- Osiris News

- Posts

- 🏛️⚠️ Bitcoin Resilient Amid Geopolitical Tensions

🏛️⚠️ Bitcoin Resilient Amid Geopolitical Tensions

🏛️⚠️ Bitcoin Resilient Amid Geopolitical Tensions

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News, the mid-week session where screens hum, keyboards clatter, and traders quietly measure the ripples from Washington to Singapore. Yesterday’s memecoin flame-out wiped billions in paper wealth, yet spot exchange volumes stayed surprisingly calm. The headline motif is clear: fear sparks quick retreats, but deeper currents of institutional commitment keep flowing. Because those undercurrents matter more than any single candle, we’ll peel back the noise and surface what is really steering sentiment.

Building on that uneasy calm, the macro backdrop refuses to relax. The Federal Reserve is expected to hold rates steady this evening, and futures desks already price two cuts for early 2025. At the same time, the GENIUS Act sailed through the Senate, corporate treasuries keep stacking BTC, and a handful of venture funds funneled fresh capital into AI-blockchain mash-ups. A Texas miner compared the week to “sailing a reefed yacht, slow, deliberate, still moving forward.” Let’s tighten the lines and pivot into the stories shaping that forward drift.

🔍 Quick Overview

Memecoin Meltdown: Geopolitical jitters sent memecoins like PEPE and FLOKI tumbling, shedding billions as traders scrambled, though Bitcoin showed a bit more backbone.

Regulatory Breakthrough: The U.S. Senate, with bipartisan gusto, passed the GENIUS Act for stablecoin regulation, signaling that clearer rules might finally be more than just a distant whisper.

Institutional Stampede: Digital asset funds saw their ninth straight week of inflows, pulling in $1.9 billion as corporate treasuries kept snapping up Bitcoin like it was the last slice of pie.

Solana's Surge: The Solana network buzzed with activity, hitting a million daily transactions as new apps, like tokenizing Twitter posts, drove volume, and pump.fun soared despite a brief, mysterious X suspension.

AI-Crypto Crossroads: Billions are pouring into the AI sector, a high-stakes game of musical chairs, as smart money increasingly eyes the quiet convergence of AI and blockchain for new applications.

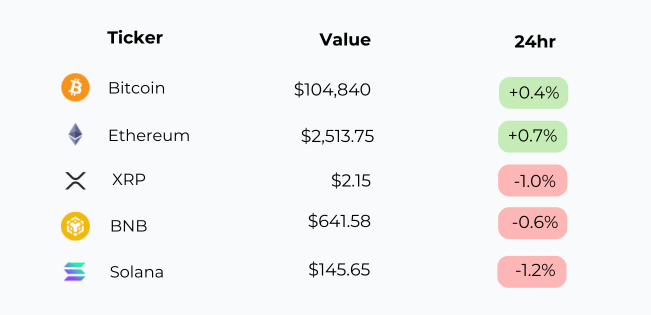

The market steadied a bit after yesterday’s plunge. Bitcoin and Ethereum managed small gains, but Solana, XRP, and BNB continued to slip, though at a slower pace. It feels like the market is catching its breath, but not quite ready to move again.

Trending News

The U.S. Senate passed the GENIUS Act, a bipartisan stablecoin bill mandating full backing and annual audits for large issuers. This legislation now moves to the House of Representatives, with President Trump's advisors indicating support for its signing into law. The bill's passage signals significant progress toward formalizing U.S. stablecoin rules, potentially shaping the future of digital asset regulation.

The advancing GENIUS Act could force Tether, issuer of the $155 B USDT, to comply with strict U.S. reserve standards or focus on non-U.S. markets. Tether's CEO has suggested the company may not directly enter the U.S. market, possibly considering a U.S.-based offshoot. This legislation could significantly alter the stablecoin landscape, potentially shifting market share and influencing Tether's global strategy.

The U.S. Senate's passage of the GENIUS Act is seen as a catalyst for Ethereum's increasing role in institutional finance, particularly as a settlement and collateral layer for stablecoins. Ethereum advocacy firms are actively engaging Wall Street to highlight ETH's importance as a neutral asset. Regulatory clarity and institutional engagement are positioning Ethereum as a foundational layer for tokenized assets and stablecoin settlement.

Beyond the Noise

The most immediate narrative unfurling before us is the sharp sag in the memecoin market, a direct consequence of escalating geopolitical tensions. As President Trump's rhetoric regarding Iran intensified, sending perceived odds of military action soaring to 73% on Polymarket, traders fled risk assets. PEPE crashed 8.2%, FLOKI dropped 5.8%, and Dogwifhat tumbled 8.5%, wiping billions from the sector. The whale netflow for PEPE collapsed by a staggering 97%, a clear signal of institutional money pulling back. This isn't just a dip; it's a stark reminder that even the most speculative corners of crypto are not immune to the world's anxieties.

This flight from risk rippled across the broader altcoin market, though Bitcoin showed a surprising resilience. While major altcoins like Ethereum, Solana, XRP, and Dogecoin saw daily losses around 5%, Bitcoin's dip was minimal by comparison, losing about $100 million in an hour before recovering above $105K. The BTC Volatility Index (DVOL), sitting around 40.86, suggests a market that, while cautious, isn't in full-blown panic. Adding to the unease, the Iranian crypto exchange Nobitex was hacked for over $80 million by a suspected Israel-linked group, a security incident that further underscores the vulnerabilities that can crackle in times of global tension.

