Hello there {{first_name|you embodiment of curiosity}};

Welcome to today's edition of Osiris News. The market is currently playing a game of "good news, bad price." While Morgan Stanley is actively filing to launch its own Bitcoin and Solana ETFs, spot prices are bleeding out as the initial January ETF inflows turn to outflows. Retail is ignoring the institutional plumbing to chase meme coins, while the macro crowd is distracted by rumors of a Venezuelan Bitcoin seizure that likely doesn't exist. It’s a classic infrastructure-price divergence: the rails are being built, but the passengers are currently arguing about the fare.

🔍 Quick Overview

Morgan Stanley: Filing for a spot Solana ETF, front-running BlackRock for high-beta client demand.

MicroStrategy: MSCI kicks the can on index exclusion, dodging billions in forced passive selling.

Flow Blockchain: Validators halted the "unstoppable" chain for 24 hours. The token is down 40%.

Seized Assets: The DOJ is liquidating BTC, directly ignoring the White House's strategic reserve policy.

Retail Rotation: Majors are stalled, so liquidity is chasing 65% rips in meme coins.

Broad pullback across majors as Bitcoin slipped below $92K and dragged the complex lower. ETH, XRP, and Solana underperformed BTC, signaling short-term risk-off rather than rotation.

New From Us

Five minutes, one brief, you are up to speed on AI

Trending News

The banking giant filed S-1s for spot Bitcoin and Solana ETFs, marking the first time a top-tier US bank has offered branded crypto products. This move signals a shift toward vertical integration in wealth management.

The index provider decided against excluding Digital Asset Treasury companies like MicroStrategy from global indexes. MSTR shares rallied 5% as the threat of forced passive fund outflows evaporated, validating corporate Bitcoin adoption strategies.

The firm staked 82,560 ETH, pushing its treasury to 3.4% of total supply and the validator queue to 19 days. This corporate accumulation is creating a verifiable on-chain supply shock despite stagnant spot prices.

The network paused operations for 24 hours after an attacker exploited a runtime bug to mint counterfeit tokens worth $4M. Validators coordinated a restart, but the token dropped significantly on the loss of trust.

Beyond the Noise

The most significant signal today isn't the price action; it's the S-1 filings from Morgan Stanley. The bank is moving from merely distributing third-party ETFs to vertically integrating them, filing for both a Bitcoin Trust and, crucially, a Solana Trust. BlackRock has not yet touched a SOL filing. This suggests Morgan Stanley sees immediate client demand for high-beta L1 exposure and is willing to front-run the regulatory approval process to capture the fee revenue in-house. It aligns with Bank of America’s quiet policy shift, now allowing advisors to proactively pitch a 1-4% crypto allocation. The banks are done piloting; they are building their own pools.

While Wall Street files paperwork, the geopolitical rumor mill is overheating regarding the capture of Nicolás Maduro. Speculation puts a $60 billion Bitcoin seizure on the table, but the on-chain reality shows barely $20 million in verified regime wallets. The real story here isn't the imaginary $60B; it's the DOJ's defiance of the White House. Prosecutors liquidated $6 million in Bitcoin from the Samourai Wallet forfeiture this week, directly violating President Trump’s March 2025 Executive Order to hold all seized assets. We are watching a live stress test of the "Strategic Bitcoin Reserve" policy, and right now, the agencies are blinking.

The corporate treasury trade dodged a bullet. MSCI decided against excluding Digital Asset Treasury Companies (DATCOs) like MicroStrategy from its global indexes. A removal would have triggered billions in forced passive selling, effectively nuking the stock prices of companies holding BTC on the balance sheet. Instead, MSCI is freezing share counts for now, kicking the can down the road. The market reacted instantly, with MSTR rallying 5% as the immediate liquidity threat vanished.

On the infrastructure layer, the Flow blockchain provided a harsh reminder of centralization risks. An attacker exploited a Cadence runtime bug to counterfeit, not steal, roughly $4 million in tokens. The validators halted the chain for 24 hours to patch the bug. While this saved user funds, it destroyed the "unstoppable network" narrative. A blockchain that can be turned off by a developer team to fix a printing error is not a settlement layer; it’s a database with extra steps. The market punished the token with a 40% drawdown.

With the majors chopping in the $90k range, retail capital has rotated aggressively into high-beta narratives. The AI sector is running hot again, with Render up over 30% as the "compute as currency" thesis gains traction. Simultaneously, the boredom trade is back in memes, with Pepe ripping 65%. This is standard behavior for a stalled market: when the safe haven assets stop moving, liquidity flows to the highest volatility tickers available until the over-extended positions are cleared.

