- Osiris News

- Posts

- 🌍💥 Bitcoin's Global Frontier: Stocks, Tokens & Market Tension!

🌍💥 Bitcoin's Global Frontier: Stocks, Tokens & Market Tension!

🌍💥 Bitcoin's Global Frontier: Stocks, Tokens & Market Tension!

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. There’s a particular feeling in the air, the kind of electric calm you get before a summer thunderstorm. Back in 2021, an app like Robinhood was where you went to buy meme stocks. Today, it’s building the rails to turn all stocks into tokens. The line between the old world of finance and this new digital frontier is not just blurring; it’s being erased with a fire hose of institutional capital and code.

This isn’t happening in a vacuum. The whole market is holding its breath. Global stocks are hitting record highs, Bitcoin is sitting comfortably above $100,000, and volatility has gone to sleep. It feels like a pressure cooker with the lid screwed on tight. A compliance officer at a downtown bank, a man who once called crypto a sideshow, was spotted this morning quietly drafting a memo on the operational risks of tokenized securities. The quiet hum you hear is the sound of the world’s financial machinery being rebuilt block by block. Let's look at the landscape and see what’s truly moving the needle.

🔍 Quick Overview

Robinhood's Crypto Leap: Robinhood launched tokenized stocks for Europe and plans its own Ethereum L2, a clear sign they’re building more than just a trading app.

Markets Ride Liquidity: Global stock markets, including the S&P 500 and Nasdaq, hit new all-time highs, fueled by an expanding M2 money supply, it seems more money still makes the world go 'round, at least on the charts.

Ripple's Regulatory Relief: Ripple settled its four-year SEC battle for $125 million, a significant win that clarifies XRP’s non-security status and finally closes a very long chapter.

AI's Power Play: The "AI super-cycle" is demanding immense energy, shifting investment focus from tech hardware to power infrastructure, because even super-brains need a super-sized plug.

Institutions Embrace Crypto: Top financial advisors now recommend substantial crypto allocations as corporate treasuries, like Metaplanet, pile into Bitcoin, the smart money is clearly making its move.

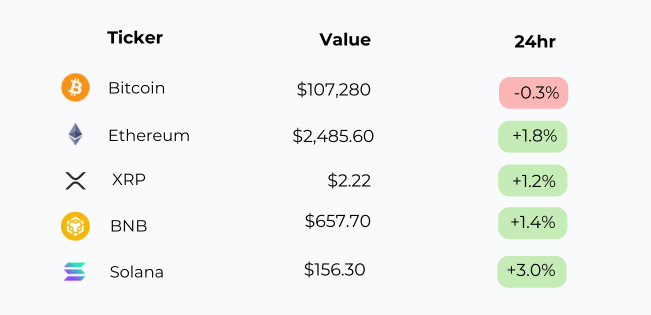

The market woke up a bit. Solana led with a 3% gain, Ethereum, XRP, and BNB followed with healthy upticks, while Bitcoin slipped slightly. It’s a subtle shift, but momentum leaned green, and some confidence crept back in.

Trending News

Euro-pegged stablecoins are gaining market share, driven by a weakening US dollar and the EU's supportive MiCA framework. The dollar has slipped to a three-year low, losing about 5% in six months, while the euro has risen. This shift indicates a growing diversification in the $250 B stablecoin market, potentially challenging USD dominance.

Dinari has received U.S. regulatory approval to offer tokenized stocks, becoming the first platform to do so. The company plans a business-to-business approach, integrating its dShares technology into other platforms. This landmark approval opens a new regulated market for digital representations of traditional equities, projected to reach $1-2 B by year-end.

South Korean retail traders have heavily invested nearly $450 M into Circle, making it the most bought overseas stock this month. Circle's stock has surged over 500% since its June 5 debut, briefly reaching a $77 B market cap. This significant investment highlights growing global confidence in stablecoin infrastructure and the potential for won-backed stablecoins.

The real-world asset (RWA) tokenization market has grown 380% in three years, reaching a $24 B market size. Reports indicate asset tokenization has transitioned from experimental pilots to scaled institutional adoption in 2024-2025. Projections from McKinsey, BCG, and Standard Chartered estimate the market could reach $2 T to $30 T by 2034, signaling massive financial transformation.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Get a List of the Best HRIS Software for Your Company

Stop wasting time on endless research and confusing options.

Our HR Software experts provide you with tailored recommendations from our database of 1,000+ vendors across HRIS, ATS, Payroll, and HCM.

✅ 15 minutes vs. hours of demos

✅ 1:1 help from an HR Software expert

✅ No spam, no sales pressure

Beyond the Noise

The biggest tremor today came from a company that once personified the retail revolution. Robinhood announced a full-throated pivot into the deep end of crypto, and the market responded by sending its stock, HOOD, soaring over 11% to a new peak. The company’s “To Catch a Token” keynote revealed that European customers can now trade tokenized stocks on Arbitrum, a popular Ethereum Layer-2 network. (Source: Robinhood's "To Catch a Token" keynote). They also rolled out perpetual futures for the EU and, not to be left out, US customers finally got staking for their Solana and Ethereum. This is a methodical, multi-pronged assault on the old ways of doing things.

