- Osiris News

- Posts

- 📈💰 Bitcoin's $2.5B Boost: Institutions Go All In!

📈💰 Bitcoin's $2.5B Boost: Institutions Go All In!

📈💰 Bitcoin's $2.5B Boost: Institutions Go All In!

Well, Tuesday is upon us, and the crypto market feels less like a casino and more like a sprawling construction site. You’ve got the heavy machinery of institutional investment laying solid foundations, while over in another corner, architects are sketching out wild, futuristic blueprints for tokenized assets and AI-driven networks. Amidst all this building, there are, of course, the usual spirited discussions with the foremen – in this case, regulators – about permits and zoning. It’s a dynamic scene, a blend of pragmatic progress and ambitious dreaming.

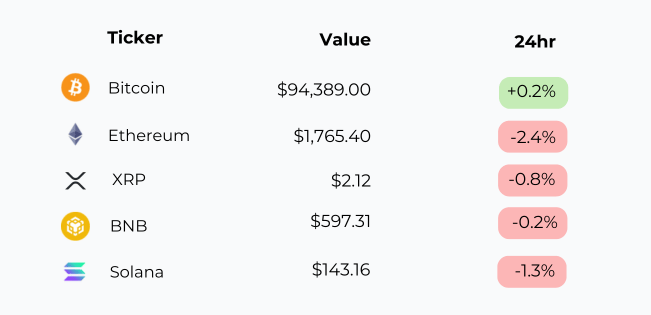

Yesterday, we touched on the big money flowing in and Bitcoin’s resilience. That current continues, with Bitcoin (BTC) holding its ground around $94,389.00 (a slight +0.2% bump in 24 hours), largely thanks to this relentless institutional appetite. But it's not just about Bitcoin; the entire digital asset space is navigating a complex path defined by regulatory developments, technological breakthroughs, and a market that’s getting wiser. The central themes today revolve around this deepening institutional commitment, the slow but crucial dance of U.S. crypto regulation, the almost science-fiction-like potential of tokenization and decentralized AI, and the ever-shifting ground beneath the blockchain platforms themselves. Before we delve into the key factors driving today’s market, let’s take a quick look at where things stand.

🔍 Quick Overview

Institutional Feast: BlackRock’s Bitcoin ETF is swallowing BTC by the billion, like a whale at a krill convention; the big money has clearly pulled up a chair.

Washington's Word: Lawmakers are polishing a new crypto market structure bill for clarity, though the stablecoin part still faces more D.C. drama than a daytime TV show.

The Tokenized Future: BlackRock's chief calls tokenizing assets finance's next big act, and with regulators like the SEC and CFTC in the audience, the show's about to start.

AI's Digital Bazaar: Bittensor’s decentralized AI network hit 100 'subnets,' a bustling marketplace for digital brainpower proving good ideas don't always need a Bay Area zip code.

Chains vs. Apps: The crypto market's hunger for new Layer 1s is cooling, with a rising cry for "more apps, less plumbing!" – like wanting more cake, not just a fancier oven.

Bitcoin stayed just above water with a 0.2% gain, but the rest of the market drifted lower—Ethereum slid 2.4%, and Solana wasn’t far behind. It’s the kind of day where Bitcoin’s pretending everything’s fine, while the rest of the crew quietly disagrees.

Trending News

House Republicans have released a new discussion draft aimed at providing much-needed regulatory clarity for digital assets in the U.S. The proposal outlines roles for the SEC and CFTC, frameworks for fundraising, and registration processes for digital commodity exchanges. This draft is intended to spark further debate and refine the path towards comprehensive crypto legislation. Clearer regulations could significantly boost institutional adoption and foster innovation by reducing uncertainty in the U.S. crypto market.

Banking giant Citi is collaborating with SDX to bring private company shares, potentially worth $75 billion, onto a blockchain platform. This initiative aims to enhance liquidity and accessibility for pre-IPO shares by leveraging tokenization. The service will initially launch in non-US markets like Switzerland and Singapore. This partnership signals growing institutional adoption of tokenization for real-world assets, potentially unlocking vast new markets and improving capital efficiency.

