- Osiris News

- Posts

- 🚀💥 Bitcoin Blasts $118K: Shorts Crushed, ETFs Surge!

🚀💥 Bitcoin Blasts $118K: Shorts Crushed, ETFs Surge!

🚀💥 Bitcoin Blasts $118K: Shorts Crushed, ETFs Surge!

Hello there you embodiment of curiosity;

Welcome to today’s edition of Osiris News. A $118K high for Bitcoin dropped like a stone into a still pond, and the ripples keep spreading. On the same wave, Ethereum snapped back above the $3K line, carried by the strongest ETF inflows since spring. Traders can feel the surface buzz, yet the real heat is deeper, record short liquidations and an emboldened Greed Index hint at pressure building below the placid charts. Because of that jolt, every conversation this morning pivots to who’s still off-sides.

Building on that, the motif today is weather: humid air before a thunderclap. Storm signals come from two fronts, political posturing that drags Bitcoin into campaign trails, and corporate treasurers rearranging cash piles faster than a summer breeze reshuffles clouds. That tension sets the stage for the market snapshot you’re reading now.

🔍 Quick Overview

Market Rockets: Bitcoin punched through $118K for a new all-time high, with Ethereum hot on its heels past $3K, proving this market still has plenty of gas in the tank.

Institutional Floodgates: Record ETF inflows, especially for Ethereum, show Wall Street isn't just window shopping anymore; they're buying the whole store, cash in hand.

Memecoin Mayhem: Solana's memecoin scene saw a changing of the guard as LetsBonk out-earned the old favorite, proving that even in this wild west, some new sheriffs struggle to keep their hats on.

Security Scares: DeFi faced a $40 million GMX exploit and a thwarted $10 million backdoor, a stark reminder that even digital fortresses need constant vigilance against the sneaky sorts.

TradFi-DeFi Tango: JPMorgan says the dance between traditional finance and DeFi is speeding up, with real-world assets now stepping onto the blockchain stage, proving old money can learn new tricks.

That’s a rally. Bitcoin broke past $117K with a 3.9% jump, Ethereum is approaching $3K, and XRP exploded with a 12.6% surge. Solana and BNB rounded out the day with steady 3%+ gains. Confidence is no longer creeping in, it’s stomping.

Trending News

Bitcoin reached a new high of $118,800, driven by steady spot ETF inflows and expectations of easing U.S. monetary policy. Ethereum also reclaimed $3,000, with BlackRock's ETH ETF seeing a record $300.9 million in daily inflows. The combined market capitalization of cryptocurrencies now exceeds $3.6 trillion, signaling renewed institutional appetite and a significant sentiment reset.

Memecoin launchpad Pump.fun acquired Solana-based wallet tracker Kolscan, valuing the firm at $4 billion ahead of its initial coin offering. This move aims to integrate real-time trader data and build a social media platform for crypto, making Kolscan services free. The acquisition signifies Pump.fun's ambition to expand beyond token launches and foster a more interconnected Solana ecosystem.

Decentralized exchange GMX experienced a $40 million exploit on its V1 platform, but the attacker began returning funds after a $5 million white-hat bounty offer. The incident stemmed from a re-entrancy vulnerability, prompting GMX to pause V1 trading while V2 remained unaffected. This event highlights ongoing DeFi vulnerabilities while demonstrating the effectiveness of white-hat bounties in fund recovery.

Consumer products manufacturer Upexi plans to raise $200 million to significantly increase its Solana (SOL) holdings, aiming for 1.65 million SOL valued at $273 million. This strategic investment follows a previous $100 million private placement, demonstrating strong corporate commitment to the Solana ecosystem. The move signals growing maturity in the crypto space, with public companies increasingly adopting digital assets for treasury reserves.

Beyond the Noise

The move was clean and brutal. Bitcoin smashed past $118,667 on Thursday evening, marking yet another all-time high as bulls pushed the market deeper into price discovery. “Bitcoin smashed past $118K on Thursday evening,” one report noted, stating the fact with the simple power of a knockout punch. The engine for this ascent was the liquidation cascade, with Bitcoin shorts accounting for $678 million of the carnage. Ethereum followed, surging over the $3,000 mark for the first time since February and triggering its own bonfire of the bears, wiping out $258 million in shorts. This was not just a rally; it was a changing of the guard, a violent eviction of anyone betting against the trend.

