- Osiris News

- Posts

- 📈 Bitcoin Breathes, ETFs Surge, US Warms Up

📈 Bitcoin Breathes, ETFs Surge, US Warms Up

🚀💼 Bitcoin's Quiet Revolution: Wall Street's Digital Pivot!

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News, a mid-week lull where the screens almost hum with anticipation rather than roar with panic. There’s a strange calm in the air today, the kind that follows a fever breaking. The market is breathing a sigh of relief on ceasefire news, but beneath the surface, a different kind of work is being done , a quiet, methodical grinding of gears as the old world of finance begins to rewire itself for a new reality. Five years ago, the notion of JPMorgan and Mastercard building on-ramps for digital dollars would have been dismissed as a fantasy. Today, it’s just Wednesday.

It’s easy to get distracted by the headlines, the geopolitical chess moves, and the daily pronouncements from the Fed. Those are the loud noises. But the real story is quieter. It’s in the code being shipped, the compliance documents being filed, and the balance sheets being re-evaluated. An intern at a bulge-bracket bank, once tasked with fetching coffee, is now trying to explain tokenized deposits to a managing director who is, for the first time, actually listening. That’s the shift. It’s slow, and then it’s all at once. Let's look beyond the noise and see where the real work is happening.

🔍 Quick Overview

Institutional Influx: Wall Street's big names aren't just dipping toes; they're building bridges and seizing scams, signaling crypto's mainstream arrival.

Real-World Assets: Tokenization of real-world assets is booming, turning illiquid private markets into transparent, digital goldmines, one blockchain block at a time.

Market Calm: Bitcoin surged past $108K as geopolitical tensions eased, proving that sometimes, a little peace and quiet is all the market needs.

Ethereum's Speed Boost: ZKsync's "Airbender" prover is slashing Ethereum transaction times and costs, making the blockchain run like a freshly tuned sports car.

Regulatory Currents: Texas put $10M into a Bitcoin reserve, while US senators outlined new crypto rules, showing states are staking claims while Washington sketches the map.

The rally cooled off sharply. Bitcoin and BNB eked out small gains, but Ethereum, Solana, and XRP slipped into the red. After yesterday’s surge, today felt more like a pause, with the market catching its breath and reassessing its footing.

Trending News

Bitcoin climbed past $107,000 this week, recovering from a dip below $100,000 as Middle East tensions eased and U.S. spot Bitcoin ETFs saw significant inflows. Wall Street and corporations continue to buy Bitcoin, with U.S. spot Bitcoin ETFs pulling in $588.5 million on June 24. This resilience suggests Bitcoin's growing integration into the broader financial system and maturing market dynamics.

Bitcoin options worth $14 billion are set to expire on Deribit this Friday, with the put-call ratio rising to 0.72, indicating potential bearish sentiment from cash-secured puts. The "max pain" point for this expiry is $102,000, suggesting a relatively tight trading range. Traders are positioning for limited price movement in the short term, despite elevated implied volatility.

The Bank for International Settlements (BIS) expressed skepticism about stablecoins, arguing they lack sufficient value guarantees and could threaten financial stability. This warning coincided with a 15% decline in Circle's stock price, a major stablecoin issuer. The BIS suggests tokenizing central bank reserves and commercial bank money as a more viable future for finance.

Over $20 billion in real-world assets have been tokenized onto blockchain networks, driven by advancements in Layer 1 and Layer 2 solutions and institutional adoption. Major financial institutions like Apollo and BlackRock are actively building the infrastructure for this transition. This shift indicates a future financial system operating globally on trustless rails, powered by programmable assets.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Beyond the Noise

The institutional tide is no longer just rising; it’s beginning to reshape the coastline. The biggest names in traditional finance are moving beyond experiments and are now building permanent infrastructure. Mastercard has partnered with Chainlink to bring crypto purchasing power to its three billion users. Paxos, a key infrastructure player, is seeing a flood of interest from TradFi firms wanting to build their own stablecoin systems. “We’ve seen a huge influx of demand for our stablecoin infrastructure in general,” said Paxos head Walter Hessert (Source: Institutional Crypto Adoption & Infrastructure). This isn’t speculative froth. It’s underscored by hard numbers, like the $100 billion in assets now under custody at BitGo and the fresh $135 million raised by Digital Asset to expand its Canton Network, which is already processing trillions in real-world assets. The message is clear: the big money is no longer dipping a toe , it’s building the pool.

