Hello there {{first_name|you embodiment of curiosity}};

Welcome to today's edition of Osiris News. The market is currently pricing in a geopolitical regime change as a bullish catalyst. While the mainstream press focuses on the military capture of Venezuelan President Nicolás Maduro, the on-chain crowd is obsessed with the fate of a rumored $60 billion Bitcoin "shadow reserve" that may have just fallen into U.S. custody. Price action is undeniably risk-on, with Bitcoin reclaiming $94k and retail capital rotating aggressively into high-beta alts. It’s a strange mix of institutional accumulation and degenerate gambling, all underpinned by the possibility that the U.S. government just inadvertently became the world's largest bag holder.

🔍 Quick Overview

Geopolitics: The market treats the U.S. seizing a $60B BTC reserve as a bullish event.

ETH Supply: A single corporate treasury now owns 3.4% of ETH, creating a 19-day validator queue.

TradFi Adoption: Bank of America advisors are now proactively selling Bitcoin ETFs. The client-led phase is over.

Prediction Markets: Alleged insider trading on Polymarket is earning it a congressional hearing and a new bill.

Retail Rotation: Capital rotates into memecoins as major L2s like Starknet suffer multi-hour outages.

Bitcoin pulled back from recent highs, cooling momentum short term. Capital rotated into ETH, XRP, and Solana, with XRP leading gains while BNB stayed relatively flat.

New From Us

Five minutes, one brief, you are up to speed on AI

Trending News

The US capture of President Maduro has ignited rumors of a $60B Bitcoin reserve potentially falling under American control. Markets are volatile as traders speculate on whether the US will liquidate the assets or add them to its strategic reserve.

The banking giant now permits wealth advisors to proactively recommend Bitcoin ETFs, suggesting a 1% to 4% portfolio allocation. This policy shift removes a major compliance barrier, opening the door for massive retail capital inflows.

Prosecutors reportedly liquidated $6M in forfeited Bitcoin from Samourai Wallet, defying President Trump’s executive order to hold all seized BTC. Critics argue this signals deep institutional resistance to the administration's new Strategic Bitcoin Reserve policy.

The firm deposited 82,560 ETH into staking contracts, pushing the validator entry queue to nearly 19 days. This aggressive corporate accumulation creates a significant on-chain supply shock while retail capital remains distracted by meme coin volatility.

Beyond the Noise

The Venezuela situation is the loudest signal in the room, but the implications go deeper than a simple regime change. Intelligence suggests the Maduro regime accumulated a massive Bitcoin treasury, potentially $60 billion, by settling illicit oil and gold sales in USDT and converting the proceeds to BTC to evade sanctions. If the U.S. now controls these keys, the Strategic Bitcoin Reserve thesis gets complicated. We are already seeing friction between the executive branch and the agencies; the DOJ reportedly liquidated $6 million (57 BTC) from a separate forfeiture case involving Samourai Wallet developers this week. This sale appears to directly violate President Trump’s March 2025 Executive Order, which mandates that forfeited Bitcoin "shall not be sold." We are watching a live stress test of whether the White House can actually force the DOJ to HODL.

The Maduro capture also triggered a massive controversy on Polymarket. A specific wallet turned $32,000 into $400,000 by betting on the capture shortly before the news broke. While prediction market advocates call this "efficiency," regulators call it insider trading. Rep. Ritchie Torres is now drafting the "Public Integrity in Financial Prediction Markets Act of 2026," which aims to ban federal officials and political insiders from trading on these platforms. The "unregulated oracle" thesis is hitting a political wall. When decentralized markets start front-running national security operations, the regulatory hammer comes down fast. Expect this to be the opening salvo in a battle over whether prediction markets are protected speech or regulated derivatives.

While the geopolitical drama plays out, the Ethereum supply squeeze we tracked last week is accelerating. BitMine Immersion Technologies staked an additional 82,560 ETH ($259M), bringing its total treasury to 4.11 million ETH, roughly 3.4% of the total supply. This aggressive corporate accumulation has clogged the network’s plumbing. The validator entry queue is now nearly 19 days long with 1.09 million ETH waiting to be locked. BitMine Chairman Tom Lee is betting the company on a cycle where ETH hits $250,000, a target that requires a complete repricing of the asset class. The divergence here is stark: price action is grinding slowly upward, but the liquid float is evaporating at an institutional scale.

Traditional finance is finally moving from "allowing" crypto to "selling" it. Bank of America has authorized its wealth advisors to proactively recommend Bitcoin ETFs (IBIT, FBTC, BITB) to clients, suggesting a 1-4% portfolio allocation. This is a significant shift from the previous "client-led" model where advisors could only execute if the client asked first. Simultaneously, Bitwise filed for 11 new Altcoin ETFs, targeting assets like Aave, Sui, Near, and Uniswap. They are clearly positioning for a 2026 regulatory environment that allows for a broader menu than just BTC and ETH. The banks are realizing that fee generation requires volatility, and they are now willing to sell that volatility to their client base.

