- Osiris News

- Posts

- 💵🔥 DeFi Burns, RWAs Build, Privacy Roars Back

💵🔥 DeFi Burns, RWAs Build, Privacy Roars Back

Defi's tumultuous landscape reveals stark market divergence, as tokenized finance transforms with $500M Wall Street investments, privacy innovations, and strategic economic restructuring.

💵🔥 DeFi Burns, RWAs Build, Privacy Roars Back

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. The market feels like a city after a localized earthquake. In one district, buildings are rubble and sirens are wailing. A few blocks over, cranes lift steel for a new tower, workers unfazed. The ground is shaking for some, and for others it is the firmest foundation they have known.

The story today is stark divergence. Old promises are failing in public while new ones are being built in quiet. One side is watching the idea of a “stable” coin burn, a bonfire of broken code and leverage. The other is watching Wall Street write $500 million checks for compliant, regulated plumbing. A degen in Singapore saw savings vanish in an exploit, while a New York fund manager added to a tokenized Treasury fund. Today, we look at the rubble and the skyscraper, and how they can exist on the same map.

🔍 Quick Overview

DeFi’s Rough Week: Balancer lost $128M, and a few “stable” coins wobbled harder than a loose chair.

Wall Street’s New Frontier: Institutions keep piling in, with Ripple raising $500M and RWA tokenization up 700% as TradFi builds bridges.

Privacy Pops: Zcash roared back, up 1,200%, with a third of supply tucked into privacy vaults.

Market Breather: Bitcoin, Ethereum, and Solana cooled while ETFs saw $2B in outflows, more retreat than panic.

Smart Money Buys: Retail clings to “Extreme Fear,” while institutional wallets added 375,000 BTC, playing the long game.

Selling pressure is still present, but it’s noticeably lighter than earlier in the week, the market is drifting rather than breaking. Bitcoin and Ethereum continue to edge down, but without urgency, while BNB’s small uptick looks more like rotation than real strength. This is a market waiting for a catalyst, not choosing a direction yet.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

The USDX stablecoin, issued by Stable Labs, depegged significantly below $0.60 from its $683 M circulating supply, impacting major DeFi platforms. This instability is under investigation, with theories including a link to the $128 M Balancer exploit and inactive backing portfolio management.

Elixir has sunsetted its deUSD synthetic dollar following a $68 M debt incurred by Stream Finance, which halted withdrawals after a $93 M loss. Elixir disabled mint/redeem functions and committed to 1:1 USDC redemption, having processed 80% of claims.

Tether transferred $97.3 M worth of Bitcoin to a known reserve address, continuing its strategy of accumulating the cryptocurrency. This move positions Tether as the second-largest private company holder of Bitcoin, with estimated reserves of 87,296 BTC.

Zcash (ZEC) experienced a significant price surge, increasing 750% since early October to over $680 and reaching a $10.9 B market cap. This rally is attributed to renewed discussions on financial surveillance and growing trust in its privacy features.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

Beyond the Noise

Chaos began in DeFi. Not a novel attack, just bad math. A rounding error in legacy Balancer v2 code unlocked $128 million from Composable Stable Pools. Funds did not seep out. They gushed across networks, leaving developers scrambling and users staring at empty wallets. It was a costly lesson in the fragility of code meant to be immutable.

The crack became a cascade. Dependencies snapped. Synthetic stables like Stream Finance’s xUSD and Elixir Network’s deUSD, built on self-referential leverage, collapsed. These were not currencies. They were mint-loops dressed up as money. When the music stopped, the illusion vanished. USDX depegged below $0.60, erasing about $250 million in value. Roughly $285 million in bad debt is now tangled in lending markets, a ghost liability that will haunt balance sheets for months.

Meanwhile, the institutional district laid marble floors. Ripple raised $500 million at a $40 billion valuation from Fortress and Citadel affiliates. This was not a bet on a meme. It was a strategic push into custody, treasury services, and RLUSD, now above $1 billion in market cap. It is the slow, well funded effort to build a bridge from Wall Street to blockchains, with tolls, guards, and approvals.

The bridge materials are Real-World Assets (RWAs). While degens chased four-digit yields on coins backed by other coins, institutions picked a simpler primitive: put U.S. Treasuries on chain. Tokenized T-bills have grown more than 700% in a year to about $1.2 billion. Securitize and VanEck are bringing these funds to Aave. Franklin Templeton is launching in Hong Kong. As one analyst put it, institutions are entering DeFi for yield and efficiency, not for the casino. They are here to build a better back office.