The power behind this move is no mystery. It is the story of the year, playing out in ever-larger numbers. The renewed institutional appetite is plain to see in the data. U.S.-based spot Bitcoin ETFs saw another massive day of inflows, but the real story was in Ethereum. The U.S. ETF inflows for ETH hit a record daily high of $383.1 million, a clear signal that big money is diversifying its bet. BlackRock’s IBIT fund alone has now quietly swelled to over $80 billion in assets, a figure that would have been science fiction just a year ago. The total crypto market cap has climbed to $3.63 trillion, and the Fear & Greed index has swung decisively into Greed. This is the new normal: a market underpinned by patient, programmatic buying from the world’s largest asset managers.

But while the grown-ups are methodically buying Bitcoin, the kids are still in the back room throwing darts in the dark, and occasionally hitting a bullseye. The Solana memecoin ecosystem provided a perfect picture of this beautiful chaos. A new launchpad called LetsBonk, backed by the BONK community, generated $1.04 million in daily revenue, doubling the take of the reigning champion, Pump.fun. The news sent the BONK token soaring nearly 52%. In a wonderful bit of irony, a different project from the Goblintown NFT creators, a token called GOB, tried to do everything right. They launched with a clever token tax and slow-unlocking mechanisms to prevent the usual pump-and-dump shenanigans. The market’s response? It sold GOB down 60%. It is a fine reminder that in the memecoin casino, good intentions are often the first casualty.

Of course, not all chaos is fun and games. Where there is fast money, there are also fast thieves. The DeFi space got a cold, hard dose of reality this week when the decentralized exchange GMX had to suspend its V1 platform after a $40 million exploit. An attacker found a design flaw in how the protocol calculated the value of its assets, a subtle but fatal vulnerability that allowed them to drain a major liquidity pool on Arbitrum. The GMX team’s newer V2 protocol was unaffected, a small mercy, but the incident was a stark reminder of the fragility that still exists at the heart of this new financial system. Every exploit like this erodes trust, a currency far more valuable than the stolen tokens. It is a quiet moral lens on the space: for every user celebrating a new all-time high, there is another staring at an empty wallet, wondering what went wrong.

Even as old protocols show their cracks, the work of building sturdier bridges to the old world continues. The convergence of TradFi and DeFi is picking up speed. A JPMorgan executive said this week that the divide could disappear in just a few years, a sentiment that is moving from talk to action. In a concrete example of this, Projective Finance launched a $7 million onchain lending pool to fund solar energy installations for public schools in Illinois. This is not a speculative token; it is a government-backed municipal loan, tokenized and made available to DeFi investors with full transparency. At the same time, the NFT marketplace OpenSea acquired a company called Rally, signaling its ambition to become an “onchain everything app” that includes crypto trading and perpetuals. The plumbing is being laid, piece by piece, to connect the trillions in traditional markets to the rails of the new one.

This all happens against a political backdrop that is becoming increasingly favorable. President Trump’s pro-crypto policies and Elon Musk’s recent announcement of a pro-Bitcoin political party are adding a layer of cultural and political validation. This gives institutional investors the air cover they need to justify their allocations to their boards. The narrative is shifting from a risky, fringe technology to a legitimate, politically-backed asset class. That shift in perception is worth more than any single day’s price move. Weekend watch: With over a billion in shorts flushed out, the market enters the weekend on a sugar high. Monday will show if it was energy or just jitters.

