- Osiris News

- Posts

- 📈💰 Ethereum Upgrades, Bitcoin ETFs: Market's Big Day!

📈💰 Ethereum Upgrades, Bitcoin ETFs: Market's Big Day!

📈💰 Ethereum Upgrades, Bitcoin ETFs: Market's Big Day!

Well, it’s Wednesday, May 7th, 2025, and the crypto world feels a bit like an actor waiting for their cue. Two major spotlights are warming up: Ethereum’s Pectra upgrade is going live today, a significant technical leap we’ve been tracking, and all ears are tuned for Federal Reserve Chair Jerome Powell’s remarks after the FOMC meeting. The market is a mixed bag of anticipation and cautious optimism, like a student before a big exam they think they’ve studied for.

Bitcoin is holding firm, buoyed by that steady drumbeat of institutional interest, while Ethereum is hoping its big day translates into more than just technical kudos. Beyond these headliners, the regulatory scene continues its slow dance, state by state and at the federal level, and the wider altcoin market is still figuring out its place in a world increasingly captivated by Bitcoin’s gravity and the curious allure of memecoins. Before we delve into the key factors driving today’s market, let’s take a quick look at where things stand.

🔍 Quick Overview

Ethereum's Big Step: Pectra upgrade rolls out major changes, like giving your wallet a PhD, but exchanges are tapping the brakes and some worry all this new staking power might end up in too few hands.

Bitcoin's Golden March: Investors are piling into Bitcoin ETFs, with BlackRock's fund gobbling up more cash than its gold counterpart—seems like digital gold is the new black, even when actual gold is shining.

Granite State Goes Crypto: New Hampshire just became the first state to officially buy Bitcoin for its reserves, basically saying "hold my maple syrup" while other states and DC are still debating the menu.

Macro Watch: All eyes are on the Fed today, though they'll likely just hum the same tune on rates; meanwhile, US-China trade talks begin, and everyone hopes more global cash will soon make crypto go "wheee!"

Altcoin Shuffle & Stablecoin Shine: That wild altcoin party of yesteryear? Might be more of a polite gathering now, with memecoins crashing the scene and big token unlocks ahead, but stablecoins are quietly becoming the reliable workhorses of the crypto economy.

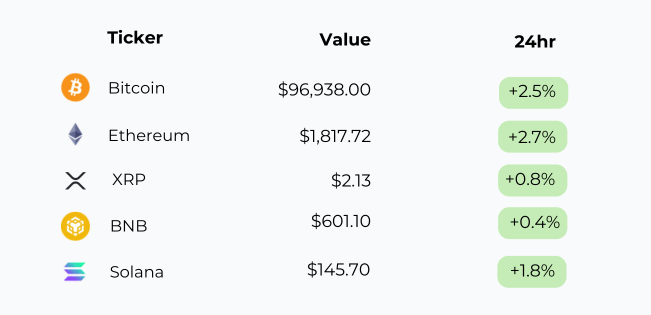

A sea of green returns—Bitcoin and Ethereum led with gains over 2%, while Solana, XRP, and BNB followed with quieter but steady climbs. It's the kind of day that doesn’t scream bull run, but definitely whispers, “we’re back on track.”

Trending News

Ethereum has successfully launched its Pectra upgrade, the largest since the 2022 Merge, introducing 11 EIPs to enhance user experience, validator operations, and Layer 2 performance. Key changes include improved wallet functionality (EIP-7702), increased validator stake limits (EIP-7251), and better Layer 2 scaling (EIP-7691). This major overhaul aims to make Ethereum more efficient, secure, and user-friendly.The Pectra upgrade could significantly boost Ethereum's scalability and usability, potentially attracting more users and developers, and impacting ETH's staking dynamics and network fees.

New Hampshire has made history by passing HB 302, establishing a "Strategic Bitcoin Reserve" that allows the state treasurer to invest up to 10% of public funds in Bitcoin. The law, advocated by the Satoshi Action Fund, permits direct purchases or investments through ETPs and allows for self-custody or qualified custodians. This move positions New Hampshire as a pioneer in state-level digital asset adoption.This landmark legislation could serve as a model for other US states, potentially increasing institutional adoption of Bitcoin and legitimizing it as a reserve asset.