This isn’t a lone wolf howling at the moon. It’s a pack hunt. Just as Robinhood made its move, Gemini launched its own tokenized stock offering for EU traders, starting with an on-chain version of MicroStrategy (MSTR), also on Arbitrum. Meanwhile, on-chain protocol Dinari secured a broker-dealer license in the U.S., a critical step toward offering tokenized securities stateside, and Coinbase is known to be working on the same prize. The message is clear: the tokenization of real-world assets is moving from a theoretical sideshow to the main event. The technology is no longer the bottleneck; the race is for regulatory approval and market share.

This bold push is happening against a macro-economic backdrop that feels almost too good to be true. The S&P 500 has rallied 28% from its April lows to hit new all-time highs, moving in near-perfect sync with the global M2 money supply on an 11-week lag. One analyst’s model, tracking this liquidity, suggests the S&P could be heading for 6800+. This isn’t just a U.S. phenomenon; Europe’s Stoxx 600 and Japan’s Nikkei 225 are also climbing. Adding political fuel to the fire, former President Trump endorsed Bitcoin, saying it “takes a lot of pressure off the dollar.” When money is this easy and political winds are at your back, you take bigger swings.

And in a move that clears a massive storm cloud from the horizon, Ripple officially ended its grueling, nearly five-year legal war with the SEC. Both sides have dropped their appeals, settling on a 125 million penalty, a far cry from the 2 billion the agency initially demanded. Most importantly, the court's original ruling that XRP is not a security stands firm. This landmark settlement doesn’t just give XRP clarity; it provides a much-needed dose of confidence for the entire industry. It’s hard to build a new financial system when you’re constantly looking over your shoulder for a lawsuit. This legal peace contrasts sharply with the eerie quiet on the trading front, where Bitcoin's implied volatility, measured by Deribit’s DVOL index, has fallen below 40% for the first time in nearly two years. The market seems to be taking a long, slow breath.

While the suits and lawyers make headlines, the engineers are in a knife fight in the dark, building the infrastructure to support this new world. The L1s are in an arms race for speed and compatibility. Kadena, a proof-of-work blockchain, just launched its Chainweb EVM testnet, aiming to offer EVM compatibility without sacrificing security. They’re backing it up with a $50 million grant program to lure developers. At the same time, BNB Chain executed its Maxwell hardfork, slashing block times in half to a mere 0.75 seconds. They’re betting that near-instant transactions will cause a “mass migration of meme coin traders” to their chain. Everyone is fighting to become the go-to settlement layer for the tokenized future.

Stepping back even further, another super-cycle is starting to simmer, one that could dwarf them all: the demand for power to fuel Artificial Intelligence. Nvidia CEO Jensen Huang’s claim that AI requires “100 times more” power is reshaping investment theses. The investment firm Coatue believes the market's focus will shift from the Mag 7 to a new class of winners: AI power companies, specialized software, and advanced semiconductors. This insatiable hunger for energy is a fundamental force, one that will create entirely new industries and redirect trillions in capital. The global competition for AI supremacy isn't just about code; it's about securing the raw energy to run it. This silent, escalating demand for power creates a kind of planetary-scale moral question we’ve only begun to ask.

So you have it. A market flush with cash and confidence. A major regulatory battle put to rest. A retail giant building a bridge from the old world to the new. And underneath it all, a furious technological race to build faster chains and find enough energy to power the thinking machines of tomorrow. The pieces are all moving at once, and while the surface of the water looks calm, the currents below are running deep and fast.

This Caught My Eye:

Source : Glassnode

Here’s a breakdown of the chart:

ETH spot ETFs logged 106K ETH in net inflows last week, extending a 7-week streak of positive momentum as price climbed from $2.2K to $2.5K.

Institutions are slowly circling Ethereum just like they did Bitcoin, turning what began as a community-led experiment into a Wall Street asset class.

Looking Ahead

As we close out the month, the dominant theme is the powerful, undeniable convergence of traditional finance and crypto. Robinhood putting real stocks on a blockchain for its European customers is more than just a new feature; it’s a structural shift, a new high-water mark for the entire industry. This isn’t about speculation anymore. It’s about re-architecting the very rails of ownership and exchange. The institutional embrace, once a tentative handshake, is now a full bear hug.

The road ahead will be defined by how this integration plays out. The experiments in Europe with tokenized assets will be watched closely. Their success or failure will dictate the pace of adoption in the U.S. and elsewhere. We’ll be watching to see which L1s can grapple with the institutional demand for speed, security, and compliance. And we will keep one eye on the energy markets, where the quiet, immense thirst of AI is creating ripples that will soon become waves. The market may feel placid today, but it is the placidity of a deep river, not a shallow pond. The world is being rebuilt, and we get to watch.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!