- Osiris News

- Posts

- 🌊🧩 Big Money Buys, Prices Slip: What Gives?

🌊🧩 Big Money Buys, Prices Slip: What Gives?

🌊🧩 Big Money Buys, Prices Slip: What Gives?

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News, the mood is careful and a little tired. Prices eased without drama, liquidations cleared some froth, and the room feels quieter than last week. The question hanging over everything is simple. If ETFs are pulling in real volume, why do screens still lean red?

Here is the frame for today. We are watching a clean split. Institutional flows are healthy, ETF volume is strong, and yet spot markets look heavy. Retail is cautious. Positioning is being reset. That is the story to track. It is a reset that sets up the next move. Now, let me bridge to what you need to know before you scan your own dashboard.

🔍 Quick Overview

Market Chill: Crypto prices took a tumble, wiping out over $400 million in leveraged bets, proving even record ETF volumes couldn't keep the party going indefinitely.

Security Shakes: Bad actors are busy, with Qubic's community voting to target Dogecoin for a 51% attack, while crypto ATMs are facing a regulatory crackdown as fraud surges.

Regulatory Reset: The Fed packed up its special crypto oversight program, signaling a clear path for banks to engage, as new legislation aims to normalize digital assets within the financial system.

Staking Shifts: Liquid staking hit a record $86 billion TVL, buoyed by SEC clarity, but a record $3.8 billion ETH unstaking queue suggests some are ready to cash out their chips.

DeFi Powerhouse: Hyperliquid is on a roll, setting new revenue records and dominating on-chain perpetuals with $30.5 billion in daily volume, proving that innovation still pays handsomely.

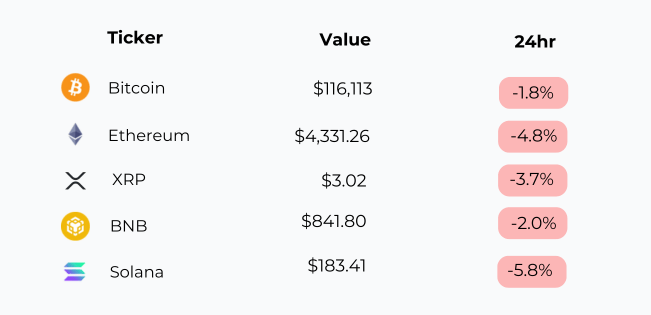

Bitcoin is still the anchor, barely nudged compared to the rest. Ethereum is feeling heavier pressure, dragging the sector with it. XRP and BNB followed the trend with moderate slippage, while Solana took the hardest beating, showing how fragile altcoins remain when sentiment cools.

Trending News

Ethereum-focused digital asset products attracted a record $2.87 billion in inflows this week, representing 77% of total digital asset inflows. Most capital, 99%, originated from the U.S., primarily via BlackRock's iShares Ethereum Trust ETF. This surge indicates growing institutional investor confidence and a maturing market favoring regulated crypto products.

Major institutions like Brevan Howard and Goldman Sachs significantly increased their Bitcoin ETF holdings, pushing total exposure past $7 billion. Norway's sovereign wealth fund also boosted its Bitcoin-equivalent exposure by 192% year-over-year. This trend signals a maturing view of digital assets and a strategic shift towards measured portfolio allocation by traditional finance.

The U.S. Federal Reserve ended its Novel Activities Supervision Program for crypto, integrating oversight into its standard process. This follows the Fed's earlier withdrawal of guidance discouraging banks from crypto involvement. This shift reflects a broader U.S. policy change, favoring a less restrictive, more integrated approach to digital assets within existing financial frameworks.

BitMine Immersion Technologies (BMNR) announced holding over 1.5 million Ethereum tokens, valued at $6.61 billion. This makes BitMine the world's largest corporate Ethereum holder and second-largest digital asset treasury. This highlights a growing trend of public companies offering investors direct exposure to digital assets and blockchain networks.

