- Osiris News

- Posts

- 🚀💥 Bitcoin Kicks Door Off Hinges: $112K+ ATH

🚀💥 Bitcoin Kicks Door Off Hinges: $112K+ ATH

🚀💥 Bitcoin Kicks Door Off Hinges: $112K+ ATH

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. BTC brushed a fresh peak just above 112 K, and the screens gave a satisfied hum rather than a roar. The surge felt different this time: quieter, steadier, pulled upward by relentless ETF inflows instead of weekend hype.

Building on that calm jolt, the real motif today is momentum meeting imagination. Institutions keep pouring into hard money even as frontier bets on AI convergence and playful memecoins crackle in the same block space. The market has stopped asking whether crypto belongs on the balance sheet and started debating which flavour carries the future’s signature beat.

🔍 Quick Overview

Bitcoin's New Summit: Bitcoin punched through to a fresh all-time high of $112K, pulling altcoins and memecoins along for the ride, fueled by a steady stream of ETF inflows.

AI's Rocket Fuel: Nvidia's $4 trillion valuation injected a fresh dose of enthusiasm into AI-related crypto tokens, proving the AI trade is still very much in vogue.

Celebrity Swings: Snoop Dogg’s NFT promo and Justin Sun’s TRUMP token buy underscored a robust memecoin rebound, showing culture and celebrity still pack a punch.

GMX's Costly Flaw: GMX v1 lost $40 million to an exploit, a sharp reminder that DeFi's security still has its Achilles' heel, impacting user confidence.

Privacy's Tightrope Walk: US prosecutors are tightening the leash on crypto privacy tools, but new apps like White Noise are still emerging, aiming to offer users a quiet digital corner.

Momentum is picking up. Ethereum surged over 5%, XRP climbed 3.7%, and Bitcoin gained nearly 3% to break through $112K. an ATH. Solana and BNB followed suit with solid green. This wasn’t just a bounce, it felt like conviction.

Trending News

U.S. spot Bitcoin ETFs have reached over $50 billion in cumulative net inflows, signaling a major shift in institutional perception. This influx, driven by asset managers and corporate treasuries, helped Bitcoin hit a new all-time high of $112,152. The milestone indicates Bitcoin's move from a niche asset to a mainstream financial portfolio component.

Coinbase partnered with Perplexity AI to provide real-time crypto market data, aiming to enhance trading decisions. CEO Brian Armstrong believes this integration will accelerate AI growth and foster a permissionless digital economy. The collaboration highlights a growing trend of combining AI's procssing power with blockchain's transparent data.

Snoop Dogg sold nearly one million digital collectibles on Telegram in about 30 minutes, generating $12 million. These collectibles will be minted on the TON blockchain, showcasing a successful integration of digital assets into social platforms. The event signals a potential shift towards integrating digital asset sales directly into messaging applications.

The U.S. House of Representatives is dedicating a "Crypto Week" to digital asset policy, with a July 16 hearing on tax rules. The goal is to establish a clear tax framework, potentially adopting ideas like a $300 transaction exemption. This indicates a shift of crypto taxation from a niche topic to a mainstream policy discussion.

Beyond the Noise

The headline rippled outward fast. BTC clearing all-time highs sent a warm updraft through risk assets, lighting altcoin candles across dashboards. BlackRock’s IBIT now babysits 700 K BTC, a position large enough to make old-school gold bugs cough. Desks buzz with the sense that an invisible bid, methodical, programmable, almost boring, has replaced the jittery retail stampede of cycles past.

Because of that lift, the AI tokens cohort, TAO, ICP, RENDER, FET, did more than tug at coattails; they jumped. Traders pointed to Nvidia’s swaggering $4 T valuation and murmured that GPU scarcity is the new oil shock. Meanwhile, miners pivot. CoreWeave grabbing Core Scientific re-routes megawatts of hash power toward model training, and the data halls now thrum like engine rooms on launch day.

Yet the week wasn’t all sunshine. GMX leaked roughly $40 M after a clever attacker slipped through its accounting cracks, yanking liquidity as if lifting planks from a bridge mid-crossing. Thousands of small savers watched screens flicker, realising rent money was trapped in lines of code. TVL on v1 collapsed; v2 survived but the brand now carries scorch marks.

Regulators, scented by the smoke, pressed harder. The Department of Justice unsealed fresh counts against Samourai developers, arguing that privacy equals intent. In the same breath, Jack Dorsey cheer-led White Noise, an encrypted Nostr messenger that swaps metadata for silence. Builders and prosecutors march in opposite directions down the same hallway; the echo feels colder by the day.

Culture, however, refuses to sit still. Snoop Dogg sold a million NFT tickets in half an hour, proving charisma still mints cash. Pump.fun announced the PUMP sale at a valuation that made veterans wince, while Justin Sun hoovered up TRUMP tokens like campaign buttons. The chain crackled with jokes, but the revenue is very real, and so is the tug of regulatory glare.

