- Osiris News

- Posts

- 🚀 Bitcoin's Green Surge: Institutional Confidence Roars!

🚀 Bitcoin's Green Surge: Institutional Confidence Roars!

🚀 Bitcoin's Green Surge: Institutional Confidence Roars!

Well, that escalated quickly. Just when folks were muttering about trade wars and market chills, Bitcoin decided to remind everyone it’s still the main event. The crypto market, often behaving like a startled cat, seems to have found its footing again this week, pushing higher with surprising vigor as we head towards Friday. The reason? Big money is flowing back in, and it’s not being shy about it.

This isn’t just a flicker of optimism; it feels more substantial. We're seeing a powerful surge in Bitcoin spot ETF inflows, the kind not witnessed since the peak frenzy back in January. This renewed institutional appetite, combined with easing macro anxieties and a perceived friendlier regulatory breeze in the US, has painted the charts green and squeezed out the short sellers in a rather dramatic fashion. Today, we’ll unpack this resurgence, look at Wall Street’s deepening crypto embrace, and consider what it all means. Before we dive deep, let’s get a quick snapshot of the market movers.

🔍 Quick Overview

Bitcoin ETFs: The big money returned with gusto, pouring over $2 billion into Bitcoin ETFs this week and launching BTC past $94k. Short sellers faced a reckoning, to the tune of $650 million.

Wall Street Integration: Wall Street's crypto curiosity turned serious, with giants like Cantor Fitzgerald backing billion-dollar Bitcoin plays. Seems the suits finally realized crypto isn't just internet funny money anymore.

Regulatory Thaw: Washington's crypto climate seems less frosty, with a new SEC chair promising clarity and banks eyeing the door previously blocked by red tape. Suddenly, the US looks open for crypto business again.

DeFi Innovation: Ether.fi launched its "DeFi bank," aiming to be the Revolut of crypto without the actual bank part. Trying to make DeFi less like assembling IKEA furniture blindfolded.

Tokenization Trend: TradFi and crypto continue their slow dance towards tokenizing everything, eyeing a future where trillions in assets trade 24/7. Think less glacial pace, more determined marathon.

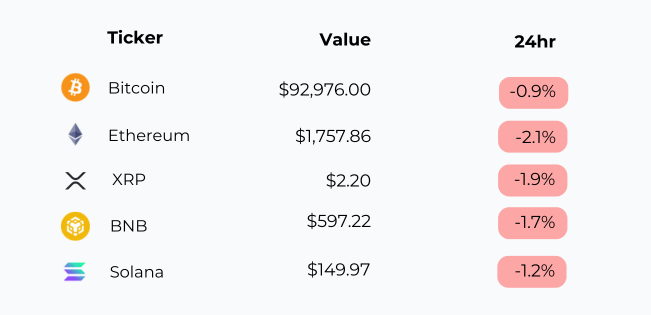

Red swept the leaderboard today, with all top coins taking a hit—Ethereum led the retreat, down over 2%, while Bitcoin, XRP, BNB, and Solana followed suit. It’s one of those market moods where everything feels slightly off, like your coffee’s gone cold and you’re not sure when.

Trending News

Restaking protocol Ether.fi is rolling out its neobanking app and Visa "Cash" card in the US, aiming to bridge DeFi and traditional finance. Users can spend fiat collateralized by their crypto holdings via the card, integrating crypto earning with everyday spending. This move could significantly increase the practical utility and accessibility of DeFi for mainstream users.

Binance is introducing "Fund Accounts" designed to attract institutional investors and asset managers by offering standardized crypto trading and reporting tools. The initiative aims to simplify crypto investing for traditional finance players, focusing on clear NAV calculations and proof of reserves. This could lower entry barriers for institutions, potentially increasing capital inflows and market maturity.

Theo, a crypto trading platform focused on institutional clients, has raised $20 million led by Hack VC and Anthos Capital. The funds will enhance its validator security and expand integrations with both TradFi and crypto platforms. This investment underscores the growing demand for robust infrastructure to facilitate institutional entry into the crypto market.

TradFi derivatives giant CME Group is preparing to list XRP futures contracts, pending CFTC approval. This would add XRP alongside Bitcoin, Ethereum, and Solana on its marketplace, offering cash-settled micro and standard contracts. The launch would provide regulated exposure to another major altcoin, potentially boosting institutional adoption and liquidity for XRP.

Beyond the Noise

The big story is undoubtedly the return of capital to US Bitcoin spot ETFs. After a period of outflows that had some questioning institutional staying power, the tide has turned decisively. According to Glassnode data, net inflows hit $381.3 million on April 21, a solid start. But then, April 22 saw a massive $912.7 million pour in, the largest daily intake since Bitcoin’s all-time high days in January. Wednesday kept the momentum going with another $917 million, pushing the weekly total comfortably over $2 billion. Funds like ARK’s ARKB ($267.1M on April 22), Fidelity’s FBTC ($253.8M), and BlackRock’s IBIT ($193.5M) led the charge. This isn't just pocket change; it signals deep, sustained conviction from some very large players.

