Welcome to today's edition of Osiris News. Bitcoin is trading like a volatile tech stock, while gold is doing exactly what crypto was supposed to do. The price action is ugly, pinned below $85,000 by a billion-dollar liquidity drain in the spot ETFs. Yet, if you look away from the charts and into the boardrooms, the industry is maturing rapidly. Fidelity is bypassing legislative gridlock to launch a stablecoin directly on Ethereum, and BitGo just rang the bell on the NYSE. The divergence between public market fear and private market execution has rarely been starker. While traders worry over a potential government shutdown, the smart money is quietly buying the plumbing. This is a structural rotation, not just a red candle.

🔍 Quick Overview

Spot ETFs: A $1.3B liquidity drain has Bitcoin trading like a risk-on asset, not a hedge.

Fidelity: Bypassing Congress to launch a stablecoin directly on Ethereum. TradFi wants the rails.

BitGo: The custodian filed for a $2B IPO. The market still pays for plumbing.

Hyperliquid: Silver perps hit $1.4B in volume. Traders will use crypto rails for anything.

US Regulation: Bill stalls over stablecoin yield. The White House meeting on Monday is now key.

Bitcoin's 5.3% retreat sets the anchor for the session, establishing a clear risk-off environment despite the asset showing marginal relative strength against the wider board. The selling pressure is notably broad, with high-beta majors like Ethereum and Solana registering the deepest cuts above 6%, while BNB currently exhibits the least volatility among the top tier.

Trending News

A violent leverage flush dragged Bitcoin below $85,000 while gold surged to record highs near $5,600. Traders treated crypto as a high-beta risk asset rather than a hedge, decoupling it from the precious metal's rally.

The asset manager unveiled the Fidelity Digital Dollar (FIDD), a regulated token pegged 1:1 with the USD. This move bypasses legislative gridlock, positioning Fidelity to compete directly with Circle and Tether for on-chain settlement.

The Agriculture Committee passed the Digital Asset Market Clarity Act in a tight 12-11 party-line vote. While a milestone for market structure rules, the lack of Democratic support signals a difficult path to becoming law.

The stablecoin issuer now holds 140 tons of bullion in a Swiss bunker, actively trading the metal to diversify backing. Tether aims to position itself as a "gold central bank" independent of traditional banking rails.

New From Us

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

The signal this week isn’t the red candle; it’s the structural break in asset correlation. Public markets are suffering from severe liquidity indigestion. Investors yanked over $1.3 billion from spot Bitcoin ETFs last week, spooked by tariff headlines and the allure of risk-free yields. With order book depth reportedly thinner than last year, these redemptions are inflicting outsized damage on price. While gold rips to new highs above $5,500 as a geopolitical hedge, Bitcoin is being treated as a risk-on asset that gets sold first when the macro picture blurs. The correlation break is real; capital is rotating into safety, and right now, that means metal, not digital code.

While the public market dumps spot, the largest operators are pivoting strategy to capture this exact rotation. Fidelity Investments is not waiting for Congress; they are launching the Fidelity Digital Dollar (FIDD) directly on the Ethereum public network. By utilizing a national trust bank charter, they effectively bypass legislative gridlock to issue a compliant token. Simultaneously, Tether is aggressively diversifying, reportedly holding 140 tons of gold while launching USAT, a regulated onshore stablecoin. This is a pincer movement: traditional finance wants the settlement rails, and crypto natives are hedging with physical assets.

The beneficiaries of this commodity boom are not the traditional exchanges, but the decentralized infrastructure rails. Hyperliquid has surged in activity following its HIP-3 upgrade, allowing permissionless listing of non-crypto assets. The platform’s Silver perpetual market hit over $1.4 billion in 24-hour volume, proving traders will use crypto rails to long traditional commodities if the UX is superior. Meanwhile, BitGo’s successful IPO filing at a $2 billion valuation shows that equity markets are willing to pay a premium for competent, regulated custody, even if token prices are down.

Beneath the heavy price action, the analyst pulse reveals a distinct divergence. While sentiment for BTC remains stuck in neutral territory due to the ETF bleed, ETH is showing bullish signals. This split suggests that despite the price stagnation, the market is pricing Ethereum's utility in the tokenization stack—backed by Fidelity's move—differently than Bitcoin's current role as a high-beta risk asset. The market is absorbing the tariff news without a complete collapse in confidence for the smart contract layer, even as the store-of-value narrative takes a short-term hit from gold's performance.