This Caught My Eye:

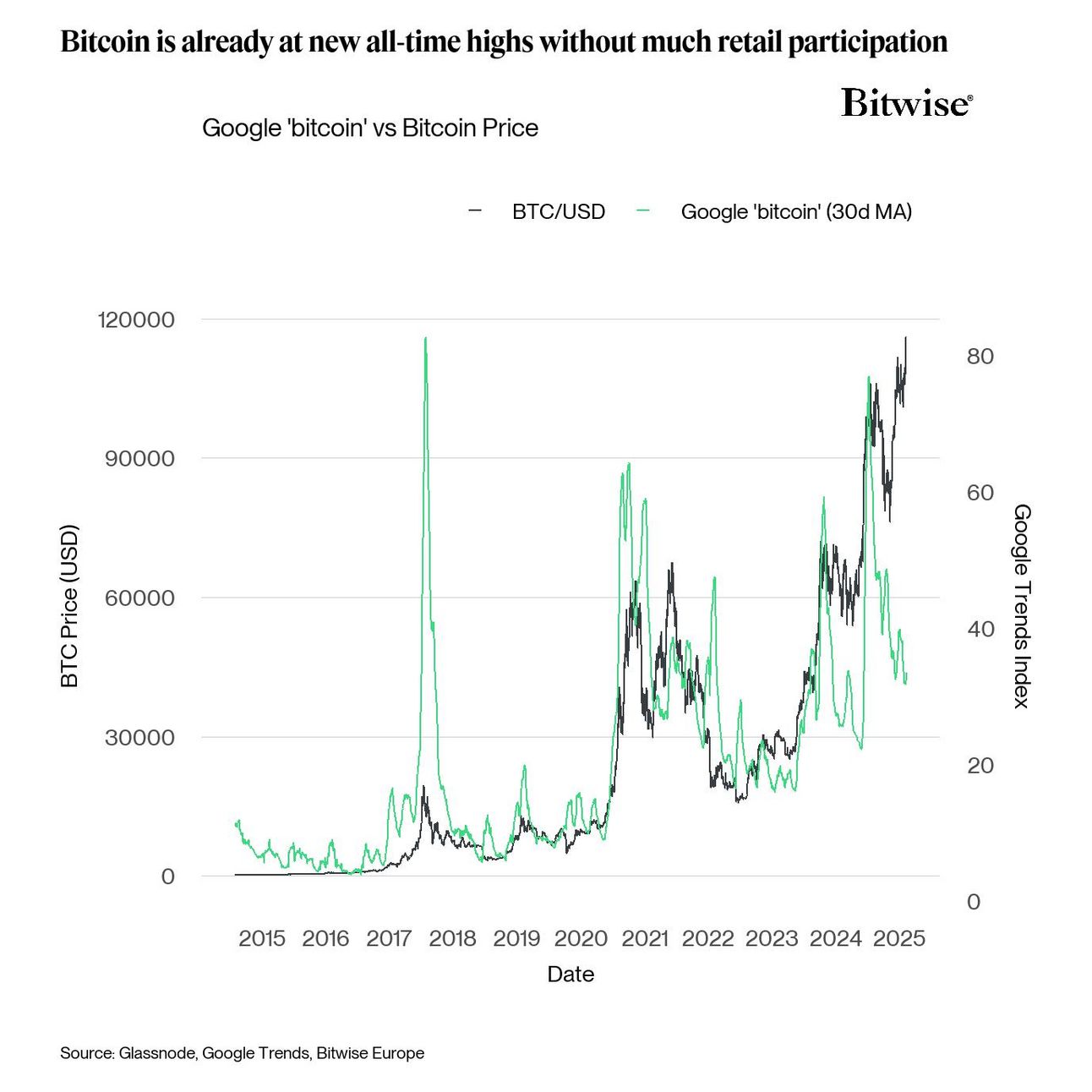

Source : Bitwise

Here’s a breakdown of the chart:

Bitcoin hit all-time highs while retail interest remains low, according to Google Trends.

Institutional demand is leading the charge, suggesting more upside if retail jumps in later.

Looking Ahead

Market air feels thick enough to snap. If Congress delivers even one clear statute next week, fresh pools of institutional cash stand ready, and the coiled spring could release. Yet a failed hearing, or one more high-profile exploit, would drain optimism just as quickly. The weather motif holds: calm hides barometric stress.

Questions linger. Will corporate loaders of Ethereum outperform hoarders of Bitcoin, or does hard money still own the storm shelter? Can wallets make chains interchangeable utilities, or will turf re-solidify? Friday closes with more humidity than lightning; by Tuesday we’ll know which front prevails. For now, remember: markets may change direction, but pressure never disappears, it only shifts.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!