- Osiris News

- Posts

- 🤷♂️ Crypto Holds Ground Amid Tariff Tantrum

🤷♂️ Crypto Holds Ground Amid Tariff Tantrum

🤷♂️ Crypto Holds Ground Amid Tariff Tantrum

Well, here we are mid-week, and the global markets decided to throw a bit of a tantrum. Like someone swapping the sugar for salt in your morning coffee, new American tariff policies have sent traditional markets scrambling. The S&P 500 and Nasdaq took noticeable tumbles. Things feel… jumpy. You can almost hear the collective gulp from Wall Street. Yet, in the often-chaotic world of crypto, things feel surprisingly steady. It's like watching your neighbor's house party get out of hand while you're calmly sipping tea.

The main story today is this clash between old-world economic fears and new-world digital resilience. We've got trade war headlines screaming from one side, while crypto innovation continues humming along on the other. Bitcoin dipped, yes, but didn't crumble. Meanwhile, projects are still building, investors are still planning, and the underlying pulse of the digital asset space beats on. It’s a strange mix of anxiety and quiet confidence.

So, what’s really driving the needle today? We'll dig into the market’s reaction to the global jitters, check in on some eye-popping Layer 2 developments, see what’s brewing in the Solana ecosystem, and unpack a rather spicy governance debate over at PancakeSwap. Before we dive deep, let's get a quick snapshot of where the major players stand.

🔍 Quick Overview

MegaETH Mania: New L2 claims lightning speeds, raising millions faster than you can say "scalability"—but centralization whispers in the wind.

Solana Staking Shuffle: Jito still king of the LST hill, but Jupiter and Binance are nipping at its heels. Yields are decent, mostly thanks to SOL's money printer.

PancakeSwap Token Tussle: veCAKE faces the chop in a tokenomics revamp that's got Curve's founder calling foul. Governance or grift? The forum's on fire.

Trump & Crypto Tango: Enforcement team axed, stablecoin test airdrop floated. Is this a crypto embrace or just a distraction from the trade war circus?

Market Mayhem, Bitcoin's Moment?: Tariffs trigger turmoil, but Bitcoin hangs tough. Is it finally a safe haven, or just the best-looking house on a bad block?

Bitcoin didn’t budge an inch, holding steady like it’s waiting for the next move. Ethereum and XRP slipped slightly, taking a breather, while BNB and Solana crept up just enough to keep the mood from turning sour. Not much action today—more like the market’s hitting the snooze button.

Trending News

Ark Invest purchased nearly $5 million in Coinbase shares across three ETFs following a market downturn. Coinbase now represents a significant portion of ARKK, ARKW, and ARKF holdings. This move signals strong confidence in Coinbase's long-term potential despite current market volatility.

Bitcoin fell 2.6% to $77,465 following a $326 million outflow from spot bitcoin ETFs, the largest single-day exodus since March 11th. The outflows are attributed to market skittishness related to President Trump's newly implemented tariffs, specifically a 104% levy on some Chinese imports.

The Argentine Chamber of Deputies has launched an investigation into President Javier Milei's alleged involvement with the Libra memecoin, which collapsed after its market cap briefly exceeded $2 billion. The investigation aims to determine if Milei was misled or profited from the memecoin's collapse.

Taurus, a Swiss fintech firm, launched Taurus-NETWORK, a platform designed to streamline digital asset settlement for banks, enabling direct exchange of digital assets within a permissioned ecosystem. Over 35 institutions are founding members, aiming to reduce counterparty risk and reliance on intermediaries.

Bitcoin's price surge to $71,000 is supported by significant new investment, with open interest reaching nearly 600,000 BTC ($42.6 billion), indicating strong bullish sentiment. The Chicago Mercantile Exchange (CME) has experienced a surge in activity, with contracts increasing by 9% in 24 hours.

