- Osiris News

- Posts

- 🌍🏛️ Bitcoin Integration: US Fumbles, France Mines

🌍🏛️ Bitcoin Integration: US Fumbles, France Mines

🌍🏛️ Bitcoin Integration: US Fumbles, France Mines

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. There is a feeling in the market today not of frantic energy, but of something heavy settling into place. It is the quiet thud of a cornerstone being laid. A corporate treasurer somewhere just signed off on a nine-figure allocation to a digital asset, and did so with the same bored expression they use for approving a new software license. The ground is hardening beneath our feet.

The emotional weather is one of dawning reality. The theme is no longer adoption, but integration. It is the messy, irreversible process of digital assets becoming a permanent part of the financial landscape. This is not a smooth software update. It is more like renovating an old house while you are still living in it—dust everywhere, surprising structural problems, and the unnerving sense that the old rules no longer apply. The market is growing up, but like any adolescent, it is still awkward, occasionally brilliant, and prone to tripping over its own feet.

🔍 Quick Overview

Bitcoin's Big Leap: Bitcoin surged past $123,000, outperforming the S&P 500 and becoming the corporate treasury's new darling.

Ethereum's ETF Influx: Ethereum ETFs saw record $726 million inflows, pushing ETH past $3,400 and cementing its role as a major player.

Stablecoins Go Mainstream: Wall Street giants like JPMorgan are embracing stablecoins, with the GENIUS Act paving the way for their global financial integration.

DeFi's Dual Path: New DeFi innovations like trading rollups emerge, but persistent security exploits remind us the wild west still has its outlaws.

Nations Eye Crypto: Governments from California to Pakistan are strategically embracing digital assets, exploring Bitcoin reserves and crypto-friendly policies.

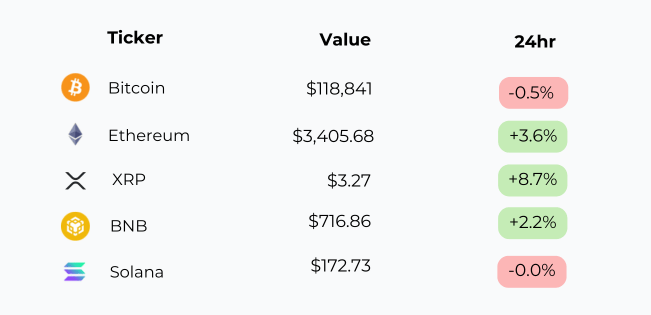

Another strong day for the majors but with a twist. XRP exploded 8.7%, stealing the spotlight. Ethereum followed with a solid 3.6%, and BNB stayed steady with a 2.2% gain. Bitcoin slipped 0.5%, and Solana ended... exactly where it started.

Trending News

U.S.-listed Ether ETFs experienced a record-breaking day with $726.74 million in net inflows, driving ETH prices past $3,560. BlackRock’s ETHA led the surge, attracting nearly $500 million and pushing cumulative ETF inflows to $6.48 billion. This influx signals growing institutional embrace and a structural shift in ETH's utility, potentially tripling network demand.

MicroStrategy, the largest corporate Bitcoin holder, reached an all-time high market capitalization of $128.4 billion as Bitcoin exceeded $122,000. The company now holds 601,550 BTC, valued at over $73 billion, with its stock up 174% over the past year. MicroStrategy's performance highlights Bitcoin's potential as a driver of shareholder value and influences broader corporate Bitcoin adoption discussions.

Tether's USDT stablecoin surpassed a $160 billion market capitalization, driven by its utility in developing countries and over $1 billion in Q1 operating profit. The company holds over $127 billion in U.S. Treasurys and is investing heavily in AI, telecommunications, and Bitcoin mining. USDT's growth solidifies its role as a global financial utility, with Tether's strategic investments signaling a broader push into tech infrastructure.

A Chainalysis report forecasts a record $4.3 billion in crypto thefts for 2025 if current trends continue, with over $2.17 billion already stolen in the first half. The North Korean Lazarus Group remains a major culprit, responsible for a $1.5 billion hack of Bybit. The surge in thefts, including "wrench attacks," underscores the critical need for enhanced operational and personal security measures for crypto investors.

Beyond the Noise

The raw power of this shift is most visible in Bitcoin. The asset surged past $123,000 this week, a move that makes traditional indices look stationary. The S&P 500 is down a staggering 15% against Bitcoin year-to-date. If you zoom out, the picture becomes almost absurd. According to The Kobeissi Letter, the S&P 500 has lost 99.98% of its value when priced in Bitcoin since 2012. This is the data that is driving the great corporate re-allocation. In the first half of 2025 alone, the number of companies with a Bitcoin treasury strategy nearly doubled, with 134 firms absorbing almost 245,000 BTC. The relentless buying continues, with MicroStrategy adding another 4,200 coins to its hoard, now over 600,000 BTC, and Cantor Fitzgerald is in late-stage talks to launch a $4 billion Bitcoin treasury SPAC.

