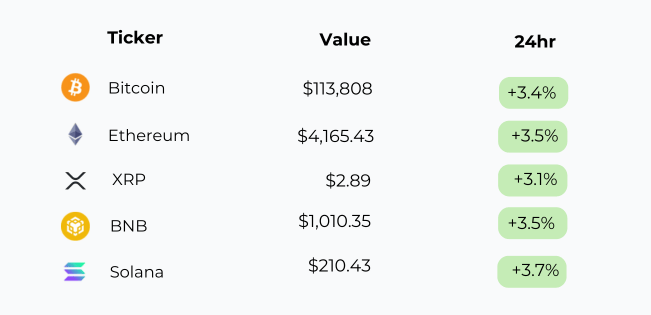

Markets snapped back after a shaky week. Bitcoin climbed steadily, Ethereum and Solana saw sharp rebounds, and XRP gained back recent losses. BNB followed the broader recovery, showing strength after multiple down sessions.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

Aster, a decentralized perpetual exchange, recorded over $25 million in fees in a single 24-hour period, surpassing competitors like Hyperliquid. The platform's native ASTER token also saw significant price appreciation following its launch, reaching a $15.1 billion FDV. This surge highlights growing momentum in DeFi derivatives and Aster's rapid ascent in the competitive DEX market.

Spot Ethereum and Bitcoin ETFs experienced record weekly outflows totaling $1.7 billion, with Ether's price dipping below $4,000. These significant departures suggest broader institutional hesitancy and a shift in risk appetite across the crypto market. The outflows reflect macroeconomic jitters and technical breakdowns, but the market's resilience absorbed selling pressure.

Major asset managers have updated S-1 filings for spot Solana ETFs with staking features, signaling imminent approval within weeks. Analysts predict these approvals will open floodgates for institutional capital, potentially mirroring Bitcoin and Ethereum ETF surges. This development could significantly enhance returns for investors and foster broader mainstream adoption for Solana.

SEC Commissioner Hester Peirce expressed regret for the agency's past crypto approach, advocating for future collaboration and innovation. This shift, attributed to new leadership, includes a Crypto Task Force and "Project Crypto" to modernize digital asset rules. The move signals a potential shift towards a more favorable regulatory environment, offering clearer guidelines for the crypto industry.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

Beyond the Noise

The document came from the U.S. Securities and Exchange Commission. It established “generic listing standards” for crypto exchange-traded funds. In plain English, the SEC just built an express lane for altcoin ETFs. The old process was a long dirt road that could take 240 days or more with no guarantee. The new process is a paved highway with a hard deadline. As one analysis put it, “For the first time ever, ETF issuers can apply for crypto products without going through the SEC’s byzantine rules.” The maximum approval time drops from eight months to 75 days.

This is not theoretical. The first vehicles are already on the highway. Grayscale converted its Digital Large Cap Fund (GDLC) into a spot ETF. A regulated product holding a basket of major altcoins is now available. Bitwise is close behind with the Bitwise 10 Crypto Index Fund (BITW) awaiting a similar decision. These funds hold assets like Solana, XRP, and Cardano. The door once cracked for Bitcoin and Ethereum is now wide open for the next tier.

The recent past shows the stakes. Spot Bitcoin ETFs drew over $40 billion in inflows, pushing BTC 98% higher in the past year (Source: Newsletter). Spot Ethereum ETFs attracted more than $10 billion, helping ETH surge 240% since April. The new framework sets the stage for similar flows across the rest of crypto. Analysts are calling October “ETF Month,” with 16 crypto ETF applications facing final SEC decisions under the faster clock.

This SEC signal is echoing in TradFi. Vanguard, the $10 trillion asset manager that sat out the initial Bitcoin ETF wave, is reportedly exploring access to third-party crypto ETFs for its clients. This slow institutional pivot can change the landscape. For years, retail took the early risk; now the largest managers are building safe, regulated bridges. Corporate treasurers also gain a clearer path beyond Bitcoin, adding a new source of buy pressure for the ecosystem.

Yet while the SEC opens one door, it knocks on others with a warrant. The same week the rules arrived, the SEC and FINRA sent letters to about 200 digital asset treasury companies, probing potential insider trading and scrutinizing unusual stock moves before large crypto purchases. Meanwhile, Canadian watchdog FINTRAC fined KuCoin $14 million for AML violations. The message is clear: welcome to the fold, but the old rules apply and fines are rising.

While this dance with the old world continues, new worlds are being built. A stablecoin-focused Layer 1 called Plasma launched its mainnet beta with over $2 billion in stablecoin TVL and a native XPL debut at a $12 billion fully diluted valuation. Backed by Tether and CEO Paolo Ardoino, Plasma aims to be the financial rails for a trillion-dollar stablecoin market. It offers zero-fee USDT transfers and targets emerging markets where stablecoins are a lifeline.

The frontier of DeFi shows the raw energy. Perpetual DEX volume hit an all-time high of $70 billion in a single day. Aster on BNB Chain led with almost $36 billion, more than half the total. Its token is hitting new highs, with whispers of its own Layer 1. The risks remain: a $782,000 smart contract exploit on the Hyperliquid-based Hyperdrive. The system is growing up, but these are still the wild, sometimes painful, teenage years.

This Caught My Eye:

Here’s a breakdown of the chart:

Institutional Collaboration: Chainlink, SWIFT, and major financial players, including DTCC, Euroclear, UBS, and BNP Paribas, are integrating blockchain to tackle $58B in corporate action inefficiencies.

Onchain Adoption Momentum: This marks a significant step toward mainstream financial institutions leveraging blockchain for settlement efficiency, automation, and cost reduction at scale.

Looking Ahead

The market sits in a fascinating crosscurrent. Late September delivered a needed purge, flushing excess leverage and resetting sentiment to palpable fear. It cleared the decks. Now, as we enter historically strong “Uptober,” the single biggest structural catalyst for altcoin adoption has been switched on. We’re about to see what happens when a rebound-ready market gets a clear, regulated on-ramp for a tidal wave of institutional capital.

This isn’t just about price; it’s the maturation of an asset class. The industry is building two futures at once: a buttoned-up, regulated world of ETFs and institutional-grade products to make old money comfortable, and a wild, permissionless frontier of stablecoin-native chains and hyper-efficient DEXs for a new kind of economy. The core question is how they connect: will DeFi’s raw energy be tamed and sanitized for Wall Street, or will the old world learn a new, much faster rhythm?

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!