Welcome to today's edition of Osiris News. Bitcoin puked. The price action finally broke the $84,000 floor, flushing out over $1.7 billion in borrowed funds and sending the market into a classic "deleveraging tape." While retail traders are licking their wounds from the liquidation cascade, the infrastructure layer is making aggressive moves to defend the asset class. Binance is stepping in as the buyer of last resort, converting $1 billion of its SAFU fund directly from stablecoins into Bitcoin. Meanwhile, Washington is sending mixed signals: the Senate Ag Committee advanced the crypto market structure bill on a razor-thin partisan vote, just as President Trump nominated a known hawk, Kevin Warsh, for Fed Chair. The divergence between price capitulation and structural maturation is widening.

🔍 Quick Overview

Bitcoin: Price broke the $84k floor, flushing out $1.7B in leveraged long positions.

Binance: Converting its $1B SAFU fund to Bitcoin, becoming the market's buyer of last resort.

Regulation: The crypto market structure bill cleared a committee on a partisan vote. A pyrrhic victory.

The Fed: Trump's pick for Fed Chair is a known hawk, threatening the easy money narrative.

Ethereum: Zombie capital from the 2016 DAO hack is being staked for ecosystem security funding.

Bitcoin is holding the line just above $84,300 with a marginal 0.5% gain, indicating consolidation rather than a decisive move from the top. The rest of the board shows poor breadth, as Ethereum and other core majors are pulling back, leaving Solana as the primary outlier with a strong 2.0% advance.

Trending News

Over $800 million in long positions were wiped out as Bitcoin touched nine-month lows near $81,000. Spot ETFs recorded their largest daily outflow since November, signaling a sharp risk-off shift from institutional allocators.

The exchange is rotating its entire $1 billion SAFU user protection fund from stablecoins into BTC over the next 30 days. This defensive maneuver positions Binance as a buyer of last resort during the current liquidity flush.

President Trump selected the former Fed governor to replace Jerome Powell, introducing a "hawk" with a mixed crypto track record. While Warsh has previously viewed Bitcoin as a gold-like store of value, he also favors CBDCs over private stablecoins.

The committee passed the market structure legislation in a 12-11 party-line vote, moving it closer to a full Senate floor vote. The bill aims to grant the CFTC primary spot market authority, though partisan gridlock remains a significant hurdle.

New From Us

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

The market is currently enduring a textbook liquidity flush. Bitcoin lost the critical $84,000 support level, triggering a cascade of long liquidations estimated between $800 million and $1.7 billion. This wasn't a fundamental repricing but a mechanical clearing of over-extended trading positions. In a move reminiscent of a central bank defending a currency peg, Binance announced it is converting its entire $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin over the next 30 days. This creates a predictable spot bid to absorb the selling pressure, effectively positioning the exchange as the buyer of last resort while ETF allocators flee.

The divergence between tourist capital and resident capital is stark. U.S. spot Bitcoin ETFs have bled over $2.6 billion in the last two weeks, with BlackRock's IBIT seeing significant outflows. Institutional allocators are treating Bitcoin as a high-beta risk asset to be sold ahead of macro uncertainty. Conversely, crypto-native entities like Tether and Binance are aggressively accumulating hard assets. Tether is hoarding gold and launching onshore stablecoins, while Binance aligns its reserves with the industry's base money. The smart money isn't leaving the casino; the house is just buying back the chips from the nervous guests.

In Washington, the "Clarity Act" cleared a major hurdle, passing the Senate Agriculture Committee, but the victory was pyrrhic. The 12-11 vote was strictly along party lines, with Democrats blocking the bill over excluded ethics provisions regarding President Trump’s crypto holdings. While the bill grants the CFTC primary authority, a win for the industry, the partisan split suggests a difficult path forward in the full Senate. Senator Cory Booker’s dissent was nuanced; he opposed the draft but emphasized that regulations should not "criminalize people who are writing code." This signals that while the specific bill is contentious, the understanding of the technology is deepening on both sides of the aisle.

Adding to the macro complexity, President Trump nominated Kevin Warsh for Federal Reserve Chair. Warsh is a known hawk who favors a smaller balance sheet and has previously expressed skepticism about private stablecoins, preferring CBDCs. The market reacted negatively, fearing that a Warsh-led Fed might tighten liquidity conditions faster than anticipated. This creates a headwind for the "liquidity pump" thesis that many bulls were banking on for 2026. The appointment forces traders to reconsider the assumption that the new administration guarantees easy money.

Elsewhere on-chain, a ghost from 2016 has returned to fund the future. Approximately 75,000 ETH, worth roughly $220 million, from the original "The DAO" hack remains unclaimed and is now being repurposed into a permanent security endowment. Instead of letting this "zombie capital" sit idle, the funds will be staked, with the yield financing audits and tooling for the Ethereum ecosystem. This move, supported by Vitalik Buterin, transforms a historic failure into a sustainable public good. It highlights a unique property of programmable money: lost assets can be recovered and redirected through social consensus and smart contract governance.

Despite the heavy price action and the regulatory noise, the analyst pulse for both Bitcoin and Ethereum remains remarkably steady and neutral. Neither asset is showing significant directional conviction in the sentiment data, which aligns with the "deleveraging" narrative rather than a fundamental trend reversal. The market is resetting, not collapsing. The flush has removed the froth, leaving a cleaner, albeit lower, structure for the next leg of the cycle.

This Caught My Eye:

Here’s a breakdown:

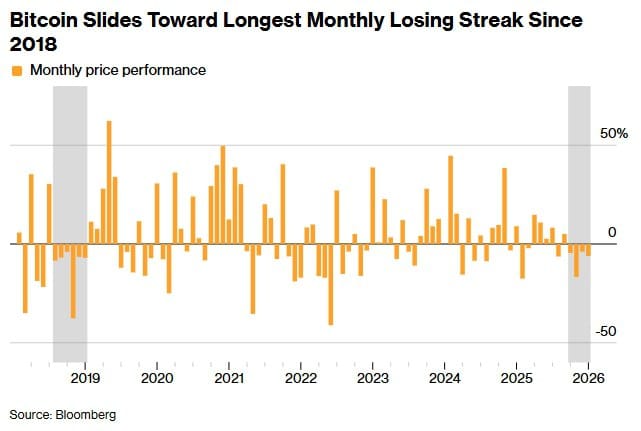

The chart’s monthly return bars show Bitcoin on track for multiple consecutive down months into early 2026, matching the longest losing streak highlighted since the 2018 period.

A nearly 6% decline in January extends this negative run, underscoring persistent downside momentum and weaker risk appetite versus the prior two years of mostly mixed monthly moves.

Looking Ahead

The immediate focus shifts to the Federal Reserve’s interest rate decision early next week and the looming government shutdown deadline. With the market already jittery, any hawkish surprise or legislative failure could exacerbate the liquidity drain seen in the ETFs. Watch the spot flows closely; if outflows persist despite Binance's $1 billion bid entering the market, it indicates a deeper risk-off shift among institutional allocators. The floor is being tested, and the next 72 hours will determine if it is made of concrete or glass.

Until Monday,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!