Yet, beneath the surface of market jitters, the underlying infrastructure continues to fizzle with innovation. The Solana ecosystem, for instance, is experiencing surging transaction volumes, driven by new applications like arena.trade, which allows users to mint tradable tokens directly from Twitter posts. This activity pushed Avalanche to one million daily transactions for the first time in over a year, doubling average fees. Meanwhile, pump.fun, the memecoin launchpad, had a wild ride: its official X account and co-founder's handle were suspended, then restored without explanation. Despite this, pump.fun's AMM volume soared from $271 million to $413 million in 24 hours. The platform is reportedly raising $1 billion via a token sale and considering acquisitions of trading bots like BULLX, data platforms like DEX Screener, and aggregators like Titan and Cube Exchange. This suggests a relentless drive for expansion, even in the face of market volatility and social media drama.

On the regulatory front, a significant shift is underway, offering a counter-narrative to the market's immediate fears. The U.S. Senate passed the GENIUS Act with bipartisan support (68-30 vote), signaling major progress toward stablecoin regulation and broader crypto clarity. Coinbase's Chief Legal Officer, Paul Graywall, noted a "complete 180" in SEC engagement, with the regulator now actively consulting the industry for clear rules, even as Coinbase continues its own litigation for sensible rules. This push for clarity extends to institutional adoption: JPMorgan launched JPMD, a permissioned USD deposit token for institutional clients, on Base, leveraging its low-cost, high-speed infrastructure for 24/7 money transfers. This move by a financial titan demonstrates a growing comfort with public blockchains, even as the SEC delayed Franklin Templeton's Solana and XRP ETF applications, seeking clarity on staking.

Despite the market's immediate sag, capital continues to swell into the digital asset space, indicating sustained institutional confidence. Digital asset funds saw nine consecutive weeks of growth, with $1.9 billion in inflows last week. This quiet absorption of capital by the big players is a powerful force. Corporations are increasingly adopting Bitcoin into their treasuries: DDC Enterprise Limited raised $528 million for Bitcoin acquisition, Fold Holdings secured a $250 million equity facility for Bitcoin purchases, and Davis Commodities Limited announced a $30 million Bitcoin reserve. Strategy added over 10,000 BTC, underpinning demand. Venture capital is also flowing into infrastructure and AI startups: A16Z Crypto invested $70 million into EigenLayer tokens, Ubyx raised $10 million from VanEck and Galaxy, and Gradient Network secured $10 million for decentralized AI. This steady flow of institutional and corporate money suggests a long-term strategic allocation, a quiet vote of confidence that often goes unnoticed amidst the daily price wiggles.

Even as these larger forces play out, the industry continues to grapple with fundamental issues like security and transparency. While the Nobitex hack was significant, Meta Pool demonstrated the importance of rapid response, limiting an exploit to $132K from a potential $27 million through early detection. Meanwhile, Blockworks Research, in collaboration with industry experts, is introducing the Token Transparency Framework, setting 18 criteria for projects to disclose essential information like supply schedules and market maker agreements. This initiative aims to bring greater clarity to crypto tokens, addressing the insufficient legal protections for token investors compared to equity holders. Entrepreneurs parked prototypes, waiting on signatures none of them can control, a quiet moral lens on the friction points that still exist between innovation and established systems.

This Caught My Eye:

Here’s a breakdown:

The 3iQ XRP ETF has officially launched on the Toronto Stock Exchange, marking the first spot XRP ETF on a major global exchange , a key milestone for Ripple’s institutional legitimacy.

While trading volume is still zero at launch, this listing grants traditional investors direct exposure to XRP without touching crypto wallets , potentially setting precedent for U.S. approvals.

Looking Ahead

Tomorrow’s pivot rests on two hinges. First, the Fed decision will either press more weight on risk assets or nod toward autumn relief. Second, committee markup of the CLARITY bill could sketch exact borders between SEC and CFTC turf, finally letting builders know which corridor to walk without legal whiplash. Both events land within twelve hours and could nudge liquidity either direction.

The theme is undeniably the relentless, accelerating pace of institutional and corporate crypto adoption, even as geopolitical tensions cause short-term market ripples. From major corporations making significant Bitcoin purchases to the GENIUS Act passing the Senate, the TradFi tide lines are actively being redrawn. This structural realignment, driven by a growing understanding of digital assets, is reshaping the very definition of a balanced portfolio. The quiet currents of mainstream adoption are now undeniable, and the friction points, while still present, are becoming less about whether crypto belongs, and more about how it will be best integrated into the existing financial fabric. This momentum, built brick by digital brick, is a powerful force.

Stepping back, the tide line of mainstream adoption keeps inching higher even while surface chop startles traders. Some desks pine for smooth seas, yet markets are seldom that generous. Better to watch the ballast beneath: steady fund inflows, rising chain throughput, and regulators who now ask questions instead of lobbing subpoenas first. The storm clouds may linger, but the vessel moves on. Which quiet metric, fee pressure, staking yields, or deposit tokens, will set the next big course change?

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!