- Osiris News

- Posts

- 🛠️ 🚨 Aave Crisis: Hostile DAO Takeover

🛠️ 🚨 Aave Crisis: Hostile DAO Takeover

Bitcoin's macro landscape trembles as $1B exits crypto markets, revealing a complex narrative of institutional shifts, governance tensions, and strategic financial recalibration.

🛠️ 🚨 Aave Crisis: Hostile DAO Takeover

Hello there you embodiment of curiosity;

Welcome to today's edition of Osiris News. The market is fading the headlines. November CPI printed a cool 2.7%, theoretically bullish, but Bitcoin stalled at $90k because traders view the data as contaminated by the recent government shutdown. We are seeing a classic end-of-year flush; nearly $1 billion exited crypto investment products last week as desks squared books for the holidays. The mood is mercenary—capital is rotating out of stagnant majors and into anything with a pulse or a yield.

🔍 Quick Overview

Macro Disconnect: Bullish CPI was ignored; institutions pulled nearly $1B from crypto funds.

Uniswap: The fee switch passed, giving UNI a direct claim on protocol revenue.

Aave: A governance crisis disguised as decentralization has investors pricing in significant risk.

Regulation: New CFTC chair signals a focus on market structure, not just enforcement.

Options Expiry: $27B in options expire Friday, guaranteeing volatility in a thin holiday market.

Early strength faded as sellers stepped back in, keeping the market stuck in a choppy, reactive range rather than a clean trend. Altcoins followed Bitcoin lower, suggesting this move was more about risk cooling off than any single token-specific shift.

New From Us

|

Five minutes, one brief, you are up to speed on AI

Beyond the Noise

The macro print was ugly in its ambiguity. Core CPI dropped to 2.6%, the lowest in years, but the "Swiss cheese" nature of the data collection—riddled with gaps from the shutdown—gave the market an excuse to ignore it. Real yields remain high at 1.9%, suppressing risk appetite. This skepticism drove the $952 million exodus from digital asset funds, snapping a four-week buying streak. The bleeding was concentrated in the US, with Ethereum products taking a $558 million hit. The "Santa Rally" is being sold into by institutions who prefer cash over uncertainty heading into 2026.

While the macro picture is muddy, on-chain governance is driving violent repricing. Uniswap finally turned on the value capture mechanism. The "UNIfication" proposal passed with 99% support, authorizing a 100 million UNI token burn and activating the fee switch. This transforms UNI from a governance pet rock into an asset with a direct link to protocol revenue. The token rallied 25% on the rumor but is cooling as the reality of a two-day timelock sets in.

Conversely, Aave is staging a self-inflicted governance crisis. A faction within the DAO is pushing to seize control of the brand and frontend from the founding team over the holiday break. The market views this as a hostile takeover disguised as decentralization; AAVE tanked 20% as investors priced in the governance risk. It’s a stark reminder that "decentralization" often just means politics without a HR department.

Underneath the price chop, the regulatory infrastructure for the next cycle is being poured. The Senate confirmed Michael Selig as CFTC Chair, completing the "dream team" pairing with Paul Atkins at the SEC. The narrative has shifted from enforcement to market structure, with the "**Clarity Act**" targeted for Q1 2026. This legislative carrot is likely why Solana and XRP funds saw inflows despite the broader market sell-off; smart money is positioning for a world where the distinction between commodity and security is finally codified.

This Caught My Eye:

Here’s a breakdown:

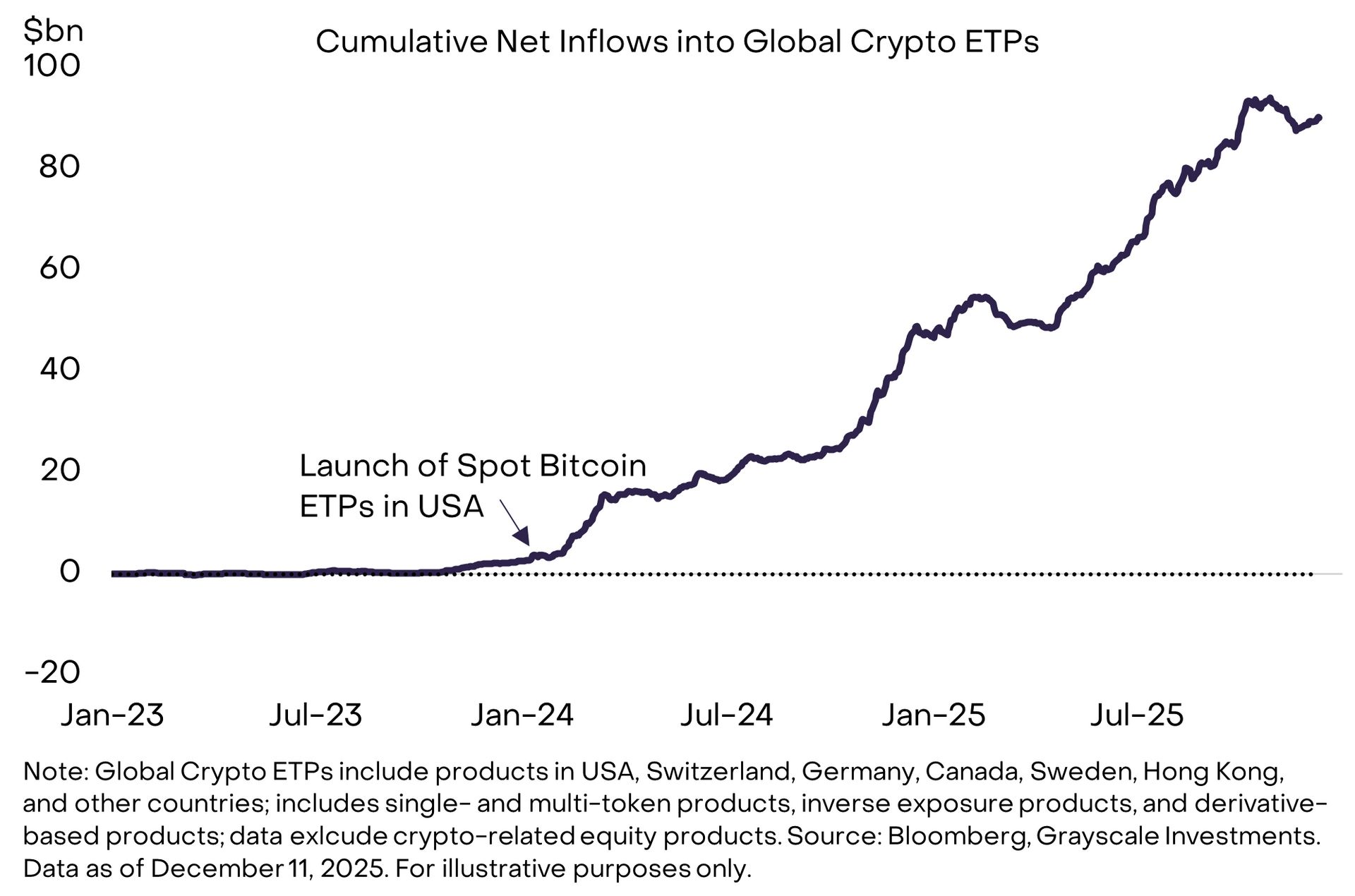

Since spot Bitcoin ETPs launched in the US in Jan 2024, crypto wrapped in ETPs has pulled in roughly $87 billion of fresh capital, turning the wrapper itself into a major structural buyer.

Even with price swings and corrections, the cumulative line keeps grinding higher, showing that institutional and wealth platform demand is still net additive rather than fleeing the space.

Looking Ahead

The immediate hurdle is Friday's $27 billion options expiry. With Bitcoin trading near $87k and max pain sitting at $96k, market makers will be hedging aggressively in a thin liquidity environment. Volatility is guaranteed. Unless Bitcoin reclaims $90k with conviction post-expiry, the path of least resistance is a slow bleed into the new year. Watch the Aave vote closely; if the DAO seizes the frontend, expect further capitulation in the token as confidence in the protocol’s management evaporates.

Until tomorrow,

- Dr.P

Be honest — was today’s Osiris worth the scroll? |

If this newsletter saved you time today or made you smirk even once, your support goes a long way. I write it solo, daily and your support really helps!