Bitcoin's price remained stable around $97,000 as traders anticipated the U.S. Federal Reserve's interest rate decision and monitored news of potential U.S.-China trade talks. While the Fed is largely expected to hold rates, market volatility is anticipated based on Chair Powell's commentary. News of trade discussions earlier provided a slight boost to Bitcoin. The Fed's guidance on future monetary policy and developments in US-China trade relations could significantly influence Bitcoin's price and overall market sentiment in the short term.

Bitwise has filed a registration statement with the SEC for a spot NEAR ETF, aiming to provide investors with exposure to the NEAR Protocol's token through traditional brokerage accounts. This move follows a trend of asset managers seeking to launch ETFs for various digital assets beyond Bitcoin. The filing underscores growing institutional interest in a wider range of cryptocurrencies.SEC approval of a NEAR ETF could pave the way for more altcoin ETFs, increasing accessibility and potentially driving new investment into specific Layer 1 protocols.

Beyond the Noise

Today is a big day for Ethereum (ETH), currently trading around $1,817.72 (a 2.7% rise). The much-anticipated Pectra upgrade has officially activated. Described as the blockchain's most significant overhaul since the 2022 Merge, it bundles 11 Ethereum Improvement Proposals (EIPs) aimed at enhancing wallet functionality—allowing normal wallets to act like smart contracts—and, notably, increasing the maximum effective balance for validators from 32 to 2048 ETH. Another neat trick? It enables protocols and apps to pay gas fees for users. However, the rollout hasn't been entirely smooth; major exchanges like Binance and Coinbase temporarily paused Ethereum services, citing security and standardization concerns. This upgrade also sharpens the focus on institutional staking. With about 3.3 million ETH already in ETFs, potentially increasing total staked ETH by over 10%, the "how" of institutional staking becomes critical. Will they opt for a few large custodians, risking validator centralization, or help distribute operations? It’s a fork in the road for Ethereum's decentralization, especially as Lido still commands over 30% of staked ETH. Despite the innovations, some podcast chatter reflects a "least hype" upgrade and considerable frustration with ETH's price performance against Bitcoin.

Speaking of Bitcoin (BTC), now hovering around $96,938.00 (up 2.5%), its narrative as "digital gold" continues to gain traction, fueled by relentless institutional adoption. While Bitcoin ETFs saw a minor $85.7 million withdrawal on May 6th, this barely dents the $40.54 billion in cumulative net inflows. Remarkably, BlackRock’s IBIT has seen more inflows this year than GLD, the most popular gold ETF, even during a strong period for actual gold. As Hunter Horsely of Bitwise noted, "Gold is having its moment. And despite that, investors are buying more Bitcoin than gold. Now imagine when it’s flipped." Investors seem to be positioning for future appreciation, anticipating another round of quantitative easing. Bitcoin's resilience during geopolitical stress and its potential as a portfolio diversifier bolsters this view. With a market dominance of 64.4% and the Crypto Fear & Greed Index at a healthy "Greed" (67), the long-term sentiment for Bitcoin remains robust, even if some short-term indicators suggest caution.

The broader market, however, is bracing for today’s FOMC announcement. The overwhelming consensus is that the Fed will hold interest rates steady; the CME FedWatch tool shows a 97.6% chance of no change. The real action will be in Chair Powell's subsequent commentary. Will he signal a hawkish stance, or hint at future easing? One newsletter author argues the Fed is making a "major policy mistake" by not cutting rates sooner amidst signs of an economic slowdown. Regardless, the expectation is that central banks globally will eventually return to lower interest rates, which is seen as rocket fuel for assets like Bitcoin and gold due to increased global liquidity. News of US-China trade talks initiating this weekend also gave Bitcoin a nudge from $94k to $97k, though some analysts remain skeptical about any quick, substantive deal emerging.