Amid the whiplash, privacy coins staged a historic move. Zcash (ZEC) is up about 1,293% since July. This is not a flicker. It is capital migration. More than 5 million ZEC, nearly one third of supply, moved into shielded vaults. People chose privacy while price screamed higher. That is not flipper energy.

The mechanics tell the same story. ZEC open interest rose over 4,000%, while funding rates turned violently negative, near -141% annualized at the peak. That points to a spot squeeze hedged in futures, large players buying float while shorting perps. It is the signature of patient capital accumulating what it believes the world will soon need more of: financial discretion. Dash is preparing confidential transactions as well.

The market now looks like three ecosystems sharing one tape. The Wild West of permissionless DeFi, where innovation is real and risk is constant. The buttoned-down world of institutional rails, focused on custody, RWAs, and compliant stablecoins. And the privacy cohort, betting that discretion becomes a premium service in an overexposed world.

Weekend watch: keep an eye on ZEC funding rates. If they stay deeply negative while spot holds, the squeeze likely continues.

This Caught My Eye:

Source : Coindesk

Here’s a breakdown of the chart:

The GENIUS Act is triggering a coordinated US stablecoin build-out, with banks, payment networks and retailers all moving to issue or settle with dollar tokens across Visa, Mastercard, Paxos, Circle and Base.

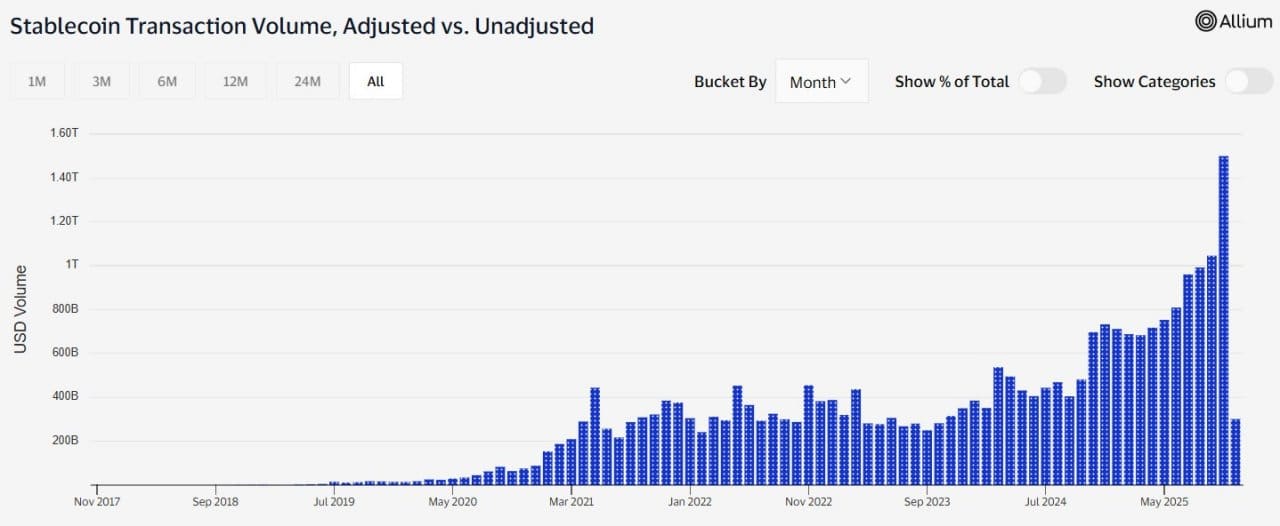

Stablecoins are now real payment infrastructure, recording $1.5T in monthly volume, with settlement shifting from pilot networks to merchant rails, interbank transfers and treasury operations.

Looking Ahead

The market has fractured. A single failure no longer sinks every boat. A broken algorithmic stable does not stop a pension fund from buying a tokenized bill. These worlds run on different principles, with different players and time horizons.

The question for the year ahead is which narrative captures more value and mindshare. Do repeated DeFi failures push all but hardened risk-takers toward a sanitized, institutional future. Or does the permissionless garage keep producing the next breakthrough. The ground is shifting, and the old maps are fading.

Until Monday,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!