- Osiris News

- Posts

- 🌍💳 Mastercard Builds Rails While US Shuts Down

🌍💳 Mastercard Builds Rails While US Shuts Down

Mastercard pioneers blockchain integration amid U.S. government uncertainty, revealing a transformative financial landscape where technological innovation quietly reshapes economic infrastructure.

🌍💳 Mastercard Builds Rails While US Shuts Down

Hello there you embodiment of curiosity;

Welcome to today’s edition of Osiris News. If you’re feeling whiplash, you’re not imagining it. The market is trying to price a future where Mastercard settles on-chain while the U.S. government struggles to keep the lights on. One system is laying rails for instant, global value transfer. The other may furlough the people who publish the data that tells us if any of it matters. The mood is a profound disconnect: one foot in the future, one in political mud.

There is real tension today. The unstoppable force is crypto’s integration into global finance. The immovable object is U.S. Congress, which may shut down the government by midnight. A Chicago trader watches Polymarket shutdown odds hit 79%, wondering if it will delay an ETF decision. A Berlin developer ships code for a Euro stablecoin that will outlast this week’s headlines. The theme is separating signal from noise and recognizing that the real work happens far from the political stage.

🔍 Quick Overview

Stablecoin Surge: The market cap hit $300 billion, with giants like Mastercard and Visa now building roads for these digital dollars, making them the new express lane for global payments.

Government Gridlock: A US government shutdown looms, threatening to delay vital economic data and crypto ETF timelines, proving even digital assets aren't immune to Washington's paperwork pile-up.

DeFi's New Bloom: Andre Cronje’s Flying Tulip raised $200 million for an ambitious on-chain exchange, leading a fresh crop of protocols that are rapidly expanding DeFi’s fertile ground with new stablecoins and derivatives.

Bitcoin's Dual Story: Bitcoin recovered past $112,000 after a volatile week, yet simultaneously, UK authorities reeled in a record $6.7 billion crypto seizure, a stark reminder that resilience meets rigorous enforcement.

Ethereum's Mixed Signals: Jerry Jones’s Game Square bet $100 million on Ethereum, and a key scalability upgrade is coming, but spot ETH ETFs just saw their largest outflows ever, a real head-scratcher for the ecosystem.

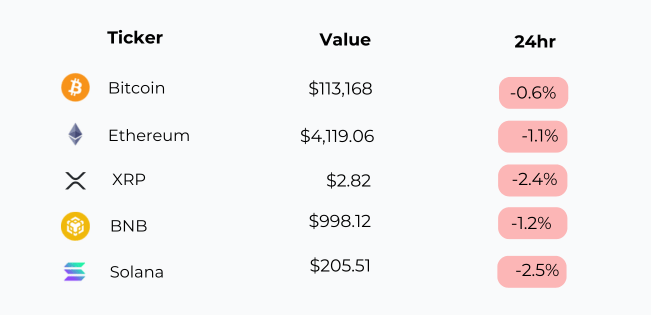

After yesterday’s bounce, momentum faded quickly. Bitcoin slipped slightly, Ethereum cooled off, and Solana gave back part of its recent rebound. XRP led the drop, while BNB also eased lower, signaling a cautious turn across majors.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

The stablecoin market has grown 42% this year to nearly $300 billion, driven by the U.S. GENIUS Act. USDC's market share increased to 25.5%, while Tether's USDT saw a decrease. This growth, fueled by clear regulations, positions stablecoins as a critical bridge between traditional finance and crypto.

The SEC approved new "generic listing standards" for crypto ETFs, streamlining the approval process and accelerating review timelines. Bloomberg analysts now estimate "100%" odds for several new spot crypto ETFs, including Litecoin, Solana, and XRP. This regulatory shift is expected to significantly increase the number of crypto ETFs launched, broadening mainstream investment access.

Tether, the stablecoin issuer, acquired 8,888.88 Bitcoin, valued at approximately $1 billion, for its Q3 2025 reserves. This purchase brings Tether's total Bitcoin holdings to nearly 109,410 BTC, making it the second-largest private company holder. The continued accumulation by a major stablecoin issuer reinforces Bitcoin's role as a strategic reserve asset for large entities.

