- Osiris News

- Posts

- 🏦💥 Bitcoin ETFs Wobble as Banks Ride Crypto Wave!

🏦💥 Bitcoin ETFs Wobble as Banks Ride Crypto Wave!

🏦💥 Bitcoin ETFs Wobble as Banks Ride Crypto Wave!

Hello there you embodiment of curiosity;

<newsletter> Welcome to today’s edition of Osiris News, and if the morning screen feels equal parts steady and strange you are not alone. Bitcoin, after shedding a few thousand in the Friday shuffle, still sits on a fortress of ETF demand; meanwhile the GENIUS Act has flipped the stablecoin switch from limbo to policy. The primary thread is blunt: bank grade tokens are clearing to launch, even as spot BTC and ETH funds briefly coughed up close to a billion.

Keeping that texture, think of Monday as a pressure front rather than a storm. Wall Street now treats crypto as plumbing, not pastime; the big funds add or subtract exposure the way a farmer shifts irrigation. BlackRock, JPMorgan, and Visa are already plumbing those pipes, and their footprints grow louder each week. Everything points toward one motif: liquidity that used to crawl now hums down blockchains, and every new account nudges the market a little farther from its fringe roots.

Institutional Tide: Wall Street's crypto embrace is real, with massive ETF inflows and the GENIUS Act opening a $117 trillion market for stablecoins, proving some old dogs do learn new tricks.

ETF Reversal: US Bitcoin and Ethereum ETFs saw nearly $1 billion exit in early August, a sharp turn after July's record inflows, reminding us even the best parties have an end.

Security Shock: A staggering $14.5 billion Bitcoin theft from 2020 went unnoticed for five years, a digital heist that makes traditional bank vaults seem as secure as a child's piggy bank.

Policy Pivot: The UK is opening retail access to crypto ETNs, while US politicians court crypto donations, signaling a slow but steady shift in the global rulebook, like a ship slowly changing course.

DeFi Momentum: Base has surged past Solana in daily token launches, showcasing rapid DeFi innovation, proving the crypto world's builders never truly sleep.

A solid rebound after yesterday’s slump. Ethereum and XRP both surged over 5%, with Solana and BNB also climbing nicely. Bitcoin inched up 1.1%, helping restore a bit of confidence to the market.

Trending News

Crypto investment funds experienced a net outflow of $223 million globally last week, breaking a 15-week inflow streak. Bitcoin-based funds led the outflows with $404 million, including $642.9 million from U.S. spot Bitcoin ETFs. This shift reflects a "risk-off sentiment" following a hawkish FOMC meeting and better-than-expected U.S. economic data.

Ethena Labs' USDe stablecoin rapidly increased its market capitalization by 75% in three weeks, reaching approximately $9.3 billion. This growth followed the signing of the GENIUS Act and a new custody partnership with Anchorage Digital. USDe's high variable return of 10% to 19% APY is attracting significant capital in the DeFi space.

Coinbase's satirical UK TV commercial, "Everything Is Fine," was pulled from screens, prompting CEO Brian Armstrong to suggest censorship. The Advertising Standards Authority (ASA) can legally ban ads deemed misleading or harmful. The incident highlights the challenges crypto companies face navigating regulations and public perception in established markets.

Base, Coinbase's Layer 2 chain, has surpassed Solana in daily new token launches, recording 54,341 on July 27 compared to Solana's 25,460. This surge is largely attributed to the integration of decentralized social networks Zora and Farcaster. This shift solidifies Base's position as a leading Layer 2 network for token creation and raises questions about the future of social finance on the blockchain.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

Beyond the Noise

The institutional turnaround is no longer rumor; it is ledger ink. Bitcoin has gained roughly thirty-thousand percent since late 2016, and the GENIUS Act puts a regulatory bow on bank-minted stablecoins. Those two facts set a bracket for the week. Because of that legal clarity, BlackRock and peers hold a combined pot just shy of one hundred billion in spot funds; when they sold last Thursday the tape dipped, when they bought Friday afternoon the chart steadied. Nothing mystical, simply program trade habits showing up in an asset class that once moved on tweets.

Payments squads are not waiting. Visa extended settlement to Stellar, Avalanche, PYUSD, and a fresh dollar token while Tether quietly climbed the league table of Treasury holders. A Manila importer toggled on-chain invoices and watched funds clear before lunch, a micro-anecdote that captures the sensation. Cheap dollars that buzz through ledgers mean fewer wires, fewer Monday morning headaches. The shift is sensory; you can almost hear transaction finality when the screen flashes green.

Under the hood, two models compete. Yield-hungry coins such as USDe chase 10 % to 19 % APY by looping collateral through futures, a design that works until spreads flatten. Bank tokens under the new law will resemble demand deposits, one to one against Treasuries, paying near-zero yield but offering audit-grade safety. Put differently, one design borrows volatility, the other borrows credibility. The market will discover which flavor merchants prefer.