IntoTheBlock and Trident Digital have merged to form Sentora, a new entity focused on bringing institutional investors into DeFi, backed by a $25 million funding round. Led by former Coinbase exec Anthony DeMartino, Sentora aims to offer a comprehensive platform including yield, compliance, and risk management. This move reflects a broader trend of M&A in the crypto space. The formation of specialized, well-funded platforms like Sentora could significantly accelerate institutional capital inflow into the DeFi sector.

The VIRTUAL token, linked to AI agent platform Virtuals Protocol on Base, has surged over 200% in the past month, outperforming Bitcoin. This impressive growth is reportedly driven by significant investments from "smart money," including institutions and crypto whales, who have poured over $14 million into the token recently. The surge is also linked to its new Genesis launchpad system. This highlights the rapidly growing investor interest and capital allocation towards AI-related crypto projects, potentially signaling a major emerging sector.

Beyond the Noise

The story of institutional Bitcoin adoption is no longer a hopeful whisper; it’s a resounding chorus. BlackRock, a name synonymous with traditional finance, continues its Bitcoin accumulation with vigor. Their IBIT ETF recently pulled in a staggering $2.5 billion worth of BTC in a single week, and daily inflows often exceed $300 million. This isn't pocket change. We're seeing U.S.-listed spot Bitcoin ETFs mark consecutive days of net inflows, now holding around 1.17 million BTC collectively. It's not just ETFs either; Bernstein analysts foresee corporations potentially adding $330 billion in Bitcoin to their treasuries by 2030, and companies like Selmer Scientific are already bolstering their balance sheets with significant BTC buys. This consistent, large-scale buying is a powerful force, absorbing new supply and signaling deep conviction. While Bitcoin leads, Ethereum (ETH), currently trading at $1,765.40 (down 2.4%), has also seen renewed institutional interest, though it’s facing some headwinds today alongside other major altcoins like XRP at $2.12 (-0.8%), BNB at $597.31 (-0.2%), and Solana (SOL) at $143.16 (-1.3%).

Of course, all this institutional enthusiasm thrives best under clear skies, which brings us to the U.S. regulatory landscape – a place that often feels more like a chess match. An updated version of the crypto market structure bill, evolving from FIT21, is making the rounds in House committees. The aim? To finally draw clearer lines for the SEC and CFTC, define decentralization (no easy task!), and even provide exemptions for DeFi (decentralized finance) if it’s truly non-custodial. Matthew Siegel of VanEck called the draft a "solid start," highlighting positives like no income limits for retail buyers and clear decentralization tests. However, as we noted yesterday, the path for stablecoin legislation, like the GENIUS Act, is proving trickier, with some Democratic opposition citing concerns, including President Trump's crypto ventures. This regulatory push-and-pull creates an undercurrent of uncertainty, even as the industry actively provides feedback, hoping to shape workable laws. The market is watching closely, as clarity here could unlock further institutional floodgates.

Speaking of unlocking the future, tokenization is rapidly moving from buzzword to tangible strategy. Larry Fink, BlackRock’s CEO, famously said, "tokenization is the future of finance," and it seems regulators are listening. The SEC is hosting a roundtable on May 12th focused squarely on tokenization, with heavyweights like BlackRock, Fidelity, and NASDAQ participating. Imagine a world where stocks, bonds, real estate, even art, can be represented as digital tokens on a blockchain – that’s the promise. The CFTC, too, is getting involved, with Acting Chair Caroline Pham announcing plans to observe industry tokenization pilot programs. This isn't just about new investment products; it's about potentially rewiring the very plumbing of financial markets for greater efficiency and accessibility. It’s a big, bold vision, and one that has serious institutional backing.

