Welcome to today's edition of Osiris News. Bitcoin is trading like a tech stock with a hangover, while gold is doing exactly what crypto was supposed to do. The price action is ugly, pinned below $87,000 by a billion-dollar liquidity drain in the ETFs. Yet, if you look away from the charts and into the boardrooms, the industry is maturing at breakneck speed. BitGo just rang the bell on the NYSE, and Ledger is reportedly eyeing a $4 billion listing. The divergence between public market fear and private market execution has rarely been starker. While traders hyperventilate over a potential government shutdown, the smart money is quietly buying the plumbing.

🔍 Quick Overview

ETF Outflows: Over $1.3B pulled from Bitcoin ETFs. Capital is rotating to gold, not digital gold.

Infrastructure Plays: BitGo lists on NYSE while traders panic. The smart money is buying the plumbing.

Private Blockchains: R3 pivots to Solana, admitting liquidity is on public chains. The thesis is dead.

Fed Chair Rumors: A pro-BTC CIO is a top contender. Executive power may soon trump legislative stalls.

Tokenized Treasuries: Circle’s USYC overtakes BlackRock’s BUIDL. The on-chain war for yield is intensifying.

Bitcoin is trading just above $88,000 following a reserved 1.9% gain, establishing a positive but cautious baseline for the session. The tape shows clear risk appetite, however, with the broader market exhibiting strong breadth led by XRP’s significant move and solid outperformance from both Ethereum and Solana.

Trending News

Investors withdrew $1.33B from U.S. spot Bitcoin ETFs last week, marking the worst outflows since February 2025. BlackRock’s IBIT bled daily as macro fears pushed capital toward gold, dragging BTC below $87,000.

The custodian successfully raised $212.8M in its public listing, securing a $2.59B valuation based on profitability and federal licensing. This marks the first major crypto-native IPO of 2026, signaling institutional capital favors regulated infrastructure over speculation.

The asset manager filed with the SEC to launch a traditional stock market product backed by BNB, the fourth-largest cryptocurrency. If approved, the fund would trade on the Nasdaq, further expanding regulated access to altcoins beyond Ethereum and Solana.

The regulator dismissed its case with prejudice after Gemini and Genesis returned 100% of assets in-kind to 340,000 customers. This resolution signals a potential shift in enforcement strategy under new leadership, prioritizing restitution over litigation.

New From Us

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

The signal this week isn’t the red candle; it’s the sheer scale of the divergence between capital allocators. Public markets are suffering from a severe case of liquidity indigestion. Investors yanked over $1.33 billion from spot Bitcoin ETFs last week, spooked by tariff headlines and the allure of risk-free yields. With order book depth reportedly thinner than last year, these redemptions are inflicting outsized damage on price. While gold rips to new highs above $5,100 as a geopolitical hedge, Bitcoin is being treated as a risk-on asset that gets sold first when the macro picture blurs. The correlation break is real; capital is rotating into safety, and right now, that means metal, not digital code.

While retail traders panic sell, the infrastructure layer is cashing in. The industry is undergoing a structural shift characterized by massive consolidation rather than new venture growth. Data shows 2025 capital transactions reached $50.6 billion, but nearly half of that volume came from just 21 large M&A deals. This is "big fish swallowing small ones." BitGo's debut on the NYSE and Ledger's potential listing validate the "picks and shovels" thesis: capital is rotating from speculative assets into the regulated plumbing required to service them. Traditional finance firms are executing "bridge M&A," acquiring crypto-native companies to gain immediate licenses and technology stacks rather than building from scratch. They want the rails, instant finality and programmable value, without necessarily exposing themselves to the volatility of the assets.

This shift toward utilizing public rails for institutional plumbing was underscored by R3’s pivot to Solana. The enterprise blockchain heavyweight, which spent years building private permissioned ledgers for banks, is moving its tokenization infrastructure to a public network. They explicitly cited that liquidity resides on public chains, not walled gardens. By targeting instant settlement and tokenized assets on Solana, R3 is effectively admitting that the private blockchain thesis is dead. Simultaneously, Coinbase is integrating Jupiter’s routing engine, turning the centralized exchange into a premium frontend for on-chain liquidity. The lines between CEX and DEX are blurring, with the former becoming a distribution layer for the latter's execution engines.

In Washington, the regulatory environment is shifting from legislative hope to executive personnel rumors. The Clarity Act, intended to be the landmark market structure bill, is effectively dead, killed by the banking lobby over stablecoin yield. Banks view third-party exchanges passing yield to users as a direct threat to their low-interest deposit monopoly. However, the rumor mill is spinning regarding the Federal Reserve. BlackRock CIO Rick Rieder is surging on prediction markets as a contender for Fed Chair. Rieder is a known proponent of Bitcoin allocation in portfolios. If the world’s largest asset manager places an ally at the helm of the world’s most powerful central bank, the legislative stalls in Congress become less relevant.

The sentiment data suggests a split beneath the surface. The analyst pulse for BTC hovers in neutral territory, reflecting the heavy price action and ETF outflows. However, ETH registers a distinct bullish outlook (NFA). This divergence suggests that despite the narratives around L2s cannibalizing revenue, the market may be viewing ETH's role in the tokenization stack, backed by BlackRock's BUIDL and Circle's USYC battles, as a source of structural resilience that Bitcoin currently lacks. The market is pricing Bitcoin on macro fear, but it is pricing Ethereum on utility and yield potential.