Zooming out, the quiet backbone of the rally might be the pending GENIUS Act. A federal stablecoin rulebook could unlock rails for payroll, trade, and, eventually, that speculative dream of an Automated Abundance Economy funded by crypto-denominated UBI. If the House signs next week, desks will thrum louder than cooling fans in a Malaysian farm.

This Caught My Eye:

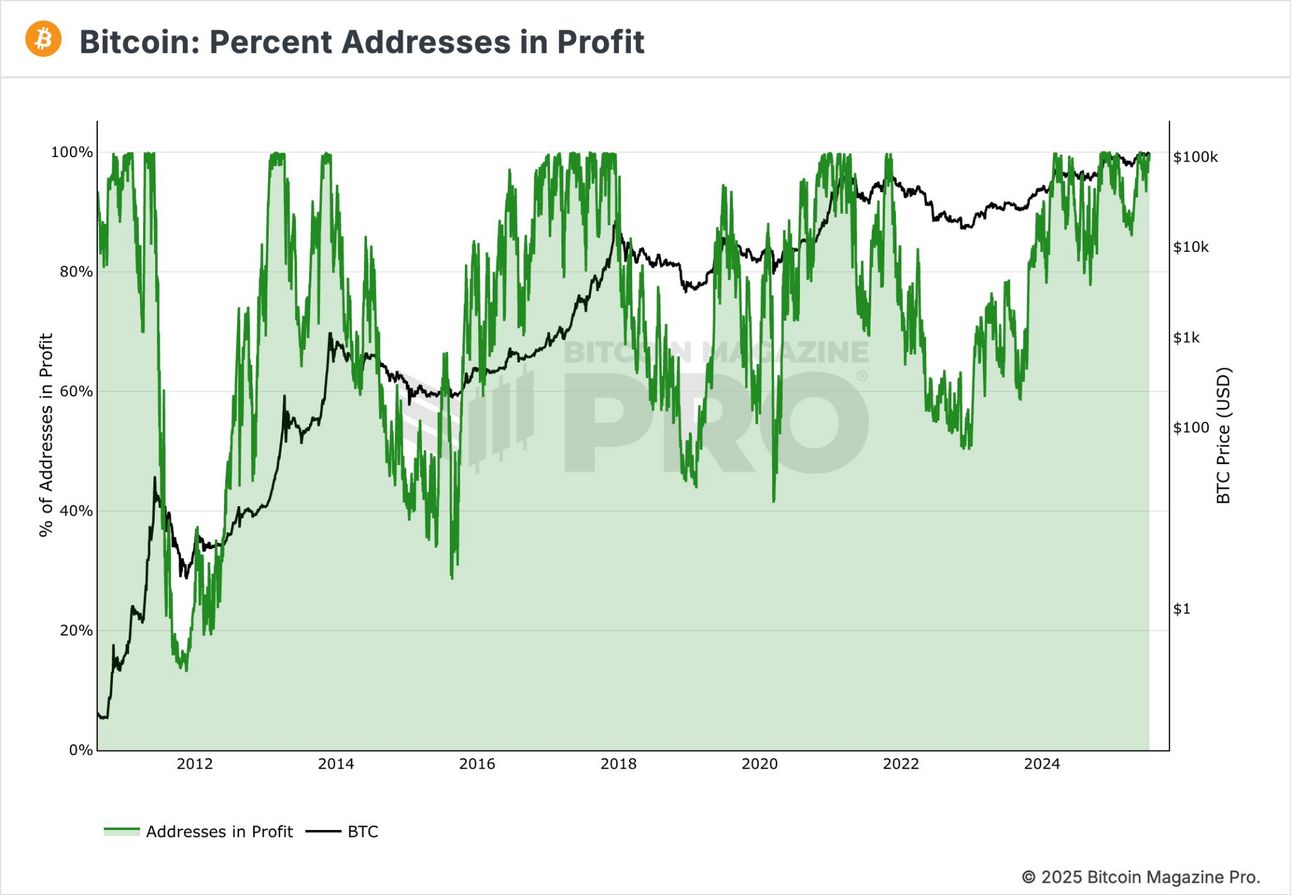

Here’s a breakdown of the chart:

99.85% of all BTC addresses are in profit, nearing full profitability across the network.

Historically, such levels precede euphoria or consolidation, but also highlight the strength of long-term conviction.

Looking Ahead

The heartbeat now is steady but quickening. Institution-grade demand has found its instrument set: spot funds for value storage, high-yield staking for ambitions, and AI-linked side bets for narrative spice. If Washington hands builders clear lanes, the tug between hard-cap scarcity and programmable utility will shape every treasury conversation from Frankfurt to São Paulo.

Two forks loom. First, will the cautious corporate crowd lean further into ETH once the rulebook lands, or double-down on the perceived safety of the orange coin? Second, can privacy tools survive a climate where each new feature is parsed for criminal intent? The tide is rising either way; what remains uncertain is whose ships are built for deep water, and whose will creak when the next squall snaps across the deck.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!