Meanwhile, the U.S. regulatory landscape remains a fascinating patchwork. New Hampshire has boldly become the first state to enact a law establishing a strategic Bitcoin reserve, authorizing the state treasurer to invest up to 5% of state funds in assets with over $500 billion market caps – effectively, Bitcoin. This move, a surprise to many after Arizona and Florida demurred, sets an interesting precedent. At the federal level, things are more complex. The proposed "MEME Act" aims to prevent public officials from financially benefiting from crypto, a not-so-subtle nod to figures like Donald Trump and his memecoin. And the politicization of crypto was evident when House Democrats walked out of a crypto-focused hearing, protesting Trump's crypto ventures. On a more positive note for some, the CFTC dropped its appeal in the Kalshi prediction markets case, a win for that sector.

The world of altcoins and memecoins is also evolving. The idea of a broad-based "altcoin season" like those of past cycles is being questioned. As K33's David Zimmerman noted, "Without fresh retail inflows, the math gets tougher for speculative tokens." Significant token unlocks are looming for altcoins ($4.3 billion in May, $2.8 billion in June, $3.2 billion in July), creating potential headwinds. This suggests the path forward for altcoins like XRP (at $2.13, up 0.8%), BNB (around $601.10, up 0.4%), and Solana (SOL, trading at $145.70, up 1.8%) will be more selective, demanding real fundamentals, user growth, or revenue. Memecoins, on the other hand, have solidified their place, representing roughly 25% of crypto trading volume at Q1's peak. They seem to be absorbing much of the speculative retail interest, for better or worse.

In stark contrast to the cautious altcoin outlook, stablecoins are viewed as an incredibly bullish sector. As Zimmerman also highlighted, "The most bullish crypto asset outside of Bitcoin right now is almost certainly stablecoins." They are increasingly integrated into payment infrastructure for both retail and institutional users. USDC, for example, hit a record $219 billion in volume in April, boosted by its Binance partnership. The Solana stablecoin market is also a leader, with supply growing 3.8% in April to a new all-time high of $12.6 billion, up 154% year-over-year. This relentless growth underscores their utility and central role in the crypto ecosystem.

This Caught My Eye:

Here’s a breakdown of the chart:

Whales & Sharks Accumulating: Wallets holding 10–10K BTC have quietly added over 81,000 BTC (+0.61%) in just six weeks — typically a bullish signal of growing institutional or long-term holder confidence.

Small Traders Capitulating: Meanwhile, wallets under 0.1 BTC have reduced their holdings by 290 BTC (-0.60%), often a sign of retail impatience that historically marks early-stage uptrends.

Looking Ahead

So, the crypto market is navigating some significant currents. We have Ethereum’s Pectra upgrade live today, a major technical milestone whose true impact on usability, staking dynamics, and network efficiency will become clearer in the coming weeks. All eyes are also on the Federal Reserve, with Chair Powell’s commentary poised to set the tone for risk assets. The steady inflow of institutional capital into Bitcoin continues to provide a strong foundation, but the broader market shows increasing divergence.

The day’s events underscore a maturing, albeit still incredibly dynamic, crypto landscape. The Pectra upgrade highlights the ongoing technological evolution, while the surrounding debates about validator centralization and exchange preparedness remind us that progress isn't always linear. New Hampshire's Bitcoin reserve is a bold local experiment, contrasting with the slower, more convoluted federal regulatory process. And the shifting fortunes of altcoins versus the persistent, perplexing energy of memecoins show a market still searching for equilibrium and lasting value propositions beyond Bitcoin and the utility of stablecoins.

Looking ahead, the immediate focus will be digesting the FOMC outcome and observing Pectra's real-world performance on Ethereum. Next week, the SEC’s roundtable on tokenization (May 12th) and US inflation data (May 13th) will provide further catalysts. It’s a period where technological advancements, macroeconomic signals, and regulatory developments are all converging. The question remains: how will these forces shape the market not just for the rest of this week, but for the months to come?

Until tomorrow,

- Dr.P