Finally, the product space is testing new boundaries. Grayscale filed for a BNB ETF, a bold move that attempts to wrap an exchange-linked utility token into a regulated wrapper. This forces the SEC to make a decision on assets closely tied to the operational success of specific crypto companies. Meanwhile, Circle’s USYC fund narrowly overtook BlackRock’s BUIDL in the tokenized treasury market, proving that superior collateral mechanics can still beat brand power. The war for the "yield-bearing dollar" is intensifying, and it is being fought on-chain, regardless of what the spot price of Bitcoin does today.

This Caught My Eye:

Here’s a breakdown:

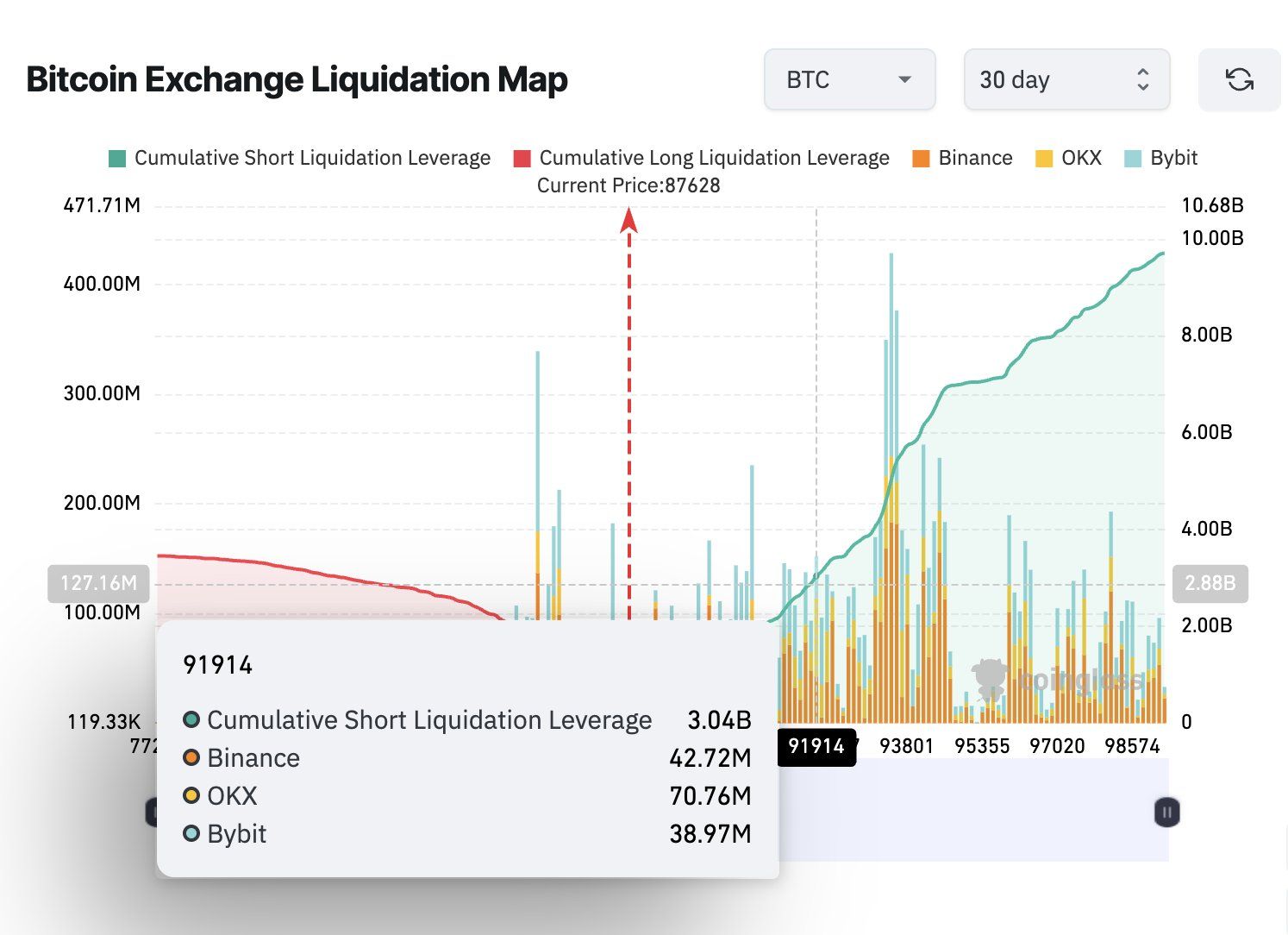

If Bitcoin spikes toward the ~$92K zone, roughly $3B in short positions would get liquidated across major exchanges.

That liquidation wall is effectively “fuel” for a potential short squeeze if buyers can push price into that range.

Looking Ahead

The immediate focus shifts to the Federal Reserve’s interest rate decision. With the market already jittery from tariff threats and a potential government shutdown on Friday, any hawkish surprise could exacerbate the liquidity drain seen in the ETFs. Watch the spot flows closely over the next 48 hours; if the outflows persist despite price stabilizing, it indicates a deeper risk-off shift among institutional allocators. Conversely, the infrastructure bid remains relentless, suggesting the floor is made of concrete even if the ceiling feels low right

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!