This tiny pause brought to you by “please let this help pay the bills” 👀

Partnered Spotlight

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

Beyond the Noise

The tape cooled, and it did it fast. Bitcoin slipped under $116,000 and Ethereum tested $4,300, which triggered over $400 million in long liquidations in short order. That is a decent flush. It landed on the same week that spot BTC and ETH ETFs posted about $40 billion in trading volume. Flows are real. Prices did not care. That disconnect matters.

Position data backs the caution. Funding rates turned negative, so traders are paying to stay short. Risk reversals favor puts, which tells you hedging demand is alive. CME open interest is still light compared to the last push, so large desks are not chasing with leverage. Institutions may be buying the exposure through ETFs, but they are not crowding the futures lane. That keeps rallies honest and dips clean, which is useful if you are patient.

The split is clearest on Ethereum. One lane shows strength. BlackRock’s ETH ETF logged record activity, with net inflows near $2.85 billion for the week. The other lane is jammed. The validator exit queue swelled toward $3.8 billion, and the wait to unstake sits near 15 days. That looks like balance sheet cleanup. Stakers unwind, new money walks in, and the network keeps moving. Price reads it as friction. Builders read it as housekeeping.

Token design is doing as much work as code this month. OKX cut the OKB supply from 300 million to 21 million by deleting roughly 279 million tokens, a move worth over $26 billion on paper. The price jumped, then cooled. Elsewhere, buyback and burn models are in fashion. Protocols like Pump route 100% of revenue into buy and burn cycles. That concentrates value for holders, and it can also mask weak product demand if you are not careful with the scoreboard you use.

Security pressure never leaves. The Qubic group boasted about a 51% attack on Monero and now points at Dogecoin as a target. If they control enough hashrate, they can rewrite short windows of history. DOGE dipped on the headline. The quiet moral line is simple. Trust breaks fast when strangers can move your settlement layer. Off chain, a Brazilian mother was held for a $600,000 BTC ransom after criminals traced her family online.

Policy is shifting toward normal. The Federal Reserve ended its “Novel Activities Supervision Program,” the special crypto watch launched in 2023. Pair that with the GENIUS Act push for private, dollar-backed stablecoins, and you see a path that treats crypto like other financial rails. Senator Cynthia Lummis framed it as a win against Operation Chokepoint 2.0. You do not need fireworks here. You need clarity. This is what clarity looks like.

Builders keep shipping while sentiment wobbles. Hyperliquid set a daily record with $7.03 million to token holders and now owns more than 70% of on-chain perps volume by some counts. Fees are burned, float tightens, usage grows. At the same time, stablecoins expand into new regions. Japan prepares its first yen-pegged stablecoin for the fall, which could open fresh corridors for trade and savings. Prices pause. Work continues.

This Caught My Eye:

Here’s a breakdown:

Ethereum Goes Mainstream: Global search interest for ETH just hit an all-time high, a signal that crypto isn’t just for insiders anymore, it’s moving into the cultural and financial mainstream.

PayPal’s Role in Onboarding: As the world’s largest online payments platform, PayPal sits at the perfect intersection to turn this rising curiosity into adoption, bridging its massive market share with Ethereum’s surge in global attention.

Looking Ahead

The split market will not last forever. ETF demand is steady, deleveraging is active, and policy tone is less hostile. Those three forces usually grind toward a cleaner base. If that base forms, spot can move without help from speculative leverage. If it fails to form, we keep chopping until weak hands are done and strong hands add more.

Watch three threads. One, does ETH unstaking pressure ease as exits clear. Two, do funding rates flip back to neutral, which would tell you shorts are less committed. Three, do regulators keep moving from one-off programs to durable rules, especially around stablecoins. Markets change slowly, then fast. Nothing here is permanent, not the fear and not the calm. The work is to stay awake, keep risk sized, and let the next clean signal come to you.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!