This construction boom extends deep into the architecture of what’s possible. The buzz around Real-World Asset (RWA) tokenization is finally solidifying into tangible products. We’re seeing more than $20 billion in tokenized assets on-chain, and the pace is quickening. Corporate treasuries are quietly adding Bitcoin and other crypto assets to their books, with firms like Nano Labs planning a treasury of up to $1 billion. This isn’t just about hedging; it’s about participating in a new, more efficient financial system , where Treasury bills become programmable, yield-bearing collateral, and private equity becomes liquid. This is the heavy, unglamorous work of laying pipes and pouring concrete for the financial rails of tomorrow.

Of course, none of this works if the underlying technology can’t keep up. For years, the knock on crypto was that it was too slow and expensive for mainstream use. That argument is beginning to wilt. Matter Labs just unveiled Airbender, a new cryptographic prover for ZKsync that can prove an entire Ethereum block in 35 seconds on a single consumer-grade GPU. This is a massive leap forward. As Matter Labs co-founder Alex Gluchowski put it, “Faster proofs unlock faster finality, cheaper apps, and crucially, proofs that can be generated anywhere.” At the same time, layer-1s like Sei are preparing for their own quantum leaps. Its upcoming “Giga” upgrade aims for a staggering 200,000 transactions per second. The tech is starting to fizzle with a new kind of energy, one that can support the institutional weight now bearing down on it.

Zooming out, this all happens against a backdrop of tentative global calm and persistent domestic uncertainty. The market rumbled with relief as a fragile ceasefire between Israel and Iran took hold, pushing Bitcoin back above $106,000. But the optimism is tempered. Fed Chair Jerome Powell continues to preach patience, adopting a “wait-and-see” approach to interest rate cuts that leaves risk assets in suspended animation. The recent market dip triggered a large deleveraging event, a healthy but painful flushing out of over-leveraged positions. It’s a reminder that even as the fundamental picture improves, the macro environment remains a fickle beast, capable of spooking the herd with a single headline.

In the middle of all this, a strange and wonderful political drama is unfolding in New York City, the very heart of global capitalism. Zohran Mamdani, a self-described socialist, just won the Democratic mayoral primary. His platform includes city-run grocery stores and rent control, policies that have finance-types in a cold sweat. In a bar in the East Village, you can almost hear the finance bros and the DSA organizers furiously debating the same event from opposite ends of the universe. Critics call it a symptom of “luxury beliefs,” noting that working-class voters largely favored the incumbent while the college-educated leaned toward the challenger. It’s a fascinating, almost comical clash of worlds. For some, this political shift only reinforces the core thesis of Bitcoin: a sovereign, apolitical asset that serves as an escape hatch when economic policies get, for lack of a better word, a little crazy.

With all this high-minded talk of institutional adoption and political theory, it's important to remember the darkness that still lurks at the edges of this world. The U.S. Secret Service, with help from Coinbase, just seized $225 million in USDT tied to “pig butchering” scams. It’s a good win for the good guys, but it’s also a stark reminder of the human cost of this industry’s wild frontier. The victims of these scams aren’t institutions; they’re ordinary people whose trust and hope were weaponized against them. This danger coexists with the mixed signals from the altcoin market, where some charts show bullish patterns like the “three white soldiers” on HYPE, while others, like PEPE, remain trapped in bearish wedges. It’s a market of profound contradictions, where immense progress is shadowed by immense risk.

So, what we have is a complex picture. The world’s largest financial players are methodically building on-ramps. The underlying technology is getting exponentially better. State governments , like Wyoming with its stablecoin pilot on Sei, and Texas with its Bitcoin reserve , are giving their blessing. And all the while, ideological battles are raging that make the case for a decentralized alternative stronger every day. The pieces are moving into place , not in one clean, sweeping motion, but in a messy, chaotic, and ultimately human process of creation.