This trend is no longer just corporate; it is sovereign. While Pakistan officially opens diplomatic relations with El Salvador to collaborate on a strategic Bitcoin reserve, and France eyes $150 million in annual revenue from mining with its excess nuclear power, a strange story is unfolding in the United States. New disclosures reveal the US Marshals Service holds only 28,988 BTC, a fraction of the nearly 200,000 coins it was thought to custody from seizures. The rest? Likely sold off years ago at lower prices. Senator Cynthia Lummis did not mince words, calling it a “total strategic blunder” that “sets the United States back years in the Bitcoin race.”. It is a perfect, almost painful, illustration of an empire fumbling the keys while new powers are learning how to build the car.

But this is not just a Bitcoin story. As the world’s attention is fixed on the new digital gold, Ethereum is quietly building a digital metropolis. It, too, is feeling the pull of institutional gravity, with its ETFs seeing a record $726 million in inflows, pushing ETH above $3,400. BlackRock’s fund led the charge, absorbing $500 million of that new capital. This is not just follow-on buying; it is a recognition that the institutional thesis has two pillars: a store of value and a world computer. The corporate world is catching on here, too. SharpLink Gaming now holds 270,000 ETH, and Peter Thiel-backed entities have taken a significant stake in a miner that custodies 163,000 ETH.

The demand for Ethereum is rooted in its utility, a sprawling ecosystem that is getting more sophisticated by the day. The world of liquid restaking—a mechanism that feels a bit like getting a spendable claim ticket for a coat you have already checked—is booming. The market leader, ether.fi, with its $8.53 billion in locked value, has leveraged its dominance to refashion itself as a crypto-native neobank, launching a Visa card that offers cashback. It is a small step, but a profound one, turning abstract DeFi yield into something you can use to buy groceries. This is the kind of innovation, alongside new protocols like Kinetiq pulling in $460 million on its first day, that gives the institutional money a reason to stay.

All this activity, from corporate treasuries to DeFi protocols, needs a stable foundation to stand on. This is the quiet, essential work being done in the world of stablecoins. The infrastructure is being built not by startups in hoodies, but by the old guard in suits. Wall Street giants like JPMorgan, Citigroup, and Bank of America are all publicly exploring stablecoin issuance. The motivation is simple: survival and efficiency. When Jamie Dimon says his bank plans “to be involved in stablecoins” to stay competitive, it is a signal that the fight for the future of money is moving onto new terrain. This is happening with the blessing of regulators, as the GENIUS Act, a bill to create a national framework for stablecoins, is expected to pass the House, providing the clarity institutions have craved.

Yet, for all this progress, the frontier remains a dangerous place. The tension between innovation and security is a constant, humming wire. For every new protocol that launches, another seems to fall. This week, the exchange BigONE suffered a $27 million breach, and Arcadia Finance was exploited for $2.5 million. Each hack is a quiet moral lens on the space; for every trader cheering a new high, there is a user somewhere staring at a drained wallet. It is not just about external threats. Sometimes the danger is a flawed strategy. The core developers of the Cosmos ecosystem, Interchain Labs, just announced they are shelving their long-planned EVM Hub, admitting they “got a lot of confidence that we were going over a cliff.” It is a brutal, honest pivot back to their core strength of providing infrastructure for sovereign chains, but it leaves developers who built on the old promise in the lurch. It is a stark reminder that even the architects of this new world are still just drawing the maps.

This Caught My Eye:

Source : Arkinvest

Here’s a breakdown of the chart:

Bitcoin dominance just hit 65%, marking its strongest level since 2020 and signaling renewed faith in BTC’s core value.

Altcoins are lagging behind, with capital rotating into Bitcoin as institutions lead the charge.

Looking Ahead

The market has crossed a psychological threshold. The narrative has shifted from if this technology will be integrated into the global financial system to how and by whom. The relentless, programmatic buying from corporations and ETFs has provided a floor that feels different, heavier than the speculative froth of past cycles. The story of the US Marshals’ fumbled Bitcoin holdings is a parable for our times: this is now a geopolitical game of strategic accumulation, and the inertia of old institutions is a massive liability.

The path forward will be defined by the tension between the immense gravity of this new capital and the still-brittle infrastructure it flows through. The questions are becoming more serious. Can the technology handle the strain? Can the builders outpace the breakers? Can the regulators find a balance between fostering innovation and protecting users? The market is no longer a fringe curiosity. It is becoming a core component of the global machine, and it is doing so in real-time, with all the noise, dust, and unpredictable failures that come with any great construction project. The game is the same, but the stakes have been raised for good.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!