Then there's the equally mind-bending world of decentralized Artificial Intelligence (AI), where projects like Bittensor ($TAO) are making serious waves. Bittensor aims to be an "incentive layer" for useful digital outputs – think machine learning models or complex data analysis – rewarding quality and utility, not just raw computing power. It recently hit a milestone of 100 "subnets," each a mini-market for specific AI tasks, from math problem-solving to protein folding. With a Bitcoin-like hard cap of 21 million tokens and a halving schedule, its tokenomics are designed for long-term value. Some are calling it the potential "Ethereum of AI coordination," a way to fund and develop AI outside traditional corporate structures. It’s a bet on incentivized collaboration, and the project certainly looks primed for a big year, reflecting a broader excitement around AI-crypto convergence.

This innovation naturally leads to questions about the platforms themselves – the Layer 1 (L1) and Layer 2 (L2) blockchains. There's a growing weariness in the market with the constant parade of new L1s, a sentiment that "we need more apps, not more chains!" The "L1 premium," where new chains historically fetched high valuations, seems to be compressing, though perhaps not entirely gone. Recent L1 raises, while substantial, are seeing more modest valuations compared to the 2021-2022 frenzy. This suggests a market correction, a sign of maturation. Interestingly, there's also a debate about application funding, with some arguing that useful apps, despite generating real revenue, are often underfunded compared to infrastructure projects. It's a complex ecosystem, with established players like Ethereum preparing for upgrades like Pectra (expected around May 7th) to improve efficiency, even as new contenders vie for attention and capital.

Amidst these grand themes, individual projects continue to push boundaries, sometimes controversially. Worldcoin (World), Sam Altman's identity project, is expanding in the U.S. and boasts over 26 million registered accounts, with 12 million users having completed iris scans. Partnerships with Visa and Stripe signal mainstream ambitions. However, significant privacy concerns and regulatory scrutiny persist, with bans in some countries and ongoing investigations. It highlights the tension between technological ambition, user adoption (often incentivized by token rewards), and fundamental rights. On a broader scale, the crypto industry is also seeing a pick-up in fundraising and M&A activity. Q1 2025 saw a spike in venture funding, largely due to a single massive Binance investment, but weekly figures generally hover in the healthy $100m-$500m range. Mergers, like Trident and IntoTheBlock forming Sentora to cater to institutional DeFi, signal a trend towards consolidation and the creation of more comprehensive service platforms. This, too, is a sign of a maturing industry, albeit one unlikely to revisit the "crazy 2021 levels" anytime soon.

This Caught My Eye:

Here’s a breakdown of the chart:

Stablecoin Growth on Polygon: The total stablecoin market cap on Polygon PoS jumped 23.3% QoQ, crossing $2B — with USDC alone growing 30.9% to hit $1B.

DAI and BUIDL Surge: DAI saw the fastest growth at +46.9% QoQ, while newer entrants like BUIDL are beginning to gain traction, hinting at a more diverse stablecoin mix ahead.

Looking Ahead

So, as this Tuesday unfolds, the crypto narrative is one of increasing sophistication and divergence. The unwavering institutional march into Bitcoin provides a strong, stabilizing anchor. Big money is not just dipping a toe; it's building infrastructure. Simultaneously, the pioneering spirit is alive and well, with tokenization and decentralized AI offering glimpses into radically different technological futures. These aren't just theories; major financial players and regulatory bodies are actively engaging, as evidenced by the upcoming SEC roundtable on tokenization.

However, this isn't a market of universal, unbridled optimism. The regulatory path, particularly in the U.S., remains a work in progress, a crucial element that will shape how quickly and broadly these innovations can be adopted. We see a more discerning investor base, less swayed by hype and more focused on utility, security, and sustainable models, as reflected in the L1 landscape's valuation adjustments. And projects like Worldcoin serve as a constant reminder of the complex ethical and societal questions that accompany powerful new technologies. The Federal Reserve's interest rate decision tomorrow, May 7th, and upcoming U.S. inflation data on May 13th, will also be key macro events for the market to digest.

As we move through the week, the story will likely be about this interplay: solid institutional demand versus evolving regulatory frameworks, groundbreaking innovation versus the need for real-world viability and ethical considerations. The market is clearly maturing, shedding some of its speculative frenzy for a more grounded, if still incredibly dynamic, approach to building the future of finance and technology. The question isn't just if crypto will be part of that future, but how – and on whose terms.

Stay curious,

-Dr. P