Regulators absorb the same tension from opposite angles. The United Kingdom just reversed a retail ban on crypto ETNs that had survived four years, while U S policymakers frame stablecoins as dollar diplomacy. Yet privacy developers feel a colder wind after Samourai founders pleaded guilty in Manhattan. Quiet moral lens: every compliance checkpoint that shields pensions from scams may also push cash-strapped migrants back toward slow remittance rails.

Builders keep grinding. Base outpaced Solana for daily token debuts, Heurist Chain promised AI agents on a zero-knowledge backbone, and Lido trimmed staff to stretch runway. Hash power hit a new record; rigs in Irkutsk whir through summer dust while North American miners flirt with AI colocation. One coder’s journal read: fixed rounding bug, shipped patch, brewed coffee. That line, repeated thousands of times, is how protocols stay upright when billions lean on them.

The curveball belongs to ETFs themselves. A tidy billion in outflows started August, the second-worst print for spot BTC funds to date, yet prices barely blinked. Structural demand may have muted volatility, but it also means liquidity providers can pull supply when macro headlines sour, leaving retail flow to chase scarcity. If you ask: “Are ETFs calming or crowding?” Both; they damp daily noise, yet when they reverse the suction feels stronger.

Synthesis arrives in a single image: a bank logo beside a block explorer hash. The rails are welded; capital no longer tiptoes. The remaining friction lies in the culture clash between open source and office towers. Until that resolves, expect screens that look polite while back-office teams scramble to reconcile new ledgers with old rules.

This Caught My Eye:

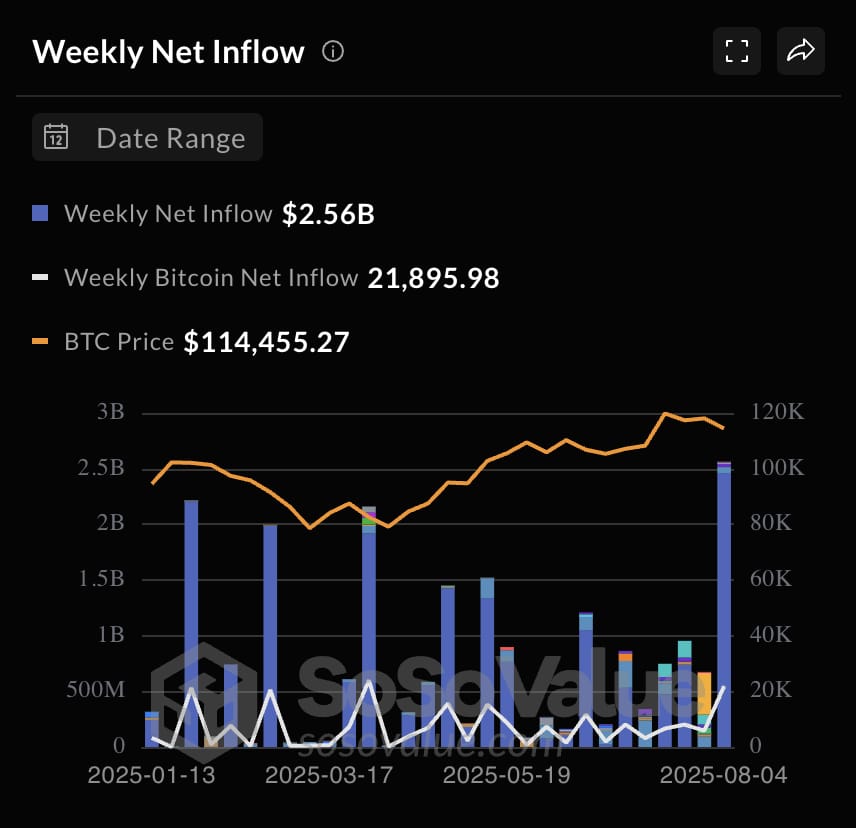

Source : SoSoValue

Here’s a breakdown of the chart:

Public companies acquired $2.56B in Bitcoin last week, marking the largest single-week inflow of 2025.

Corporate BTC holdings now total ~$81.2B, showing deepening institutional conviction in Bitcoin as a treasury asset.

Looking Ahead

Momentum now depends on habits rather than hope. Bank-issued stablecoins will begin as pilot programs but once payroll and supply-chain invoices run across them the migration will quicken. ETF creations and redemptions will stay the quiet metronome beneath price, filling or draining reserves each afternoon. If those two spigots remain open, every macro wobble converts into discount buying, not fear.

Several forks loom. Will the Clarity Act pass intact or emerge watered down? Do UK ETNs ignite wider European demand or merely rotate existing risk? Does the first batch of bank tokens crowd out riskier synthetic dollars or onboard a fresh swath of users ready for Ethereum-style programmability? Circle August’s Jackson Hole symposium; central bankers will compare private rails with public debts. Markets forget quickly, policies linger, and nothing in crypto is permanent even when it feels inevitable.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!