Retail capital, meanwhile, has stopped pretending to care about fundamentals. The XRP chart is up 30% since the calendar turn, and the memecoin sector rallied 23%, led by a 65% move in Pepe ($PEPE). This is a classic risk-on rotation; when the majors (BTC/ETH) stabilize, impatient money flows to high-beta assets. However, the infrastructure supporting this casino remains fragile. Starknet suffered a four-hour outage, and the Flow blockchain halted for 24 hours following a $4 million exploit. Vitalik Buterin claims Ethereum has "solved the trilemma" via PeerDAS and zkEVMs, but the reality is that L2 stability and bridge security are still major.

This Caught My Eye:

Here’s a breakdown:

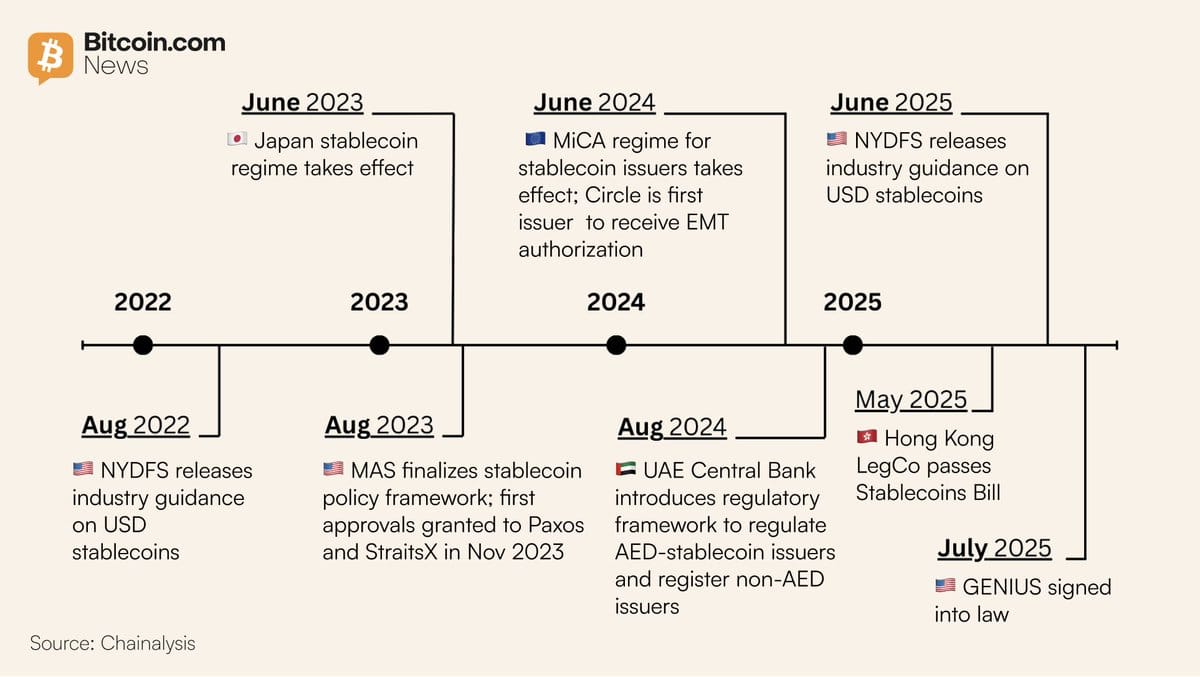

Since 2022, major hubs including Japan, the EU (MiCA), Singapore, UAE, Hong Kong, and New York’s NYDFS have rolled out dedicated stablecoin regimes, accelerating regulatory clarity worldwide.

By July 2025, 11 of the top 25 jurisdictions now have rules in force, with the U.S. GENIUS Act emerging as the reference standard for reserves, redemption rights, and AML compliance.

Looking Ahead

Watch the DOJ's wallet management closely this week. If we see further liquidations of forfeited assets despite the Executive Order, it signals a breakdown in the Strategic Reserve policy implementation. The Torres bill regarding Polymarket poses a serious liquidity risk to prediction markets; if geofencing or strict KYC becomes mandatory for US participants, volume will plummet. On the macro side, keep an eye on tomorrow's ISM Manufacturing PMI. A print above 50 would validate the business cycle expansion theory that institutional buyers like BitMine are betting on. Until then, expect volatility to remain concentrated in meme coins and high-beta alts while the majors wait for a liquidity signal.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll?

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!