Deutsche Börse and Circle signed an MOU to integrate regulated stablecoins, EURC and USDC, into European financial market infrastructure. This initiative will list and trade stablecoins on 360T’s digital exchange, with Clearstream handling custody. The partnership, driven by MiCA, aims to reduce settlement risk and costs, setting a precedent for wider stablecoin adoption in traditional finance.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Beyond the Noise

The noise is Washington. A fight over spending and healthcare has the U.S. on the brink of a shutdown that would halt key services. Markets face blindness, not panic. The Bureau of Labor Statistics says the September jobs report will not publish if the government closes. The Federal Reserve, due to decide rates in late October, would lose its best instruments. For every basis point Goldman Sachs says this could shave off GDP, thousands of federal workers face unpaid furloughs.

While the old system sputters, a new one is reaching escape velocity. Global stablecoin market cap is near $300 billion, doubling since January and up 18% in 90 days. These are not speculative chips. This is financial plumbing being ripped out and replaced. Citi estimates stablecoins have already processed $18 trillion this year, more than double 2024. This is a parallel financial system under construction, and legacy giants are now building with it.

Adoption is moving fast. Mastercard is working with nine major European banks to integrate stablecoins for faster, cheaper payments. Visa is piloting a program so businesses can use stablecoins instead of pre-depositing cash locally. This is not a trial balloon. It is a re-architecture of money movement. The wave rides on new clarity. A Fed governor called stablecoins “key to America’s payment future,” and the Genius Act is widely cited as the green light. PayPal’s PYUSD is at new highs after a fresh partnership.

Builders in crypto are in a parallel boom. Andre Cronje raised $200 million for Flying Tulip, an all-in-one on-chain venue for spot, derivatives, and lending, valued at $1 billion pre-code release. New networks are attracting staggering capital. Plasma, an EVM chain built for stablecoins, launched mainnet beta and already holds $5.4 billion TVL, making it the sixth-largest DeFi network overnight.

Growth draws builders and law enforcement. Ethereum moves forward, with the Fusaka testnet going live tomorrow to improve scalability. Regulators are using sharper tools. UK authorities seized 61,000 BTC worth over $6.7 billion from a Chinese national in the world’s largest crypto seizure. Poland passed a tough new crypto law that exceeds EU standards, with fines up to $2.8 million and potential jail time, which critics call a “real horror” for small firms.

Through it all, Bitcoin remains the stoic center. After a week with over $4 billion in liquidations, price recovered and held above $112,000. On-chain data supports an intact bull structure, with long-term holders in profit. The Fear & Greed Index is back to Neutral. MicroStrategy keeps adding. Public figures weigh in. YoungHoon Kim, citing an IQ of 276, said he went all-in on Bitcoin and predicts 100x in the next decade. It is a bold claim that reflects deep conviction despite short-term storms.

This Caught My Eye:

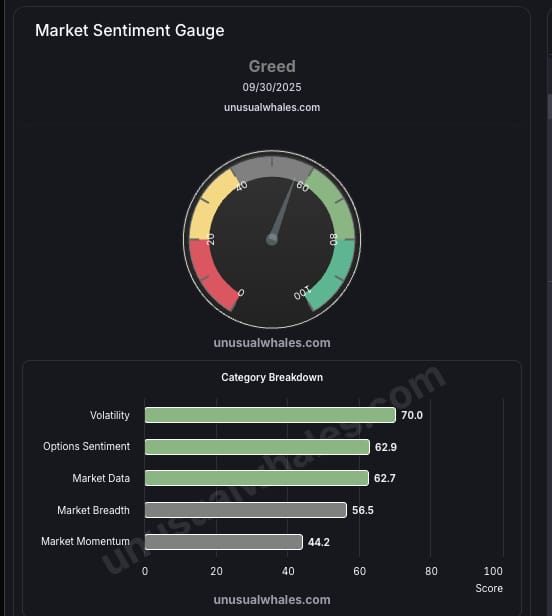

Source : Unusualwhales

Here’s a breakdown:

Market Sentiment: The gauge sits in Greed territory as of Sept 30, 2025, with strong readings in volatility (70.0) and options sentiment (62.9).

Mixed Signals: While market data and breadth remain solid, momentum lags at 44.2, suggesting traders are cautious despite overall optimism.

Looking Ahead

Two realities compete. The short-term story is Washington’s noise. A shutdown would add uncertainty, delay critical data, and possibly slow regulatory timelines for products the market wants. Expect headline chop and calendar friction.

The longer story has more gravity. A global system is being rebuilt on new rails, and it is not waiting for permission. The $46 billion net inflow to stablecoins in the last three months did not care about spending bills. Mastercard developers and Fusaka engineers are not checking shutdown odds. They are building. The question for the next quarter is which story pulls harder. Will political friction slow the new momentum, or are we hearing the last loud gasps of a system being replaced in plain sight?

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!