This Caught My Eye:

Here’s a breakdown:

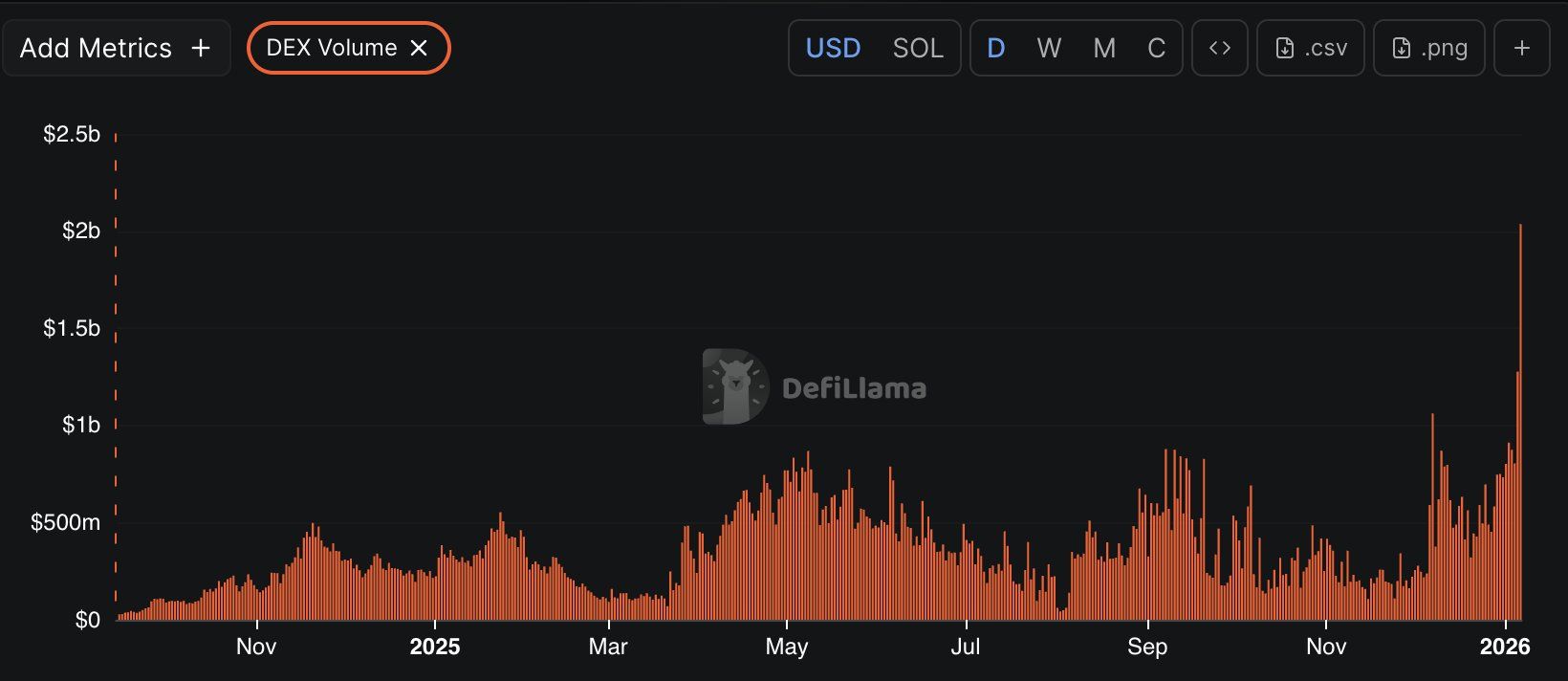

PumpFun’s daily DEX volume ripping to a record $2B, with back-to-back ATHs, shows a sharp surge in speculative flow into Solana memecoins rather than broad market caution.

It looks like the early stages of a memecoin mania returning, but a full-blown frenzy usually needs more confirmation: sustained high volumes for weeks, new token launches going vertical, rising retail inflows, and listings spilling over to major CEXs.

Looking Ahead

Keep eyes on the Supreme Court this Friday at 10 AM ET for the ruling on the Trump tariffs; a removal of these tariffs could act as a massive liquidity injection for risk assets. Next Thursday, the Senate Banking Committee votes on the crypto market structure markup, a critical step for regulatory clarity that David Sacks is currently whipping votes for. In the interim, watch for continued volatility in the Solana ecosystem as the market prices in the Morgan Stanley filing against the reality of a likely delayed SEC approval.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!