Beyond the Noise

The ripples from the US-China trade tussle are undeniable. Global stocks took a beating, with the S&P 500 marking one of its worst starts to a year and volatility spiking. Bond yields surged in ways that made traders scratch their heads, unsure if we're heading for stagflation or depression. The offshore Chinese yuan weakened, a classic sign of economic stress. As one analyst put it, folks seem "frozen," waiting for more certainty before making big moves. It’s a stark reminder that even crypto doesn't live in a vacuum.

Amidst this chaos, crypto markets certainly felt the pressure. Bitcoin dipped below $75,000 during Asian trading before recovering slightly to around $77,675 (roughly flat over 24 hours). We saw $443 million in liquidations across the market in the last day, and DEX (decentralized exchange) volumes slumped by 34%. Ethereum followed suit, trading around $1,496 (down 0.6%). Other majors showed mixed results: Ripple (XRP) at $1.84 (-2.0%), BNB at $564.34 (+1.3%), and Solana (SOL) at $107.07 (+2.0%). Despite the dip, crypto held up better than many expected compared to the sharp equity sell-offs.

This relative stability brings the Bitcoin-as-a-hedge narrative back into focus. It has that historical "store of value" reputation, a digital rock people cling to in stormy seas. Plus, its connection to traditional finance via ETFs provides a familiar entry point for big money. Technically, BTC retraced towards a key support level around $73,757 (the March 2024 high). A bounce from here could signal the broader uptrend is still intact. However, further pullbacks could disproportionately hurt altcoins.

While macro forces swirl, innovation hasn't paused. Meet MegaETH, a new Ethereum Layer 2 (L2) solution making bold claims. It reportedly hit 1,700 Mgas/s on its testnet – speeds that dwarf existing players like Optimism and Arbitrum. How? Through "node specialization" and ditching consensus for a single sequencer, a move that centralizes block production but boosts speed. It also uses a custom state tree, gaining write bandwidth but sacrificing full EVM-equivalency. Investors seem impressed: MegaETH raised $10 million in minutes from retail investors and $20 million from VCs like Dragonfly, with Vitalik Buterin chipping in as an angel investor. Apps built on it, using a super-fast oracle called "Bolt," have raised even more capital, suggesting strong ecosystem belief.

Over in the Solana ecosystem, things are also buzzing. Liquid staking tokens (LSTs) now represent 12.8% of all staked SOL, double the share from a year ago, showing growing demand for yield-bearing, tradable staked assets. Jito's jitoSOL remains the dominant force (38% market share), though competitors like Binance's bnSOL and Jupiter's jupSOL are vying for position. With over $45 billion in SOL staked and net yields around 8.25% (mostly from SOL issuance), it’s a healthy ecosystem. And now, Solana has launched Confidential Balances, using zero-knowledge proofs (ZKPs) to enable private token transfers and balances. It’s like proving you have money in a locked box without opening it – a big deal for institutions needing privacy.

Not all developments are met with universal applause. PancakeSwap's proposed Tokenomics v3 has stirred controversy. The plan aims to simplify governance by deprecating the veCAKE locking model in favor of direct emissions management with a one-year max lock. Supporters say it will cut emissions by 43% and better incentivize productive pools. But critics are loud. Curve founder Michael Egorov called it a "governance attack at its finest," warning it could let insiders wipe out existing holders' rights. Others argue the real problem was emissions being siphoned off by bribe markets, and that killing veCAKE isn't the answer. It’s a complex debate about balancing governance integrity, token value, and protocol growth.

Looking at the bigger picture, institutional interest remains strong despite market jitters. An EY/Coinbase survey found 87% of institutional investors plan to increase crypto allocations in 2025, driven by innovation and the potential for new crypto-powered services. Regulatory clarity remains the #1 catalyst they’re waiting for. We also saw Ripple make a massive $1.25B acquisition of prime broker Hidden Road, and BlackRock tapped Anchorage as a custodian. Meanwhile, the Trump administration is reportedly scaling back crypto enforcement, disbanding the DOJ's dedicated crypto unit, which could signal a friendlier stance. And in this volatile environment, strategies like tax-loss harvesting (TLH) become particularly relevant for crypto investors managing multi-asset portfolios, especially since the "wash rule" doesn't currently apply (though that could change).