In Washington, the legislative process has hit a critical snag. The Senate Ag Committee advanced the market structure bill, but the vote was strictly partisan. The sticking point remains stablecoin yield, which the banking lobby views as a threat to their low-interest deposit monopoly. Consequently, the White House is convening a meeting on Monday to force a compromise. Until that resolution hits, expect volatility to remain high as the "Clarity Act" faces a steep uphill battle in the full Senate.

This Caught My Eye:

Here’s a breakdown:

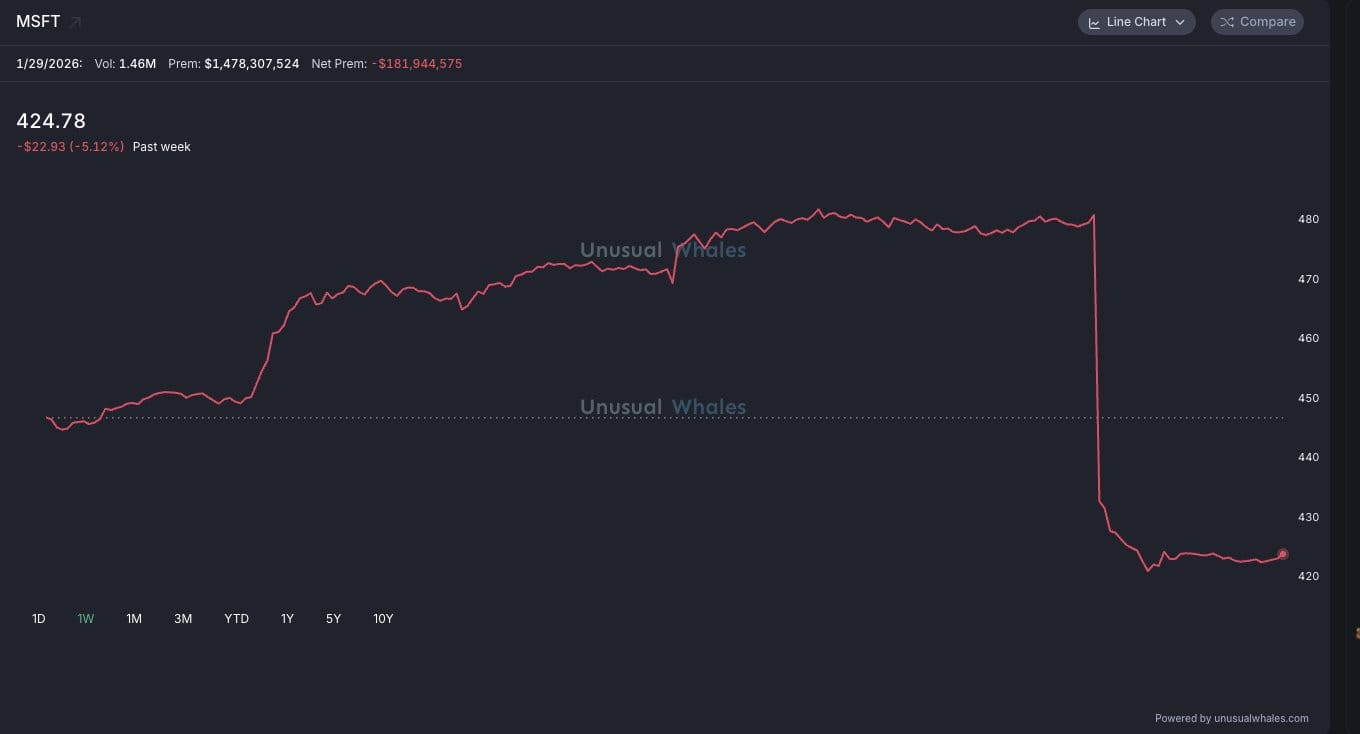

MSFT shows a sharp gap down to about $424.78, with the 1-week view indicating a -5.12% move and most of the decline concentrated in a single late-session drop.

A sudden double-digit style selloff in a mega-cap like Microsoft matters because it can drive broader index performance and signal a rapid repricing of large-cap risk.

Looking Ahead

The immediate focus shifts to the Federal Reserve’s interest rate decision tomorrow and the looming government shutdown deadline on Friday. With the market already jittery, any hawkish surprise from the Fed or a failure to pass a spending bill could exacerbate the liquidity drain seen in the ETFs. Watch the spot flows closely over the next 48 hours; if the outflows persist despite price stabilizing, it indicates a deeper risk-off shift among institutional allocators. Conversely, if the macro data comes in soft, the underlying bid from accumulators could stabilize the floor. The macro environment is noisy, but the infrastructure build-out ignores the ticker.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!