- Osiris News

- Posts

- 💰📈 Bitcoin Surges Past $117K: What’s Next?

💰📈 Bitcoin Surges Past $117K: What’s Next?

Bitcoin's powerful ascent to $117K signals a transformative market moment, revealing institutional momentum and strategic shifts reshaping the crypto landscape with unprecedented financial precision.

💰📈 Bitcoin Surges Past $117K: What’s Next?

Hello there you embodiment of curiosity;

Welcome to today’s edition of Osiris News. If the ground felt like it shifted, it did. The market woke up and ran. Bitcoin ripped past $117,000, a clean, decisive break that erased weeks of chop and hushed the bears. The air today feels like conviction.

This isn’t just price. It’s a confluence of tailwinds hitting as we enter a historically strong month. While the U.S. government shut down, a quiet regulatory pivot arrived, and corporate treasurers wrote large checks. In London, $60 million in short liquidations cascaded through the early session, a sharp lesson in betting against momentum. The theme: resilience, and a bullish case built atop the old world’s dysfunction.

🔍 Quick Overview

Bitcoin’s powerful ascent: BTC cleared $117,000 on Uptober tailwinds and steady institutional buying.

Stablecoins get corporate keys: Stripe and Visa enable issuance and cross-border payments for businesses.

Regulatory gates open wider: The SEC now lets state-chartered trusts act as qualified crypto custodians.

Altcoins join the party: Zcash and Subsquid surged, Starknet is pushing Bitcoin DeFi, Solana drew billions.

AI’s dual-edged frontier: New modular L1s and InfoFi are rising while attackers gain sharper tools, so vigilance matters.

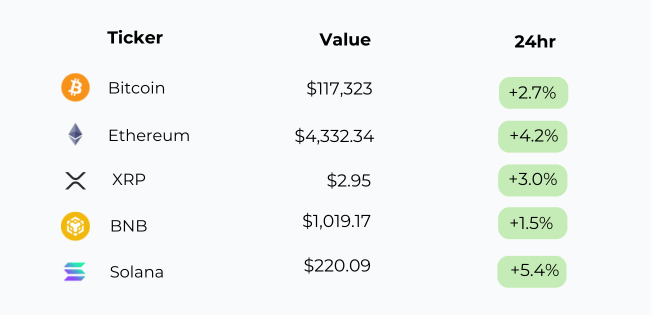

Markets bounced back sharply today, with Bitcoin reclaiming lost ground and Ethereum leading majors higher. Solana outperformed with strong gains, while XRP and BNB followed with steady advances, signaling renewed risk appetite across the board.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Trending News

The U.S. Treasury and IRS clarified that corporations can exclude unrealized digital asset gains when calculating their 15% corporate alternative minimum tax. This guidance benefits MicroStrategy, which holds over $27 billion in unrealized Bitcoin profits. The clarity reduces uncertainty for institutional crypto holders and sets a positive precedent for future digital asset taxation.

CryptoQuant forecasts Bitcoin could reach $160,000 to $200,000 by year-end, driven by increasing spot demand and whale activity. Bitcoin has surpassed the "trader's on-chain realized price" of $116,000, now trading around $117,300. Rising demand metrics and key price level breakouts signal strong market sentiment and potential for further rallies.

Nasdaq-listed Upexi's $6.7 million initial investment in Solana (SOL) has grown to $410 million, representing an unrealized gain exceeding 1,300%. The company stakes its 2 million SOL holdings, earning an approximate 8% yield. This success highlights increasing institutional interest in Solana and the blurring lines between traditional finance and crypto.

Staking is solidifying its status as a new asset class, with over $500 billion locked in proof-of-stake networks, including more than $100 billion in Ethereum. This offers a unique value proposition for allocators, providing returns driven by network usage and validator performance. The growing size and diverse participation in staking are attracting significant capital and developing new market infrastructure.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

Beyond the Noise

The rally started as a hum and became a roar. Bitcoin is up 7% this week, pushing total crypto market cap above $4 trillion for the first time. Seasonality helps: “Uptober” is real, Q4 has a >50% median BTC return over twelve years (Source: Osiris News). Prediction markets put a 65% chance on BTC topping $125,000 before dipping below $105,000. Options flow shows traders dumping downside hedges.

Backdrop: The U.S. government is officially shut down. Instead of spooking risk assets, the gridlock strengthens the case for scarce, non-sovereign money. Macro volatility rose, but Bitcoin’s safe-haven appeal sharpened, a digital lifeboat amid fiscal drama. The failure of the old system is acting as a tailwind for the new one.

Big money is executing on that thesis. Metaplanet bought 5,288 BTC (~$600M), now the #4 corporate holder. MicroStrategy raised $128M and immediately added 196 BTC (spending $22M). Tether stacked 8,888 BTC, lifting reserves above $12B. This is deliberate balance-sheet accumulation, not retail twitch.

Regulatory gears turned, too. Under Chair Paul Atkins, the SEC issued a no-action letter allowing state-chartered trusts to act as qualified custodians for crypto. Dry language, huge impact: it opens a compliant path for advisers and pensions to custody digital assets with regulated U.S. institutions, removing a long-standing adoption roadblock.

The validation is lifting forgotten boats. Zcash (ZEC) ripped 46%, snapping an eight-year downtrend vs BTC, a reminder that narratives flip fast. Builders are busy: Starknet launched a 100M STRK program for Bitcoin DeFi, pulling the oldest asset into high-velocity DeFi.

Not all green shoots survive. Plasma’s XPL is a cautionary tale: after nearly $6B TVL at launch, the token fell ~45% in four days. On-chain flows showed large exchange deposits; Nansen flagged minimal “Smart Money” participation while top traders exited. Buyers were mostly fresh wallets, classic exit-liquidity dynamics.

The real work is in the plumbing. Stripe unveiled Open Issuance so any company can mint/manage a stablecoin with minimal code. Visa piloted cross-border payments funded directly in stablecoins. This is the quiet rebuild of value rails for the internet, happening now, far from D.C.’s noise.

This Caught My Eye:

Source : CryptoQuant

Here’s a breakdown of the chart:

Crypto Market Cap: The total market cap surged to $4.03T, adding $160B in the past 24 hours.

Momentum Check: A sharp mid-session rally pushed the market above the $4T threshold, signaling strong inflows and renewed bullish momentum.

Looking Ahead

Two engines pull the market. First: classic cyclical momentum. Narratives are clean, institutional buying steady, Q4 seasonality favorable. Charts look healthy; recent fear has been flushed. This is price, sentiment, rotation.

Second: structural change. SEC clarity is a generational shift, foundation for entire business models. Stripe and Visa integrating stablecoins marks a new standard. The parallel system is connecting to legacy finance as an upgrade, not a curiosity. The near-term question isn’t if adoption happens, but how fast the old world adapts to rails that don’t shut for holidays, or politics

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!