This Caught My Eye:

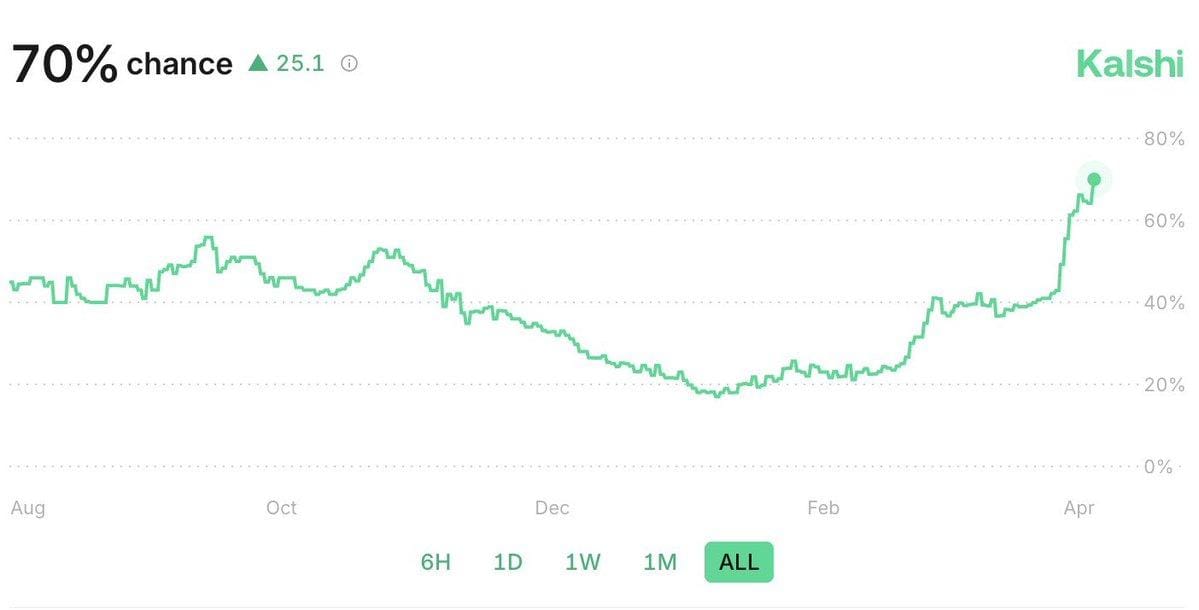

Here’s a breakdown of the chart:

Recession risk is surging: According to Kalshi, markets now place a 70% chance of a U.S. recession, up 25.1 points recently—a steep climb signaling growing concern over economic slowdown.

Sharp sentiment reversal: After months of subdued expectations through late 2023 and early 2024, recession odds have rocketed upward in March, reflecting shifting macro signals or policy fears driving investor caution.

Looking Ahead

So, we're left navigating a landscape marked by stark contrasts. On one hand, global markets are clearly spooked by trade wars and economic uncertainty, reminding us that crypto isn't entirely immune to macroeconomic gravity. The drops in traditional assets and the surge in bond yields are flashing warning signs that are hard to ignore.

Yet, on the other hand, the crypto space itself shows remarkable resilience and forward momentum. Bitcoin is holding relatively firm, institutions are signalling stronger conviction for 2025, and innovation continues at pace – from ambitious L2s like MegaETH to privacy enhancements on Solana and major acquisitions like Ripple's. Even the heated debate around PancakeSwap, while contentious, speaks to an active and engaged community grappling with how best to evolve.

The big question heading into the rest of the week is which force will dominate: the external macro pressures or the internal crypto-native developments? Will Bitcoin solidify its role as a relative safe haven, or will broader market fear eventually drag it, and the altcoins, lower? There are no easy answers. For now, the market seems to be taking a deep breath, watching, and waiting. Keep your head on a swivel.

- Dr.P