What’s fueling this? It seems to be a mix of factors. Reports suggest US President Trump might be softening his stance on China tariffs, easing one source of market jitters. We’ve also seen some softer inflation prints, which always helps risk assets. Add the perception of a more crypto-friendly SEC under new Chair Paul S. Atkins, who has pledged a "clear, pro-innovation crypto policy," and the environment suddenly looks much brighter. As one analyst put it, "BTC has been buoyed by tariff backpedaling, soft inflation prints and a return of ETF inflows."

This potent cocktail sent Bitcoin surging back above the crucial $94,000 mark, reaching its highest level in over 50 days. Remember the $91k level some feared was the bull market's last stand? Bitcoin now has two daily closes above it, suggesting the uptrend may be back on track. This sharp move caught many off guard, especially short sellers. Over $650 million in total liquidations hit the market in 24 hours, with shorts accounting for more than half ($326M+) of those losses. As someone noted wryly, "Throw in a few hundred million of short liquidations, and you have a recipe for a very nice pop." Adding to the bullish picture, exchange inflows are reportedly at three-year lows, hinting that potential sellers might be holding onto their coins.

Beyond the ETF flows, Wall Street’s integration with crypto continues to deepen. We're hearing reports of major players like Cantor Fitzgerald backing a massive $3 billion crypto acquisition venture called 21 Capital, aiming to scoop up Bitcoin in this perceived favorable environment. Meanwhile, established crypto giant Coinbase is reportedly exploring a US federal bank charter, a move that would significantly bridge the gap between digital assets and traditional banking. We also see companies like Riot Platforms leveraging their $1.8 billion Bitcoin stash for a $100 million loan from Coinbase, showcasing new ways crypto holdings can fuel growth. Even altcoins are getting institutional attention, with SOL Strategies securing a $500 million credit line (backed by staked SOL) to buy more Solana. It seems Wall Street, as one observer put it, is "addicted to volatility," and crypto certainly delivers.

This institutional warming trend isn't just anecdotal. LMAX Group CEO David Mercer reports increased demand from banks looking to offer crypto services, spurred by the regulatory thaw. He expects "double digit banks" offering spot crypto by the end of 2026. An EY-Parthenon/Coinbase survey found 87% of institutional investors plan to increase crypto allocations in 2025. And Coinbase even confirmed sovereign wealth funds have been recent buyers. This isn't just about Bitcoin anymore; the broader market is benefiting. Looking at the top cryptos today, we see Bitcoin (BTC) up a strong 6%, Ethereum (ETH) climbing 5%, Solana (SOL) jumping 7%, Binance Coin (BNB) adding 4%, and Ripple (XRP) gaining 3% in the last 24 hours, pushing the total crypto market cap back towards the $3 trillion mark.

Amidst the market excitement, innovation continues. We saw the launch of the Initia Layer 1 mainnet this week, aiming to solve the fragmentation issues plaguing modular blockchain ecosystems with its integrated "Interwoven Stack." While technical debates, like the one on Ethereum's roadmap concerning EOF versus a potential RISC-V future, continue among developers, the immediate focus seems to be on shipping near-term upgrades like PeerDAS. These foundational developments, alongside evolving DeFi platforms like Ether.fi launching its "DeFi bank" concept and the growing interest in crypto indices for diversification, point towards a maturing ecosystem looking to improve usability and attract broader participation. The long-term vision of tokenizing real-world assets, estimated by some to be a $20-25 trillion opportunity by 2030, underpins much of this activity, promising a future of more efficient, accessible, and interconnected financial markets.

This Caught My Eye:

Here’s a breakdown:

No more trading fees for PYUSD on Coinbase: Users can now buy, sell, and redeem PYUSD 1:1 for USD without platform fees—removing a major friction point to drive adoption and boost usage in DeFi and payments.

PayPal doubles down with incentives: With a 3.7% annual yield launching in summer 2025, and a focus on expanding to platforms like Solana and MoonPay, PYUSD is clearly stepping up its game to challenge USDT and USDC’s dominance.

Looking Ahead

So, as we head towards the end of the week, the crypto narrative has taken a decidedly bullish turn. The resurgence of Bitcoin ETF inflows is the headline act, providing strong validation that institutional interest isn't just a fleeting phase. It suggests a growing comfort level and perhaps, as MEXC's Tracy Jin noted, the start of a "structural shift" where Bitcoin solidifies its role as an independent asset class, not just digital gold.

The sheer scale of capital flowing in, coupled with Wall Street's increasingly tangible crypto integration and a more supportive regulatory outlook in the US, paints a picture of an asset class gaining serious traction. Of course, challenges remain – DeFi needs smoother user experiences, regulation still needs refinement globally, and volatility is always part of the crypto bargain. It's never a straight line up, and expecting bumps along the road is just common sense.

Still, the momentum feels significant heading into the weekend. The combination of institutional validation, technological progress, and easing macro/regulatory headwinds creates a compelling setup. Will this rally sustain itself? Can Bitcoin challenge its $109k all-time high in the coming months, as some optimists hope? Only time will tell, but right now, the market is certainly giving us plenty to watch and wonder about. Stay tuned.

- Dr.P