This Caught My Eye:

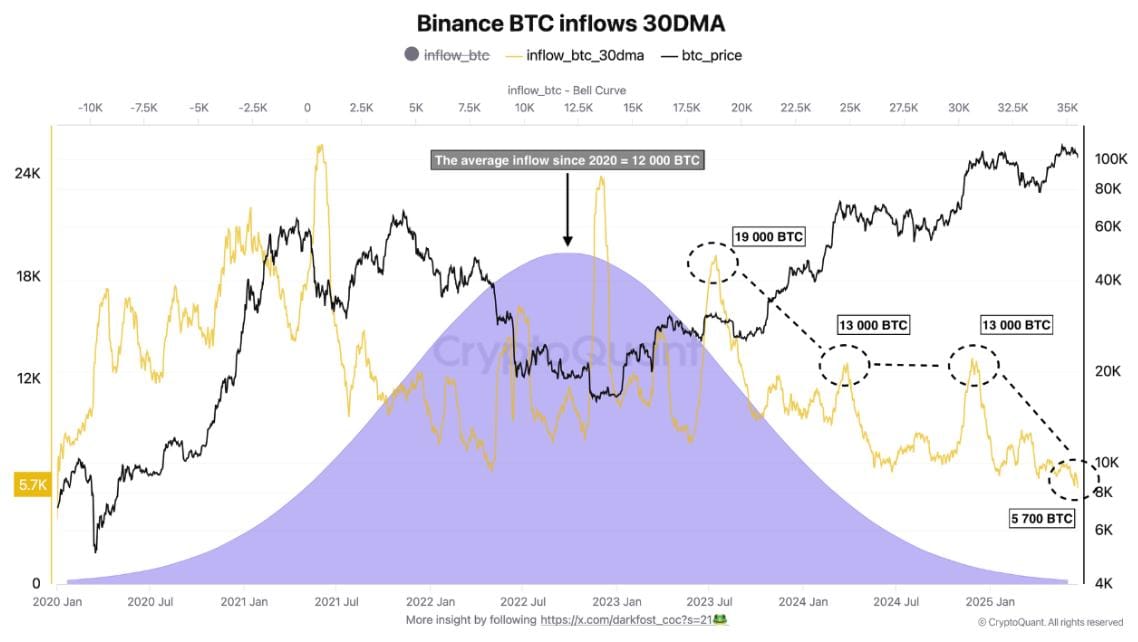

Source : CryptoQuant

Here’s a breakdown of the chart:

Bitcoin inflows to Binance are down to 5,700 BTC, the lowest level since the 2022–2023 bear market.

This steep drop from peaks of 19K and 13K suggests seller exhaustion and a shift to stronger hands holding on tight.

With exchange inflows now well below the 12K BTC historical average, this signals reduced sell pressure, a potential foundation for the next leg up.

Looking Ahead

As we close out this Wednesday, the dominant theme isn’t a price chart , it’s a blueprint. The frantic energy of the last bull run has been replaced by the steady hum of construction. We are watching the relentless acceleration of institutional and corporate adoption, underpinned by major financial players and the maturation of RWA tokenization. From Mastercard integrating stablecoins to BitGo crossing $100 billion in custody, and Sei being tapped for a state-level stablecoin pilot, the TradFi tide lines are shifting. The conversation is no longer about if crypto will be integrated , but how. Tokenized T-bills, permissioned DEXs, programmable treasuries , the foundations are being laid, brick by digital brick. What once felt like speculation now feels like infrastructure.

The road ahead is long, and the rewiring isn’t finished. These new systems will face bottlenecks, regulatory pushback, and complexities that only emerge at scale. There’s a big difference between building a bridge and having the world’s capital try to cross it. Patient capital knows this , it’s not betting on a single headline, but on a full transformation. As markets lurch through short-term cycles, the structural realignment beneath is what matters. We’ll be watching Powell’s next move, but we’ll also be watching what the builders are doing when no one’s looking. The adoption grows. The infrastructure hardens. The patient capital understands this. It’s not betting on a single quarter or a single headline. It’s betting on the entire rewiring.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!